PenFed Pathfinder® Rewards Visa Signature® Card Review

This credit card offers stellar perks usually reserved for cards with very high annual fees. Take advantage of an annual domestic air travel reimbursement and earn as much as four points per $1 for your travel purchases.

PenFed Pathfinder® Rewards Visa Signature® Card

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- Enjoy perks usually reserved for cards with sky-high annual fees, including an annual travel reimbursement and Global Entry/TSA PreCheck application fee reimbursement.

- The travel category where you'll earn three or four points per $1 spent is broad. You'll earn big points for your flights as well as your regular commuter bus or train tickets.

- Earn 50,000 bonus points after you spend $3,000 in the first 90 days.

- You will need to join PenFed Credit Union to take advantage of this card and, if you want the highest possible rewards, you'll need to be a member of the military or open a checking account with the credit union.

PenFed Pathfinder® Rewards Visa Signature® Card Essentials

The new PenFed Pathfinder® Rewards Visa Signature® Card offers unprecedented perks for a no-annual-fee rewards card. When you consider the $100 annual domestic air travel reimbursement, the complimentary Priority Pass Select™ membership and the Global Entry or TSA PreCheck® benefit every five years, PenFed is basically going to pay you to use the card. And that’s before we even discuss the rewards-earning opportunities that could be as high as four points per $1 spent.

Combining the best attributes of a travel card with the best attributes of a rewards card, the PenFed Pathfinder® Rewards Visa Signature® Card rewards you on purchases both big and small. Whether it’s a gracious four points (for members of the military as well as Access America Checking account holders) or three points (for everyone else) for all travel purchases (including airline tickets, hotel stays, taxis, tolls, etc) or a still respectable 1.5 points for all other purchases, the PenFed Pathfinder® Rewards Visa Signature® Card helps you to earn points fast. Plus, the 50,000 bonus points you’ll earn after spending at least $3,000 with the card within the first 90 days will give you a nice boost towards point redemption, which can be used on anything from airline tickets to gift cards.

Basically, the card offers superb opportunities to earn points on travel and everyday purchases, the freedom to redeem your points how you want (with no caps or limits on rewards), travel reimbursements generally reserved for cards with sky-high annual fees, plus an exceptionally low APR.

And, the Pentagon Federal Credit Union is easy to join even if you aren’t and have never been a member of the military or worked for the government. More on membership below.

Notable features of the PenFed Pathfinder® Rewards Visa Signature® Card:

- AnnualFees annual fee (waived if you qualify for the Honors Advantage program. As a PenFed Pathfinder® Rewards cardholder, if you qualify for Honors Advantage (member of the military or Access America or Free Checking account holder) at the time of the application, Penfed will waive the annual fee on your account. If you were not eligible at account opening, but subsequently become eligible, the annual fee will be waived on your next anniversary. If at any time, you fail to maintain the eligibility requirements, you will no longer be eligible for the waiver. You will receive advance notice of this change)

- No foreign transaction fees

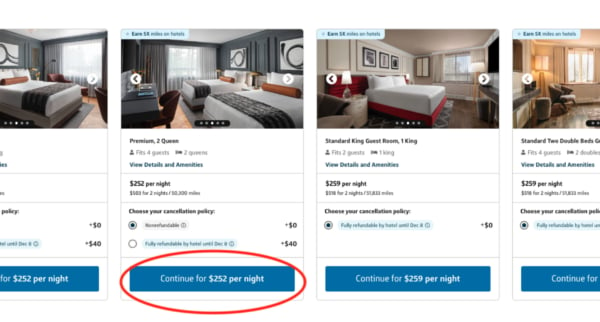

- $100 annual ancillary domestic air travel reimbursement

- $100 Global Entry or $85 TSA PreCheck® application fee reimbursement every five years

- Roadside assistance and travel and emergency assistance

- Complimentary Priority Pass Select™ membership

- Baggage loss and delay insurance and travel accident insurance

- Auto loss and damage insurance

- Trip cancellation and interruption protection

- Extended warranty and purchase protection

What Our Editors Like Most About the PenFed Pathfinder® Rewards Visa Signature® Card

If you are a member of the military, or an Access America Checking account holder, the four points you’ll earn on travel purchases is huge. And even if you’re not, three points for everyone else is still a higher earn rate than even travel rewards cards with annual fees in the $450 range.

PenFed Pathfinder® Rewards Visa Signature® Card cardholders can quickly rack up points close to home since the broad definition of "travel" includes everything from commuter transportation and ride-sharing purchases to airfare and hotel stays. Knowing you’re earning bonus rewards toward your next getaway every time you take the bus into work just might make the Monday to Friday grind a bit more bearable.

Let’s say you maintain an Access America Checking account with PenFed, so you earn four points on your travel purchases. Now, if you spend $1,200 a month on travel (remember, "travel" includes everyday expenses like bus and train tickets, tolls and taxi/ride-sharing fares in addition to standard airfare and hotel stays) and $2,500 a month on other expenses (3,750 points), you would earn 8,550 points a month, totaling 102,600 points annually (or 88,200 annually for standard cardholders). Add in the 50,000 point signup bonus, and with those numbers, you’ll have earned 152,600 (or 138,200) in your first year, just for making purchases you’d be making anyway.

Those points could prove very useful, especially if you have a big trip or some other sort of hefty expense coming up for which you’d like to offset the cost.

In addition to the huge points-earning potential, we like that the PenFed Pathfinder® Rewards Visa Signature® Card also offers a number of great travel and retail benefits, such as roadside assistance and travel and emergency assistance, as well as trip cancellation and interruption protection. Knowing you’re earning points on your trip when using your card is great, but knowing you’re protected on that trip thanks to your card is even better. Plus, no foreign transaction fees certainly don’t hurt!

Potential Downsides of the PenFed Pathfinder® Rewards Visa Signature® Card

While military members and Access America Checking account holders will benefit greatly with four points earned for all travel purchases, those who aren’t in the military or who are not Access America Checking account holders might not be as thrilled with a reduced three-point earning rate, especially as there are other cards on the market with similar offers.

Furthermore, to be eligible for the PenFed Pathfinder® Rewards Visa Signature® Card, you must be a PenFed Credit Union member; however, membership eligibility is available through a wide range of employment, association membership or volunteerism opportunities so don’t write this card off yet.

How to Become a PenFed Credit Union Member:

The PenFed Credit Union will only consider applications for the PenFed Pathfinder® Rewards Visa Signature® Card if you are a PenFed Credit Union member. You are eligible for membership if:

- You are an active or retired member of the United States Military or Uniformed Services.

- You are an employee of a qualifying organization such as Argon Engineering, Armed Forces Benefit Association, or the Enterprise Information Services.

- You belong to or volunteer with certain associations or organizations such as the American Red Cross (donating blood qualifies you for membership!), The Marine Corps League or the US Coast Guard Auxiliary.

- You are an employee of the United States government, including the National Security Council, DHS, or the Department of Homeland Security.

- You are the relative or housemate of someone who is eligible.

- You live or work at an eligible location, such as Fort Hood Texas, Fort Myer Virginia, or Fort Shafter Hawaii.

- You are a Voices for American Troops or National Military Family Association member. (PenFed Credit Union makes joining easy, right on the membership application page, for a one-time enrollment fee of $17.)

For a full list of qualifying military services, associations, organizations, government agencies, and locations, please see visit PenFed’s website.

How the PenFed Pathfinder® Rewards Visa Signature® Card Compares to Other Rewards Credit Cards

PenFed Pathfinder® Rewards Visa Signature® Card vs. Capital One VentureOne Rewards Credit Card

discontinued

Not so sure about an annual fee? That’s okay. Let’s take a look at a no-annual-fee card.

What’s great about the no-annual-fee Capital One VentureOne Rewards Credit Card is that it earns an unlimited 1.25 miles per $1 on every purchase, everyday; and 5 miles per dollar on hotels, vacation rentals and rental cars booked through Capital One Travel. Plus, you can earn 20,000 Miles once you spend $500 on purchases within three months from account opening.

It’s a pretty simple reward structure, but that’s what’s so nice about it. Instead of worrying about having certain cards to use with certain purchases, the Capital One VentureOne Rewards Credit Card is a nice card to have on hand for all your purchases. It might not earn you rewards as quickly as the PenFed Pathfinder® Rewards Visa Signature® Card, but it’s a nice, stable card to always have on hand, and with regular use, could gain you some serious rewards over time, especially if it’s your go to card. Plus, there are no foreign transaction fees, so it’s great for travel.

PenFed Pathfinder Rewards American Express Credit Card vs. Citi Strata Premier℠ Card

discontinued

With the Citi Strata Premier℠ Card new users have the possibility of earning a higher amount of rewards points as PenFed Pathfinder® Rewards Visa Signature® Card holders. There is, once again, an annual fee (AnnualFees) associated with the card, whereas with the PenFed card, there is an opportunity to avoid it if you meet certain qualifications. Considering the fact, though, that new Citi cardholders can earn signup_reward bonus ThankYou® Points after spending signup_bonus_spend_amount in the first three months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com – many users will find the annual fee more than worth it. Additionally, earn 10 points per $1 spent on hotels, car rentals, and attractions booked through CitiTravel.com; three points per $1 spent on air travel and other hotel purchases, at restaurants, supermarkets, gas and EV charging stations; and one point per $1 spent on all other purchases. Citi is a CardRatings advertiser.

Since credit cards aren’t all about bonuses though, let’s take a look at how these two cards compare otherwise.

Earning rewards with both of these cards is easy, but the earning rates vary slightly between the two. While they both earn three points on certain purchases, the PenFed Pathfinder® Rewards Visa Signature® Card has the added perk of four points earned on travel purchases that are made as a PenFed Honors Advantage member. Another perk is that users of the PenFed card can earn 1.5 points on all other purchases, while Citi cardholders only earn one point for purchases made in the "other" category. However, it should also be noted that in addition to multiple points earned on air travel and hotels, Citi users can also earn a whopping 10 points on hotels, car rentals, and attractions booked on CitiTravel.com, and three points on gas purchases, as well as three points at restaurants and supermarkets. So, if it’s the rewards structure where your decision lies, you’ll need to take your spending habits into consideration to figure out which card might benefit you the most.

And then lastly, since again, credit cards aren’t all about bonuses and rewards, there are a couple of other things we should point out about the two cards. There’s, of course, the fact that you must join the PenFed Credit Union to use the PenFed card, and if you want the highest possible rewards, you’ll need to be a member of the military or open a checking account with the credit union, whereas you won’t have to worry about these types of stipulations with the Citi card.

PenFed Pathfinder® Rewards Visa Signature® Card vs. Chase Sapphire Reserve®

Despite the fact these cards charge very different annual fees, we think that the PenFed Pathfinder® Rewards Visa Signature® Card and Chase Sapphire Reserve® (See Rates and Fees) are in a few ways, similar. They both earn points on travel purchases, and there are no caps or limits on rewards. The Chase card earns cardholders 8X points on all purchases through Chase Travel℠, including The Edit℠; 4X points on flights and hotels booked direct; 3X points on dining worldwide; and 1X points on all other purchases. Both cards offer annual travel reimbursements and Global Entry/TSA PreCheck fee credits. The one big difference people are sure to notice, though, is that Chase Sapphire Reserve® has a hefty annual fee of AnnualFees (plus $195 for each additional user).

One thing to keep in mind though, is that even though Chase Sapphire Reserve® has such a high annual fee, it does have many favorable perks to help outweigh this cost. For starters, the welcome bonus is large – Earn 125,000 bonus points after you spend $6,000 on purchases in the first three months from account opening.

Additionally, Chase Sapphire Reserve® cardholders receive a $300 statement credit each year to cover travel expenses such as airline tickets and hotels versus PenFed’s $100 annual domestic anciliary air travel benefit. Furthermore, in addition to the points earned on travel purchases, Chase Sapphire Reserve® members have an additional chance to earn three points when they use their card for dining purchases; however, outside of travel and dining, only one point per $1 will be earned, compared to the PenFed Pathfinder® Rewards Visa Signature® Card‘s 1.5.

So do the cards compare apples to apples? Not exactly. Still, even with Chase’s annual fee, thanks to the other card parks, we think that as far as rewards go, they come pretty close. You’ll just have to decide if that major annual fee is worth it to you.

Who Should Get the PenFed Pathfinder® Rewards Visa Signature® Card?

The PenFed Pathfinder® Rewards Visa Signature® Card is a surprisingly good card option for members of the military or for Access America Checking account holders, in particular, as the card earns a whopping four points for every $1 spent on travel purchases. And even if you’re not a military member or an Access America Checking account holder, with three points earned on travel – even travel on commuter transportation – and 1.5 points on everything else, we still think the PenFed Pathfinder® Rewards Visa Signature® Card is a great card for those looking to easily accumulate a lot of points. Consider the points-earning opportunities along with the annual travel reimbursement of $100 and Global Entry/TSA PreCheck® fee credit and you have yourself a truly unique rewards card.

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.