Capital One Venture Rewards Credit Card review

If you love to travel, this card is an attractive option. As a cardholder, you can easily earn miles on all purchases made with the card, making it an easy way to rack up rewards. Plus, the miles are a cinch to redeem.

Capital One Venture Rewards Credit Card

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- For a limited time, earn $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend signup_bonus_spend_amount on purchases within the first three months from account opening - that's equal to signup_reward in travel!

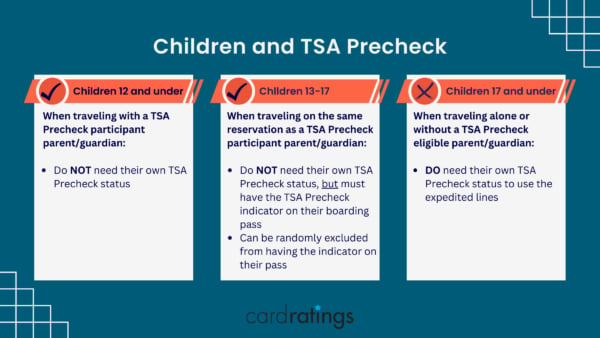

- Cardholders are eligible for a reimbursement of their Global Entry or TSA PreCheck application fee, a perk worth up to $120.

- Miles are earned on all purchases, not just travel purchases, so there's some serious point-earning potential with this card.

- If you plan to spend less than $5,000 annually you may be better off with a card without an annual fee such as the Capital One VentureOne Rewards Credit Card

Capital One(R) Venture(R) Rewards Credit Card benefits

Do you travel frequently? The Capital One Venture Rewards Credit Card is an attractive option for the serial wanderluster; that’s why it’s regularly recognized among our best credit cards for travel.

The Capital One Venture Rewards Credit Card offers you:

- For a limited time, earn $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend signup_bonus_spend_amount on purchases within the first three months from account opening – that’s equal to signup_reward in travel!

- 2X miles per $1 spent on every purchase, every day

- 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Rewards don’t expire for the life of the account

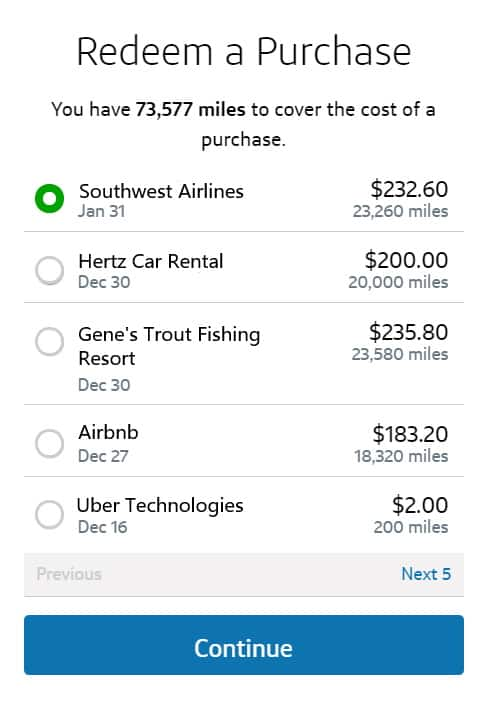

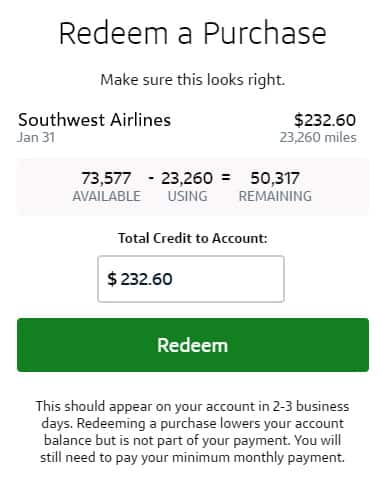

- Enjoy the flexibility to redeem rewards to offset any eligible travel purchase

- Transfer your miles to 15+ leading travel loyalty programs

Just because the rewards are called "miles," don’t restrict your thinking to only airlines. Rewards can be redeemed for a variety of travel expenses, such as hotel accommodations, auto rentals and theme park tickets, or turned into cash and merchandise credit if you don’t intend to travel (more on that below).

The $250 to use on Capital One Travel in your first cardholder year, plus the 75,000 bonus miles offer starts things off on a nice foot, but the real star power of the Venture card is that it enables you to earn 2X the miles on every dollar spent, on every purchase, with no cap and no expiration on miles earned for the life of the account, and the redemption options are very flexible, too. This makes it one of the most compelling rewards cards on the market.

Another wildly popular personal travel rewards card– the Chase Sapphire Preferred® Card – also offers plenty of perks for cardholders, but neither of these cards has to be the only travel credit card in your wallet. It could be an excellent strategy to carry both the Chase card, so you have travel rewards that can be redeemed as statement credit to cover virtually any travel purchase, even those that aren’t available through Chase Travel. We compare these two cards further later in this article.

Since you’re earning two miles for every dollar you spend on the card, you’re essentially claiming a 2% rebate. That’s better than many cash-back credit cards on the market. And because you control your own travel bookings, you’re not subject to the whims of airline restrictions.

In fact, redeeming rewards with the Venture card is as simple as earning them. You can use the Capital One travel portal to make a booking or transfer your rewards to a travel partner, or, you can simply choose the "cover your travel purchases" option to get reimbursed for a recent travel purchase. This allows you more flexibility in how you travel with rewards. Plane tickets (even on lesser-known or budget airlines), cruise lines, taxi cabs, travel agents, rail lines and limousine services are just a handful of categories covered. This means you can use rewards to cover more specific things such as an Airbnb stay, or a National Park campsite booking.

And just because the Venture card is advertised as a travel card doesn’t mean you can’t redeem rewards for other things, too. Say this is your go-to card, and thanks to the limited-time welcome offer, you can end up racking up $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend signup_bonus_spend_amount on purchases within the first three months from account opening – that’s equal to signup_reward in travel! Problem is though, you aren’t really planning on traveling anytime soon. Say, perhaps, you have home renovation projects you need to tend to instead. Venture miles can be great for this too thanks to the option to redeem for gift cards.

From Amazon, to Barnes & Noble to Sephora, the gift card choices are plentiful. What’s really applicable to this example though is gift cards to places like Home Depot, Lowes, Walmart, Target, Sam’s Club, West Elm, Pottery Barn and other home good stores (*gift card options subject to change). Take the Home Depot gift card, for example. At the time of this writing, 100 miles equals $.80, meaning, 150,000 bonus miles are good for $1,200 in Home Depot gift cards. That can go a long way towards updating your hall bathroom.

In short, truly one of the greatest things about the Capital One(R) Venture(R) Rewards Credit Card is the flexibility that it offers— both in earning rewards, and redeeming them.

Capital One(R) Venture(R) Rewards Credit Card travel benefits

Regardless of whether your travel is domestic or international, this card has you covered. Some of the top Capital One Venture Rewards Credit Card travel benefits include:

- Up to $120 credit towards Global Entry or TSA PreCheck costs

- No foreign transaction fees

- And more

And let’s not forget about the ability to fly any airline, stay at any hotel, anytime, as well as the ability to transfer miles to over 15 leading travel loyalty programs.

Capital One Venture travel partners

- Accor Live Limitless

- Aeromexico Club Premier

- Air Canada Aeroplan

- Air France- KLM Flying Blue

- Asia Miles

- Avianca LifeMiles

- British Airways Avios

- Choice Hotels

- Emirates Skywards

- Ethiad Guest

- EVA Infinity MileageLand

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Air Portugal

- Turkish Airlines Miles&Smiles

- Wyndham Rewards

- Virgin Red

Capital One(R) Venture(R) Rewards Credit Card foreign transaction fee

Foreign transaction fees are an easy way to waste money while traveling internationally. These fees usually average around 3%, so if you’re making a lot of transactions in a foreign currency, the costs can add up quickly.

Each time you make a purchase with your Venture card abroad, you’ll save yourself a nice chunk of change. Think of it this way: if you travel to France using a card that charges a 3% foreign transaction fee, and you spend $5,000 on your trip, you’ll tack on an additional $150 just in fees. However, if you were to travel with the Capital One Venture Rewards Credit Card, that’s $150 you could save and put towards something like a nice souvenir or one last delicious Michelin-star meal.

Potential downsides of the Capital One(R) Venture(R) Rewards Credit Card

The annual fee (annual_fees) can be a turnoff — cardholders need to be consistent travelers and card users to redeem enough miles to offset this cost.

Because this card does not offer a cash-back reward program, the perks lie within its travel benefits and not its cash-back features. If a cardholder redeems their miles for something other than travel perks, options and rates are subject to change without notice — meaning you may not get the same dollar-for-dollar value as with redeeming miles for travel. As you saw in the example above though, redeeming for things other than travel can pay off, but the rates just aren’t guaranteed.

How the Capital One(R) Venture(R) Rewards Credit Card compares to other cards

Capital One(R) Venture(R) Rewards Credit Card vs. Chase Sapphire Preferred® Card

discontinued

Both cards offer travel-friendly features and the value of their bonuses is similar. Chase Sapphire Preferred® Card cardholders can earn signup_reward bonus points once spending signup_bonus_spend_amount on purchases in the first three months of opening an account.

When it comes to earning rewards, however, the structures are a bit different and if you are someone who just wants a straightforward rewards structure, the Venture card is likely better for you. With the Chase Sapphire Preferred® Card, you earn 5X points on travel purchased through Chase Travel; 3X on dining, select streaming services and online groceries; 2X on all other travel purchases; 1x on all other purchases; up to $50 in statement credits each account anniversary year for hotel stays through Chase Travel℠; plus more. That’s compared to the two miles per $1 spent on all your purchases with the Capital One card.

These cards are both travel rewards credit darlings, so if travel rewards are your goal, you might want to consider carrying both. To learn more about how they line up side-by-side, check out our in-depth Capital One Venture vs. Chase Sapphire Preferred® comparison.

Capital One(R) Venture(R) Rewards Credit Card vs. Capital One VentureOne Rewards Credit Card

discontinued

When you look at the all-around benefits of each card, the Capital One(R) Venture(R) Rewards Credit Card comes out on top— but that doesn’t mean it’s best for everyone. The biggest stand out is that the Capital One Venture Rewards Credit Card charges an annual fee, whereas the Capital One VentureOne Rewards Credit Card does not. If you’re not going to spend $5,000 or more in a year, the Capital One Venture Rewards Credit Card is probably not worth the annual fee.

The Capital One Venture Rewards Credit Card offers unlimited 2X miles per $1 on every purchase, every day, whereas the Capital One VentureOne Rewards Credit Card card offers 1.25X miles per $1 on every purchase, every day.

The Capital One VentureOne Rewards Credit Card does not offer a credit for Global Entry or TSA PreCheck. Earn 20,000 Miles once you spend $500 on purchases within three months from account opening; compared to signup_reward miles once you spend signup_bonus_spend_amount on purchases within three months from account opening, with the annual fee version.

One thing that the Capital One VentureOne Rewards Credit Card offers is an introductory 0% APR on purchases and balance transfers for intro_apr_duration (then, RegAPR; balance transfer fee applies, which is a nice benefit that the Capital One Venture Rewards Credit Card does not offer.

Is the Capital One(R) Venture(R) Rewards Credit Card a good card?

The Capital One Venture Rewards Credit Card is a good card for general travel rewards, especially if you don’t want to worry about spending caps and categories, as it earns 2X miles on every purchase made, with no caps on the amount you can earn. Remember, though, that you want to do better than just break even on the annual fee. Since the annual fee is annual_fees and your miles can be redeemed for at least $.01 each on travel, the Capital One Venture Rewards Credit Card is a good card for people who plan to spend at LEAST $5,000 each year on their card in general purchases ($5,000 x 2 miles per $1 spent = 10,000 miles).

Frequently asked questions

What is the welcome bonus for the card_name?

Is the card_name hard to get?

What is the average credit limit for the card_name?

Does card_name have foreign transaction fees?

Is the Capital One Venture worth the annual fee?

Our Methodology

Survey methodology: CardRatings commissioned Slice MR in November 2024 to survey 1,666 cardholders nationwide. CardRatings’ website analytics from Jan. 1, 2024-Oct. 31, 2024 were used to determine a selection of the most popular cards. Responses to 10 questions were given on a scale of 1-10. For nine of these questions, respondents’ scores were averaged under broad topics. The overall rating represents an average of respondents’ responses to their overall rating of each card.

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.