Capital One VentureOne Rewards Credit Card review

What stands out about this card is its flexibility in travel rewards. You earn miles on every purchase, and redeeming them for travel is straightforward. This card is ideal for those who value the freedom to travel on their own terms.

Capital One VentureOne Rewards Credit Card

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- Given that this card doesn't charge an annual fee, it's a great starter card for those looking to introduce a travel credit card to their wallet.

- Earn 20,000 Miles once you spend $500 on purchases within three months from account opening.

- A travel rewards card with an intro 0% APR offer?! You read that right: This card offers an introductory 0% APR on purchases and balance transfers for intro_apr_duration from account opening (then, RegAPR; balance transfer fee applies).

- If you plan to spend $5,000 or more annually, the Capital One Venture Rewards Credit Card may be a better choice to earn greater rewards.

Capital One(R) VentureOne(R) Rewards Credit Card rewards

The Capital One VentureOne Rewards Credit Card rarely gets much attention outside of its own website since the big brother Capital One Venture Rewards Credit Card has stolen the spotlight through national ad campaigns. But the Capital One VentureOne Rewards Credit Card holds its own thanks to word-of-mouth and a not-ungenerous 1.25 miles per $1 spent on all your purchases. Sure, that’s less than the better-known sibling’s two-miles-per-$1 offer, but with no annual fee, the Capital One VentureOne Rewards Credit Card could be just the right "no-strings-attached" fit for a rewards-card seeker who just doesn’t travel enough or spend enough on credit cards to justify an annual fee.

Most notable features of the Capital One VentureOne Rewards Credit Card:

- Enjoy 20,000 Miles once you spend $500 on purchases within three months from account opening.

- Earn unlimited 1.25 miles per $1 on every purchase, every day, and pay no annual fee.

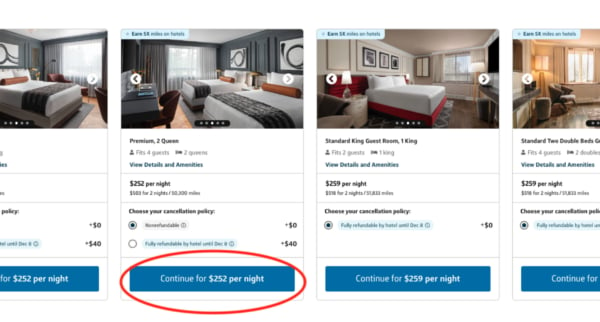

- Earn 5X miles on hotels, vacation rentals, and car rentals booked through Capital One Travel.

- Transfer your miles to multiple leading travel loyalty programs.

- Fly any airline, stay at any hotel, anytime.

- Enjoy a 0% intro APR on purchases and balance transfers for intro_apr_duration (then, RegAPR; balance transfer fee applies).

- Pay no foreign transaction fees.

- Miles won’t expire for the life of the account and there’s no limit to how many miles you can earn.

Capital One VentureOne Rewards Credit Card benefits

When we called the Capital One VentureOne Rewards Credit Card a "no strings attached" card above, we meant it.

While some rewards credit cards, particularly travel rewards cards, have an introductory no-annual-fee offer for the first year, many expect you to pay a fee every year after that. With the Capital One VentureOne Rewards Credit Card, this is something you’ll never have to worry about, which means you don’t need to work through the math of whether you’ll earn enough rewards in a given year to offset the fee.

And though you might not earn as many miles per purchase as with the annual_fees-per-year Capital One Venture Rewards Credit Card, the Capital One VentureOne Rewards Credit Card does still allow you to rack up 1.25 miles for every $1 spent; offers a nice offer of 20,000 bonus miles once you spend $500 on purchases within the first three months from account opening; and as an added bonus, has introductory 0% interest APR on purchases and balance transfers for the first intro_apr_duration (then, RegAPR; balance transfer fee applies). These perks, along with no annual fee ever, certainly make the Capital One VentureOne Rewards Credit Card one to not overlook.

There are also a number of travel benefits offered with this card. Capital One VentureOne Rewards Credit Card holders have access to travel assistance services, auto rental insurance, and more. There are also no foreign transaction fees associated with this card, making it a great international companion as well.

Potential downsides of the Capital One VentureOne Rewards Credit Card

No annual fee is great, but those looking for a rewards card that will gain miles quickly might become frustrated with the 1.25 mile per $1 ratio. While the no-annual-fee perk makes the Capital One VentureOne Rewards Credit Card a great option for those who have time to work on their mile accumulation, those wanting to gain miles fast might want to consider a card with a higher mile-to-$1 ratio.

How do cardholders rate the Capital One VentureOne Rewards Credit Card?

CardRatings commissioned Dynata in November 2025 to survey 2,797 cardholders nationwide. Responses were given on a scale of 1-10 and respondents’ ratings were then averaged under broad topics. Here are the results for the Capital One VentureOne Rewards Credit Card:

| Value For Price | 6.65 |

| Features Satisfaction And Engagement | 7.36 |

| Competitive Edge | 7.41 |

| Customer Service | 7.80 |

| Overall Rating | 8.30 |

Survey results by question

Respondents rated their personal experience with the card_name, answering questions on a scale from 1-10. The results for a sampling of questions can be found below:

How does the Capital One VentureOne Rewards Credit Card compare to other cards?

Capital One VentureOne Rewards Credit Card vs. Capital One Quicksilver Cash Rewards Credit Card

discontinued

The Capital One Quicksilver Cash Rewards Credit Card has no annual fees, no foreign transaction fees, a 0% intro APR period on purchases and balance transfers (for intro_apr_duration, then RegAPR after that; balance transfer fee applies), has a decent $200 cash bonus offer once you spend $500 on purchases within the first three months from account opening), and earns rewards on every purchase made.

One big difference is that the Capital One Quicksilver Cash Rewards Credit Card earns cash back instead of miles, and the earning rate is a bit higher, at 1.5% per dollar spent, versus the 1.25 miles you get with the Capital One VentureOne Rewards Credit Card.

Capital One VentureOne Rewards Credit Card vs. Capital One Venture Rewards Credit Card

discontinued

Do you and your family only have a couple long weekends on the horizon, or are you dreaming of a year of jetsetting? Choosing between the Capital One VentureOne Rewards Credit Card and the Capital One Venture Rewards Credit Card just requires you to know your annual "break-even" point.

Both the Capital One VentureOne Rewards Credit Card and Capital One Venture Rewards Credit Card feature one-time bonus offers for new cardholders. The Capital One VentureOne Rewards Credit Card offers a 20,000 bonus miles once you spend $500 on purchases within the first three months from account opening, and the Capital One Venture Rewards Credit Card offers a limited-time bonus of $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend signup_bonus_spend_amount on purchases within the first three months from account opening – that’s equal to signup_reward in travel!

If you are looking at bonus offers alone, the Capital One Venture Rewards Credit Card is a clear front-runner for the slot in your wallet reserved for a travel rewards card; however, if you don’t spend very much on credit cards or don’t travel that often, the Capital One VentureOne Rewards Credit Card becomes a better deal as the years pass.

Quick math estimates that, with the Capital One Venture Rewards Credit Card annual fee, you’ll have to spend about $5,000 on the card every year to break even. If you’re funneling every monthly expense, vacation charge and supermarket purchase to your travel rewards card, you’ll hit that mark pretty quickly each year. If that’s not for you, the Capital One VentureOne Rewards Credit Card gives you the ability to earn rewards for travel without spending a dime on annual fees.

Is the Capital One VentureOne Rewards Credit Card a good card?

The Capital One VentureOne Rewards Credit Card is a great no annual fee credit card option for those who are in no hurry to cash in on their miles, and who have some time to work on their mile accumulation. Plus, if you’re just looking for a card that earns miles in the background while you go about your daily spending, this one won’t disappoint thanks to its simple, flat-rate earning structure.

Frequently asked questions

What credit score is needed for the card_name?

What is the credit limit for the card_name?

What's the difference between Capital One Venture and VentureOne?

Is card_name a Visa or Mastercard?

Our Methodology

Survey methodology: CardRatings commissioned Dynata in November 2025 to survey 2,797 cardholders nationwide. CardRatings' website analytics from Jan. 1, 2025, to Oct. 2, 2025 were used to determine a selection of the most popular cards. Respondents were asked a series of questions about specific characteristics of credit cards they used regularly, as well as for their overall rating of each card. Responses were sorted into categories: "Value for Price," "Features Satisfaction and Engagement," "Competitive Edge," and "Customer Service." Responses within each category were averaged to determine the score for that category. In addition, the overall ratings for each card were averaged. "Cardholder favorite" cards are those that scored in the top 10 overall. Card issuers cannot pay to be included on these lists or influence the order in which cards appear.

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.