Capital One Venture X Rewards Credit Card review

With a healthy welcome bonus opportunity and numerous travel perks, this premium card from Capital One offers a lot of benefits for a relatively low annual fee, so you can spend your money where it counts.

Capital One Venture X Rewards Credit Card

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- Earn signup_reward bonus miles when you spend signup_bonus_spend_amount on purchases in the first three months from account opening, equal to $750 in travel!

- Get 10,000 bonus miles every year starting on your first account anniversary.

- Earn a healthy 2X miles on your everyday purchases as well as extra rewards on certain bookings through the Capital One Travel portal.

- The annual travel credit is nice, but earning it means you'll need to do your travel bookings through the Capital One Travel portal. That makes this credit not as flexible as similar credits offered by other premium cards.

Capital One Venture Rewards Credit Card

discontinued_disclaimerAs a stand-out option in the premium travel card space, the Capital One Venture X Rewards Credit Card comes to the marketplace armed with many of the perks luxury travelers have become accustomed to, as well as a beefed up version of Capital One’s popular rewards program. And it does it all with a lower-than-expected annual fee in the premium card space.

Cardholders can earn numerous bonuses, including a welcome offer of signup_reward bonus miles when you spend signup_bonus_spend_amount on purchases in the first three months from account opening, equal to $750 in travel, a 10,000-mile card anniversary bonus, and a $300 annual credit for bookings made through Capital One Travel. We get into the details on how to take advantage of all these offers below.

Cardholders also receive access to 1,300+ lounges, including Capital One Lounges and participating Priority Pass™ lounges, after enrollment.

One of the characteristics that may not be flashy but should catch your eye is the card’s annual fee. It’s just AnnualFees, which isn’t anything to sneeze at, but it is much lower than that of other premium cards, such as CardNamediscontinued (AnnualFees) and The Platinum Card® from American Express discontinued (AnnualFees, See Rates and Fees; American Express is a CardRatings advertiser).

Capital One Venture X Rewards Credit Card welcome bonus

If you become a Capital One Venture X Rewards Credit Card cardholder, it will be well worth it to put that card to use right away. New cardholders can earn a welcome bonus of signup_reward bonus miles when you spend signup_bonus_spend_amount on purchases in the first three months from account opening, equal to $750 in travel!

The signup_reward miles have a value of $750 if redeemed for travel-related purchases (plane, hotel, rental car) through Capital One Travel or for a statement credit against travel purchases.

Additional redemption options include gift cards, merchandise and more.

Capital One Venture X Rewards Credit Card travel benefits

If you are a frequent traveler for business or pleasure, the Capital One Venture X Rewards Credit Card is a solid consideration for your wallet, if only for the travel benefits that come with the card.

As you begin your journey, your card membership opens the door to numerous benefits in the area of convenience and comfort. Capital One Venture X Rewards Credit Card cardholders and authorized users receive access to more than 1,300 lounges, including Capital One Lounges and participating Priority Pass™ lounges, after enrollment.

Cardholders also save with up to a $120 credit for either their TSA PreCheck® or Global Entry application fee.

And when you return from your trip, a quick look at your Capital One rewards account will reveal you’ve been earning solid miles on every leg of your journey and you haven’t been paying foreign transaction fees (if traveling internationally) while you do it.

Finally, elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more.

Capital One Venture X Rewards Credit Card rewards

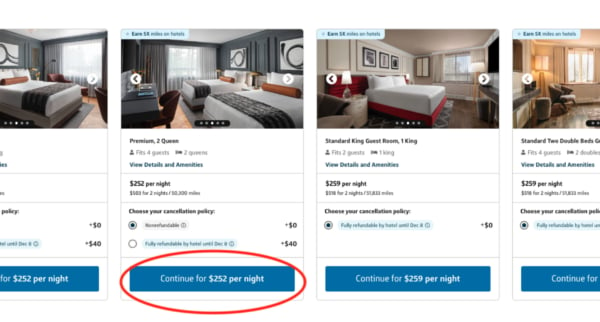

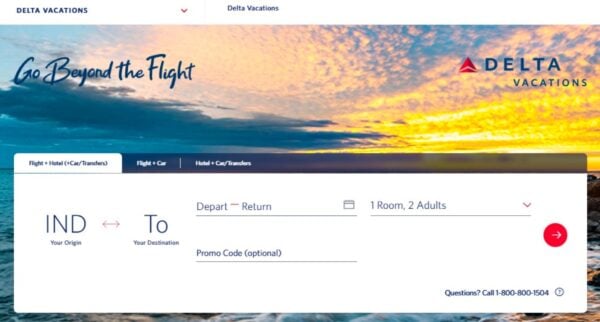

Speaking of earning rewards, the Capital One Venture X Rewards Credit Card makes it easy to keep refilling your rewards bank, offering 10 miles for every $1 spent on hotels and rental cars through Capital One Travel and five miles for every $1 spent on flights and vacation rentals booked via the portal. Additionally, you earn two miles for every $1 spent on all other purchases.

As already mentioned, those miles are redeemable for, among other things, statement credit at $.01 each to cover travel-related purchases, which according to the Capital One definition of travel, could mean anything from a train ticket to a cruise and much more.

How to offset the Capital One Venture X Rewards Credit Card annual fee

While the AnnualFees annual fee might seem steep, in reality the Capital One Venture X Rewards Credit Card can pay for itself multiple times over if you put it to good use and take advantage of all the statement credit opportunities.

For new cardholders, for instance, earning the signup_reward bonus miles is worth as much as $750 for travel statement credit when you use those miles to cover a recent travel purchase. That’s almost equal to more than two years’ worth of annual fees. That bonus could be worth even more if you transfer the miles strategically to one of Capital One’s travel partners.

On an ongoing basis, however, it pays to put all the statement credit opportunities to good use:

- $300 annual credit for bookings through Capital One Travel

- Receive 10,000 bonus miles each year – that’s equal to $100 in travel – beginning with your first anniversary

- Save with up to $120 in statement credit to cover your Global Entry or TSA PreCheck® application fee

Between the annual miles bonus as well as the $300 annual credit for bookings through Capital One Travel, you can more than offset the annual fee.

Beyond that, a frequent traveler booking through Capital One Travel could even more easily offset the fee. That’s because you earn 10 miles for every $1 spent on hotels and rental cars, and five miles for every $1 spent on flights and vacation rentals booked via Capital One Travel. As an example, a cardholder who makes monthly trips for business plus an annual family vacation could spend $8,000 per year on airline travel (earning 40,000 miles), $4,000 on hotel stays (40,000 miles) and $3,000 on car rentals (30,000 miles). This cardholder would have earned 110,000 miles, with a value of $1,100 in travel. Add to that the everyday 2X miles per $1 spent that you earn on all your other purchases, and it’s not difficult to see how the annual fee is a distant afterthought.

What are the downsides of Capital One Venture X?

On the other hand, if you don’t travel frequently, that annual fee can become a burden. This is a card that shouldn’t sit in your wallet gathering dust.

You also need to remember that many of these benefits – particularly the annual travel credit of $300 – require you to book through Capital One Travel to earn it. Some of the other premium cards allow more flexibility when it comes to earning a travel credit. If you prefer to use an agent you or your company requires you to go through a different portal or system, you could miss out on that statement credit.

Another issue could be the convenience and accessibility of some of the perks. For example, while the Capital One Lounges at airports promise to offer a luxurious, relaxing place for cardholders to wait for their flight to board, they are not yet commonplace. There are currently only five Capital One Lounges open to eligible cardholders.

How do cardholders rate the Capital One Venture X Rewards Credit Card?

CardRatings commissioned Dynata in November 2025 to survey 2,797 cardholders nationwide. Responses were given on a scale of 1-10 and respondents’ ratings were then averaged under broad topics. Here are the results for the Capital One Venture X Rewards Credit Card:

| Value For Price | 6.79 |

| Features Satisfaction And Engagement | 6.91 |

| Competitive Edge | 7.13 |

| Customer Service | 7.88 |

| Overall Rating | 8.29 |

Survey results by question

Respondents rated their personal experience with the card_name, answering questions on a scale from 1-10. The results for a sampling of questions can be found below:

How does the Capital One Venture X Rewards Credit Card compare to other credit cards?

Capital One Venture X Rewards Credit Card vs. Chase Sapphire Reserve®

discontinued

Capital One Venture X Rewards Credit Card and Chase Sapphire Reserve® have similar rewards program: While Venture X card offers 10X miles/points on hotels and car rentals; 5X miles/points on flights (and vacation rentals for Venture X); and 2X miles on all other purchases, the Sapphire Reserve card offers 8X points on all purchases through Chase Travel℠, including The Edit℠; 4X points on flights and hotels booked direct; 3X points on dining worldwide; and 1X points on all other purchases.

A big difference between the cards is the annual fee each charges: AnnualFees for Venture X vs. AnnualFees for Sapphire Reserve. Even though the fee is higher for Sapphire Reserve, there are still options to offset it, including up to $300 in statement credit annually for travel purchases – and they don’t have to be booked via a particular portal, making this credit more flexible to earn.

Chase Sapphire Reserve® does not offer an equivalent to Venture X’s 10,000-mile annual card anniversary bonus.

Capital One Venture X Rewards Credit Card vs. The Platinum Card® from American Express

discontinued

It’s hard to miss that The Platinum Card® from American Express has a massive annual fee (AnnualFees; See Rates and Fees), even when compared to another premium card like the Capital One Venture X Rewards Credit Card. That said, it allows the chance to offset that fee through a series of annual credit opportunities and benefits (enrollment required for some benefits). These include access to the Global Lounge Collection®, an airport lounge program with over 1,550 lounges worldwide; up to $200 airline fee credit (with one pre-selected airline); $600 Hotel Credit split semi-annually as up to $300 in statement credits semi-annually on prepaid Fine Hotels + Resorts® or The Hotel Collection* bookings through American Express Travel® (minimum two-night stay required); up to $200 Uber Cash and $120 Uber One Credit (terms apply); a credit of $120 or $85 for your Global Entry or TSA PreCheck, respectively, application fee; and much more!

Both cards have impressive welcome offers, but the Platinum Card®’s standard reward program is not quite as attractive as that of Venture X in that it’s more restricted when it comes to earning more than one point per $1 spent. With the American Express Platinum Card(R), you earn 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel® (including Fine Hotels + Resorts® and The Hotel Collection bookings); 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year; and 1X point on all other eligible purchases. Enrollment required for some benefits.

Also, with The Platinum Card® from American Express, if you want to redeem your points for travel, you would do so through American Express Travel portal or by transferring points to one of the loyalty program partners. There’s a lot of value to be had there, but it’s not quite as flexible as what Venture X offers with its ability to cover recent travel purchases with miles.

Once again, the American Express Platinum Card(R) also does not offer an equivalent to Venture X’s 10,000-mile annual card anniversary bonus.

Should you upgrade your Venture card to Venture X?

If you are already a Capital One(R) Venture(R) Rewards Credit Card cardholder, you may be wondering if you should upgrade your Venture account to a Venture X account.

Capital One Venture X Rewards Credit Card should be viewed as the luxury alternative to the Capital One Venture Rewards Credit Card card, but if you’re looking for similar rewards without the added perks and luxury polish, Venture Rewards might be a better option.

Capital One Venture Rewards Credit Card has a significantly more affordable annual fee (AnnualFees; compared to Venture X, but the benefits and perks are on a smaller, less luxurious scale. For starters, Venture Rewards does not offer the 10,000-mile annual bonus after your cardholder anniversary. It also doesn’t offer $300 annual travel credit for your purchases through the Capital One Travel portal (Venture Rewards offers $250 annual travel credit).

The regular rewards program offers the same base rate of 2X miles on "other purchases," but the earning via the Capital One travel portal is more modest at 5X miles on hotels, vacation rentals, and rental cars booked through Capital One Travel (versus 10X on hotels and rental cars and 5X on flights and vacation rentals through Capital One Travel for Venture X).

See an in depth comparison of how these cards compare side-by-side, and learn more about what one CardRatings’ editor considered as she decided whether or not to upgrade her account.

Is the Capital One Venture X Rewards Credit Card worth it?

A premium card from Capital One was long overdue and the Capital One Venture X Rewards Credit Card is helping to fill a gap in affordable luxury card options. The modest annual fee (for a luxury card with all these perks) is enough to grab our attention, but the opportunity to offset it with several combinations of available statement credits and regular rewards earning is what really makes it impressive.

While the lack of Capital One Lounges is disappointing for now, our fingers are crossed that the footprint will grow and, in the meantime, that the Priority Pass lounge access will meet the airport lounge needs for many cardholders.

Overall, this is a solid card choice with a lucrative welcome bonus and the opportunity to keep racking up rewards day after day.

Frequently asked questions

What is the welcome bonus for the card_name?

Is the Venture X card hard to get?

Is the Capital One Venture X a metal credit card?

Does Venture X have foreign transaction fees?

Our Methodology

Survey methodology: CardRatings commissioned Dynata in November 2025 to survey 2,797 cardholders nationwide. CardRatings' website analytics from Jan. 1, 2025, to Oct. 2, 2025 were used to determine a selection of the most popular cards. Respondents were asked a series of questions about specific characteristics of credit cards they used regularly, as well as for their overall rating of each card. Responses were sorted into categories: "Value for Price," "Features Satisfaction and Engagement," "Competitive Edge," and "Customer Service." Responses within each category were averaged to determine the score for that category. In addition, the overall ratings for each card were averaged. "Cardholder favorite" cards are those that scored in the top 10 overall. Card issuers cannot pay to be included on these lists or influence the order in which cards appear.

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.

To see the rates and fees for The Platinum Card® from American Express, please see the following link: See Rates and Fees

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.