Why you should trust CardRatings.com

At CardRatings.com we discuss the most up-to-date news and trends within the credit card space. Since we first pioneered the concept of online credit card reviews in 1998, our team of financial experts has provided comprehensive and unbiased credit card reviews for more than 175 cards, plus hundreds of additional resource articles to help educate everyday cardholders so they can feel more confident about their card choices. All our content is written and reviewed by industry experts. Though our content may occasionally contain references to products from our partners, we maintain strict editorial integrity and advertiser relationships and compensation never influences ratings, reviews or featured products. The difference between editorial content and advertising must always be clearly stated. Learn more.

Although both FICO® and VantageScore have the same purpose of helping lenders evaluate whether or not consumers are likely to repay their debts, there are some important differences between the two models that you should understand. Continue on to learn how these two systems differ, and learn answers to some of the most commonly asked credit score questions.

What is a credit score?

Before we get into discussing the differences between credit scoring models, it’s important to first understand what a credit score is. In short, a credit score is a number that quickly tells a lender whether you’re a good credit risk or a shaky one.

Credit scores help lenders determine whether consumers are likely to repay their debts, and the higher the score, the more that helps you.

If your credit score is high, you’ll likely receive better terms on the loan, such as receiving a low interest rate. On the other hand, if your credit score is low, you may receive less favorable terms, like a high interest rate.

What is the difference between a credit score and a credit report?

A credit score and credit report are two different things, though many people mistakenly use the terms interchangeably. One is a numerical grade and one is a detailed collection of information – both communicate your credit worthiness.

A credit report works like a kind of report card that mortgage lenders, car loan providers, landlords, collection agencies, and potential employers can use to get summary of your financial history. It includes a historical record of things like your credit accounts, credit inquires, mortgages, and student loans. It also includes related public records such as bankruptcy filings. Credit reports show how much you owe creditors, the length of you accounts, and how consistently you make on-time payments. Credit scores are not reflected on your credit report. Instead, they are used as type of shortcut that credit issuers use to determine whether or not to grant you credit.

Credit reports are produced by the three major credit bureaus: Equifax, Experian and TransUnion.

Why is it important to review your credit report on a regular basis?

We’ll let Linda Simpson field this question. Simpson is a professor at Eastern Illinois University who teaches, among other courses, personal and family financial literacy and family budgeting and debt management.

Reviewing a credit report is essential to help a person better understand their current credit situation… There may be inaccurate or incomplete information in a credit report, so it is best to get the problem resolved rather than waiting until applying for a loan.

So what are you looking for? Simpson says you just want to make sure that the information is accurate, complete and up-to-date.

You’d think it would be, of course, but companies can make mistakes – and if there are any errors, especially ones that make you look like a credit risk, you’re going to want to insist that the credit bureau fixes your credit report. Another reason to look at your credit report on a regular basis is that you might discover signs of identity theft or credit fraud.

“Credit bureaus must allow the opportunity to fix any mistakes on the report,” Simpson says.

(It happens more than you would think. Earlier this year, a Consumer Reports study found that 34% of consumers probably have at least one mistake on their credit report.)

By law, a free credit report can be requested every 12 months from each credit reporting agency so Simpson recommends staggering requests to keep up with your credit report year round. “Ideally, a person can stagger the requests and check their credit report every 3-4 months. For example, reports can be requested using the following timeline each year: March – Equifax; July – TransUnion; November – Experian. At minimum, a request for a credit report should be made annually.”

Now that we’ve established the basics of a credit scores and reports, let’s dive further into the differences between the VantageScore and FICO® credit scoring models…

What is a FICO® Score?

Developed by the Fair Isaac Corporation in 1989, FICO® Scores are used by top lenders to make decisions about whether or not a consumer should be able to obtain credit. The score is based on data from the three major credit bureaus– Equifax, Experian, and TransUnion– which track people’s credit information to generate a three-digit score ranging from 300 to 850 based on a person’s payment activities; the higher the score, the better.

Since its inception, the Fair Isaac Corporation has updated FICO® Score models based on developments in the consumer lending field. It’s the model that lenders most often turn to, and the one that factors in information such as how many times you’ve been turned down for a card or whether an account has been sent to collections, all of which can lower your score.

Of course, it also includes the good stuff, like how often you make credit card and mortgage payments on time, which can raise your score.

The most popular version of the FICO® Score that lenders use is the 2004 FICO® 8 formula, however, the newer, 2014 FICO® 9 formula is becoming more widely adopted. This model reduces the impact of medical debt on your score and will add in rental payments to credit reports when landlords choose to report this information, which could help people without much of a credit history to build a credit file.

What are FICO® 10 and FICO® 10T?

FICO® Scores 10 and 10T are the newest FICO® Score models. According to myFICO, the new models account for shifts in consumer credit data since the last version was released. They are designed to do a better job of helping lenders evaluate credit risk and make better lending decisions. For example, FICO® estimates that using FICO® 10 could reduce mortgage defaults by up to 17%. By reducing losses, lenders can offer more competitive lending to consumers who pay their bills.

What’s different about the new FICO® Scores? If you have a good credit score with previous versions of FICO, you should also have a good score with FICO® 10 and FICO® 10T. Your FICO® 10 score is likely to be within 20 points of your score using previous credit models. The new models may penalize a person’s score more for one or more late payments, and for using a high percentage of your available credit. Having personal (unsecured) loans may also negatively impact a score.

FICO® 10T (for “trending”) not only considers your credit information at one point in time, but it looks at trends over the last 24 months or longer. It’s also called “time-series data,” and is more like a video of your credit history, as compared to a snapshot in time. For example, say your credit utilization rate is 33%; in other words, you are using 33% of your available credit. If your credit history shows that your credit utilization rate is going down over time, FICO® 10T will look on your credit history more favorably than if your utilization rate has been steadily climbing. The trending model may also work in your favor if you have occasional major expenditures that you pay off quickly. For example, if you buy a major appliance, causing your balance to spike during one reporting period, it will have less effect on your credit score using the trending model.

How do I get a FICO® 10 score?

FICO® 10 scores are now available to the three major credit bureaus. however, they cannot yet be accessed by consumers. With that said, most lenders are still using the FICO® 8 model for most non-mortgage lending decisions such as credit cards and personal loans.

How do common factors affect my FICO® score?

Making late payments. If you have a pristine credit history, even one late payment can lower your credit score significantly. The more late payments you have, or the more overdue they become, the more damage they could do to your score.

FICO® Scores weight all late payments the same, regardless of whether they are mortgage, credit card or other debt.

Late payments can stay on your credit report for up to seven years. However, they have less impact on your score the farther they are in the past. By making all your minimum payments regularly from now on, you can improve your score, possibly faster than you think.

➤ SEE MORE:Do late credit card payments affect your credit score?

Making credit inquiries. Shopping for credit can cause a dip in your credit score because excessive credit inquiries can indicate that you are increasing your debt levels. Fortunately, FICO® takes credit shopping into consideration. If you make multiple inquiries on car, home, or student loans in a 45-day period of time, FICO® weights them as only one inquiry.

Accounts sent to collections. Under the FICO® system, balances of less than $100 that creditors send to collections are not considered, and FICO® ignores amounts of any size after you’ve paid them off.

Current credit card balances. The amount of available credit you use at any given time generally indicates how well you manage money, so credit scoring systems compare your balances to available credit. The amount of credit you have used, divided by your available credit, equals your credit utilization ratio. A higher ratio can negatively impact your credit score, even if you never miss any payments.

Length of time credit has been reported. For a FICO® score, you should have at least one credit account that has been active for at least six months and that the creditor has reported to the credit bureaus.

➤ FURTHER READING:Changes you don’t expect to lower your credit score

What can I do to improve my FICO® score?

There’s always hope for improving your credit score. If your credit history is thin, perhaps because you are just starting to use credit, or if your credit has suffered setbacks for any reason, you can start building a better score today. Just pay all bills on time, keep your credit utilization rates low, and be careful about applying for new credit. Be especially careful about consolidating consumer debt with a personal loan and then charging up your credit card balances again. The personal loan combined with increasing total debt can hurt your score.

When you are trying to reduce your credit utilization ratio, which is especially important under the new FICO® 10 models, remember that keeping your available credit limits high is as important as chipping away at your balances owed. Your ratio should immediately improve if your creditors increase your limits. You may also want to leave credit cards open even when you are not using them; closing unused cards reduces your total credit limit and may impact your score. Of course, don’t increase your available credit if you may be tempted to increase your debt or if you cannot keep good track of your accounts. It won’t help your credit under any scoring model to go further into debt.

If you don’t qualify for credit, but you want to build a credit history, consider a secured credit card. With these cards, you deposit money in an account, generally equal to the amount of your credit limit on the card. This protects the credit card company in case you stop making payments. After you have proven yourself as a good risk, you should become eligible for an unsecured card.

If you are concerned about your score with FICO® 10 or FICO® 10T, you should especially pay attention to scrupulously making payments on time without fail. Consider setting up automatic minimum payments, or fail-proof reminders for yourself. You should also keep your balances low in proportion to your credit limits.

➤ SEE MORE:How to improve your credit score when you have no credit

What is a VantageScore?

The VantageScore credit scoring model was developed in 2006 by the TransUnion, Equifax, and Experian credit bureaus in order to offer an alternative to FICO® Scores. Although it is not as widespread as the FICO® scoring system, VantageScore has gained popularity in recent year as it is thought to provide a wider picture of a person’s credit history rather than just a snapshot. This system formerly used percentages in order to evaluate people’s creditworthiness, but it changed its scoring criteria to the following:

- Total credit usage, balance and available credit (extremely influential)

- Credit mix and experience (highly influential)

- Payment history (moderately influential)

- Age of credit history (less influential)

- New accounts (less influential)

VantageScore is similar to FICO® in that it works on a 300 to 850 scale, but it’s more closely related to the FICO® Score 8 model, which doesn’t factor in paid collection accounts and reduced the impact of medical collections on credit scores, than it is to FICO® 9.

Frequently asked credit score questions

What is considered a good credit score?

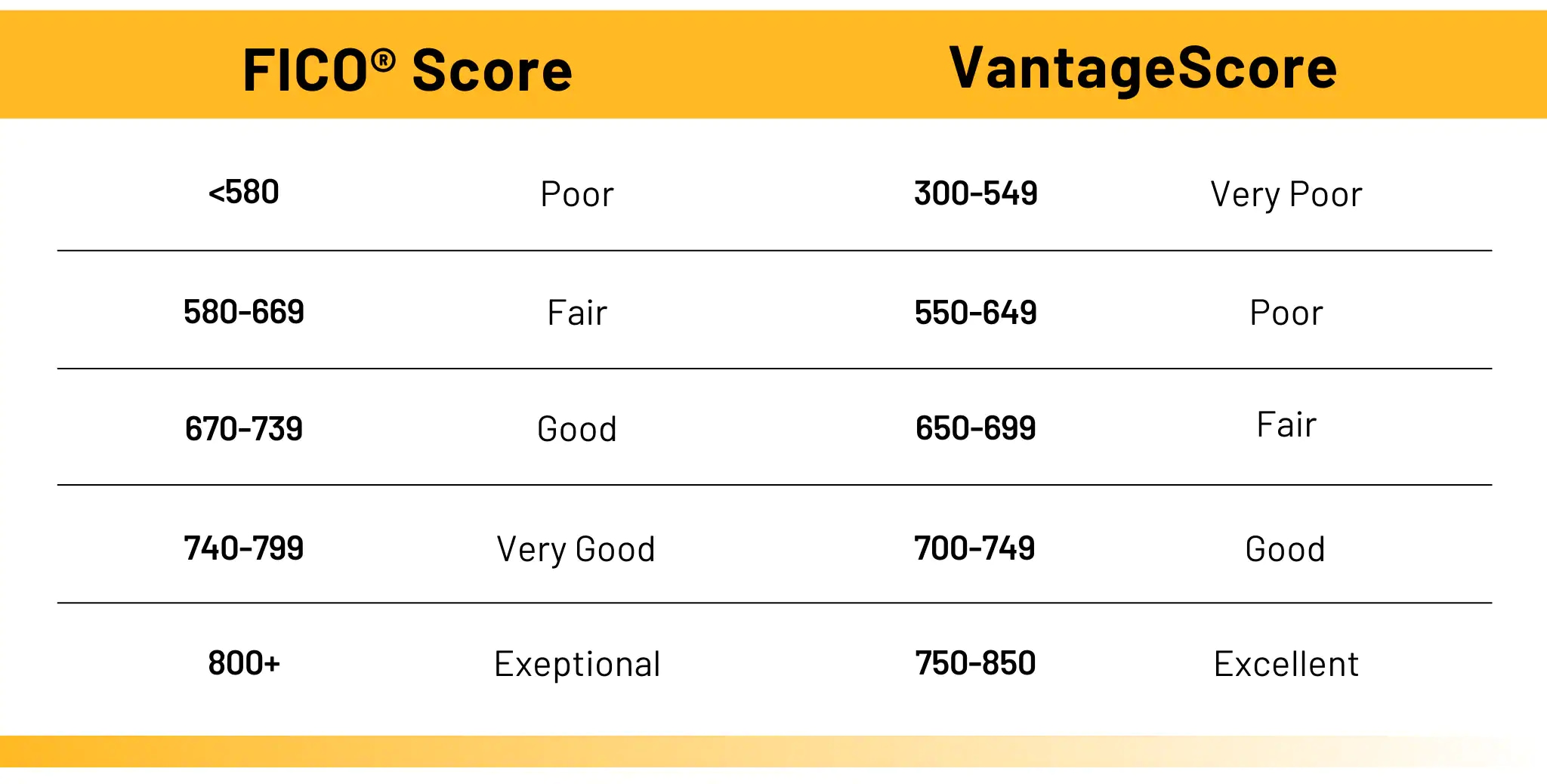

The credit score range for both FICO® and VantageScore is 300 to 850; however, the way the scores classify consumers are slightly different. For example, in the FICO® system, a very poor score range is anything 579 and below, while VantageScore’s very poor credit score range is up to 549. In order to be considered a very good credit risk, people must have a 740 to 799 FICO® Score and a 700 to 749 VantageScore. With FICO®, the top tier score range is between 800 and 850 and 750 to 850 in the VantageScore system.

Why do I have different FICO® Scores?

As mentioned above, there are different FICO® Score formulas that are commonly used.

Depending on which formula is used could produce varying results. Furthermore, there are FICO® Scores geared toward different industries, such as auto and mortgage lending, as well as credit card issuing. These measure and weigh your financial information in slightly different ways. Lastly, your scores may vary slightly depending on which credit bureau you use to pull your report. Each bureau may receive information from your creditors at different times over the course of a month, which could affect things like the amount of credit they report you’re using.

Because of this, if you really want to stay on top of your credit score, it can be a smart move to request credit scores from multiple bureaus to compare your results. Not that there’s much you can do right away if you find a bunch of varied credit scores, but if you know that one of your FICO® Scores is kind of weak, it might motivate you to do what you can to work harder to improve your credit scores.

That’s the benefit of understanding FICO® and VantageScore – and everything with credit scores and credit reports. Knowledge is power. If you are turned down for a loan, you want to know why. If you’re worried you will be turned down, but you learn that your scores are actually higher than you believed, that’s helpful to know, too.

How long does a consumer’s credit history need to be to establish a VantageScore and FICO® score?

In order to earn a VantageScore you must have at least one credit account that has been active for a minimum of one month, and at least one credit account that has been reported to credit bureaus in the last two years. With a FICO® score, you should have at least one credit account that has been active for at least six months and has been reported to the credit bureaus during that time.

How significant are late payments in the FICO® and VantageScore systems?

Late payments are heavily weighted for both, but each system handles them slightly differently. In both cases the scores are calculated based on how many payments have been missed, how recently the payments were missed, and how many accounts have late payments on them. However, with FICO® Scores, all late payments are weighted the same, while VantageScores weigh late payments made on mortgages more heavily than those made on other credit accounts.

How does VantageScore and FICO® handle credit inquiries?

Although shopping around for the best deal on a credit card or loan is a smart decision, it can count against consumers on their credit score because each application they submit is considered an inquiry into their credit history.

Fortunately, both VantageScore and FICO® take into consideration that people may be looking for the best rates they can get, such as when they buy a car and multiple loan applications are submitted at once. In order to address this, both scoring systems do something called deduplicating, also known as deduping.

Deduplicating, or deduping, means if you have multiple inquiries on your report in a short period of time, they are weighted as one inquiry. For VantageScore, the deduplicating period lasts for a 14-day window, while FICO® provides a 45-day window.

Additionally, FICO® and VantageScore look at the types of inquiries made differently during the deduplicating process. For a FICO® score, deduplication only applies to car, home, and student loans, while with VantageScore, it applies to all types of credit inquiries.

How are collection accounts handled by VantageScore and FICO®?

Both credit scoring models consider when your accounts have been sent to collections. But they’re different in a couple of ways.

In the VantageScore system, accounts that were sent to collections will be ignored when you pay them off, no matter what amount was owed. That said, VantageScore will consider unpaid collections amounts of any size.

On the other hand, in the FICO® system, balances of less than $100 that are sent to collections are not considered at all, and FICO® will ignore amounts of any size after you’ve paid them off.

How do the current balances on my credit card count toward my VantageScore and FICO® Scores?

Since the amount of available credit that you use at any given time is considered an indicator of how well you manage money, both scoring systems look at how high your balances are compared to your available credit.

Both models also look at the amount of credit you have used and divides it by the amount of credit you have available in order to determine your credit utilization percentage, also known as your credit utilization ratio or credit utilization rate.

The higher that percentage is, the more it could count against you in your credit score. However, VantageScore will also look at whether or not the high percentage is for short periods of time, or if you have a high percentage but generally pay your bill in full each month.

How can I get my credit scores from FICO® and VantageScore?

You can find out what your credit scores are from both systems through nonprofit credit counselors, the three credit reporting bureaus, personal finance websites, and lenders. In some cases, you may be required to pay a fee in order to access your score, but try to avoid that – especially if the fee seems really high. Additionally, many credit card issuers offer free credit score reports to cardholders which is a nice added perk to some of the best credit cards.

Historically, everybody’s been entitled to one free copy of their credit report every 12 months from each of the three nationwide credit reporting companies. When the COVID-19 pandemic began, however, Experian, Equifax and TransUnion announced that they would offer free credit reports to all Americans – every week. That program is expected to end Dec. 31, 2023.

What credit cards offer free credit scores?

Some of the big banks offering free credit scores include:

- American Express. Whether you have an American Express credit card or not, you can find out your VantageScore for free on their website through MyCredit Guide.

- Bank of America credit card customers have free access to their FICO® score.

- Barclays will also give its credit card members their free FICO® credit score.

- Capital One will let anyone see their VantageScore for free through CreditWise from Capital One.

- Some Citi credit cards offer free FICO® credit scores.

- Discover also offers a free FICO® credit score to anyone.

- And eligible Wells Fargo credit cardholders can get a free FICO® credit score.

What can I do to improve my VantageScore and FICO® score?

You may not have the ideal credit score at the moment, but FICO® and VantageScore will monitor your activities regularly, which gives you the chance to improve your scores. This can be done by paying all of your bills on time, keeping your credit utilization rates low, and refraining from applying for new credit unless it’s absolutely necessary.

Additionally, through responsible use, secured credit cards can boost the credit score for someone just starting out on their credit journey or help you rebuild your credit score if you’ve made some credit missteps in the past. Secured credit cards allow you to earn the trust of lenders without posing as much of a risk since you’re putting your own money on the line.

Why is it wise to begin building a strong credit score well in advance of applying for an auto or home loan?

Look at it this way. If you want to buy a house or a car, do you really want to first wait around for weeks or months while you wait for your credit bureau to fix problems that you’ve found? You want to get this done now, long before you’re applying for a loan.

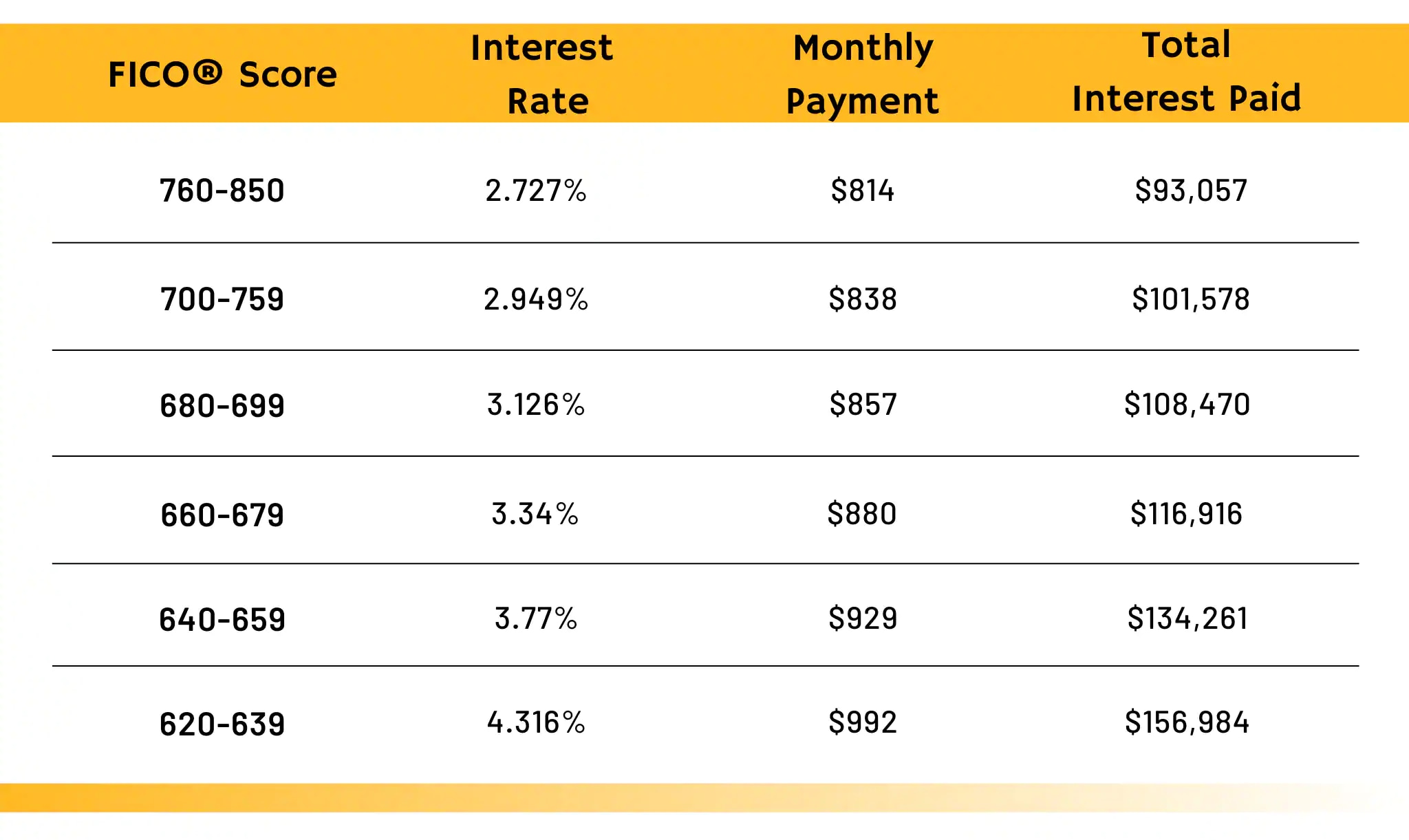

You might not think fixing credit report errors is a big deal, but raising your credit score can definitely save you money. Take Simpson’s example of interest rates on a 30-year fixed loan of $200,000 based on credit scores:

Simpson sets the scene of two home buyers purchasing a house. One person with a credit score of 625 with an interest rate of 4.316%, which sounds pretty good, and another person with a credit score of 765, and an even better interest rate of 2.727%. In this scenario, the person with the credit score of 625 would pay $178 more a month than the homeowner with a credit score of 765.

Not only is that a lot more per month, over the course of a 30-year loan, the person with the 625 credit score is paying $63,927 more in interest charges over the person with the 765 credit score.

In short, a person will have an easier time renting an apartment, securing a lower interest rate on a loan, and will be better prepared for the future with a higher credit score,” Simpson says. “It is important to start early in establishing credit.

Bottom line with credit scores

It may seem like a hassle, learning the difference between a VantageScore and a FICO® score, but if you’ve read through all of this, you haven’t wasted your time. Credit scores impact our lives more than many people think. Because a poor credit score can mean lousy terms with a loan, you literally can lose hundreds and thousands of dollars – all because of a bad credit score.

When it comes to FICO® and VantageScore, you may not be keeping score, but your future lenders are.