Hilton Honors American Express Surpass® Card review

This is the card for your Hilton stays but also for everyday purchases at U.S. restaurants, U.S. supermarkets, U.S. gas stations, and U.S. online retail purchases. Plus it offers perks for travelers including airport lounge access.

Hilton Honors American Express Surpass® Card

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- The opportunity to earn a weekend night stay reward after spending at least $15,000 on eligible purchases in a calendar year gives you an ongoing option to more than offset the annual fee.

- There's a mega limited-time welcome offer opportunity with this card of signup_reward bonus points plus a Free Night Reward after you spend signup_bonus_spend_amount in purchases in the first six months of card membership. Offer Ends 4/15/2026.

- This branded card offers you bonus rewards opportunities outside of just your Hilton purchases.

- There is an annual fee to think about. If you're a casual credit card user who won't spend enough for the annual weekend night reward, you might want to consider a more general rewards card without an annual fee.

Marriott Bonvoy Bevy® American Express® Card

discontinued_disclaimerHilton Honors American Express Surpass(R) Card benefits

For frequent travelers, especially those who are loyal to the Hilton brand, the Hilton Honors American Express Surpass® Card warrants some attention. American Express is a CardRatings advertiser.

To start things off on the right foot, for a limited time, new Surpass® cardholders can earn signup_reward bonus points plus a Free Night Reward after you spend signup_bonus_spend_amount in purchases in the first six months of card membership. Offer Ends 4/15/2026. Cardholders will also receive a weekend night reward stay when spending at least $15,000 on eligible purchases in a calendar year, a perk that can more than offset the card’s AnnualFees annual fee. (See Rates and Fees)

Beyond bonuses, your points can add up quickly with 12 points earned for every $1 spent on eligible purchases directly with a participating hotel or resort within the Hilton portfolio. You’ll also earn six points on eligible purchases at U.S. restaurants, U.S. supermarkets and U.S. gas stations, four points per $1 spent on U.S. online retail purchases, and three points per $1 spent on all other eligible purchases. With so much potential to earn rewards on purchases other than at Hilton properties, this card turns out to be a solid option for your everyday purchases, too.

Cardholders also enjoy Gold status in the Hilton Honors program, and the card makes Hilton Honors Diamond status easily within reach. Plus, spend $40,000 on eligible purchases on your Card in a calendar year and you can earn an upgrade to Hilton Honors Diamond status through the end of the next calendar year. Terms and Limitations apply. Enrollment required for select benefits.

The Hilton Honors American Express Surpass(R) Card has no fee for foreign transactions, which has the potential to save you hundreds of dollars if you travel internationally often. (See Rates and Fees)

Potential downsides of the Hilton Honors American Express Surpass(R) Card

The Hilton Honors American Express Surpass® Card isn’t for everyone. If you don’t travel very often, then many of the perks and bonuses could be out of reach. In that case, you might want to look for a card that doesn’t have an annual fee or that offers cash-back rewards instead.

Remember, too, that the rewards for non-Hilton purchases are decent, but you’ll really maximize the potential with this card if you stay regularly at Hilton properties. Hilton Honors points can also be redeemed for perks other than free hotel stays including purchases on Amazon.com; car rentals and rental upgrades; and special experiences such as private concerts, luxury weekends and VIP access to special events; however, you’ll likely get the most out of your points using them for free hotel stays.

How the Hilton Honors American Express Surpass(R) Card compares to other cards

Hilton Honors American Express Surpass(R) Card vs. Hilton Honors Card from American Express

discontinued

Anyone who stays at Hilton properties on a regular basis can probably benefit from a Hilton Honors credit card. Both the Hilton Honors American Express Surpass(R) Card and the Hilton Honors American Express Card offer points and perks that can be used at hotels and resorts across the globe.

The Hilton Honors Card from American Express is an entry-level card that doesn’t charge an annual fee but also doesn’t come with the same perks as the Surpass® card. (See Rates and Fees) In exchange for an annual fee, the Surpass® card comes with complimentary Gold Status, and a free weekend night reward after you spend $15,000 on eligible purchases per year. Meanwhile, the Hilton Honors Card from American Express offers complimentary Silver Status and a limited-time welcome opportunity to earn signup_reward bonus points plus a Free Night Reward after you spend signup_bonus_spend_amount in purchases in the first six months of card membership. Offer Ends 4/15/2026.

While you can’t go wrong with either of these cards, frequent travelers may find that a higher status level and airport lounge access are well worth the annual fee charged by the Surpass® card.

Hilton Honors American Express Surpass(R) Card vs. American Express(R) Gold Card

discontinued

If you prefer to stay at Hilton hotels and resorts, a Hilton Honors credit card may seem like the best choice. However, it’s worth considering whether a general purpose rewards card might be better. For example, let’s see how the Hilton Honors American Express Surpass(R) Card stacks up against the American Express® Gold Card.

For a annual_fees annual fee, the Amex Gold card gives you the opportunity to earn up to $120 in dining credits at select restaurants and a $100 credit towards eligible charges with every booking of two nights or more through AmexTravel.com, at over 1,000 upscale hotels worldwide with The Hotel Collection. Eligible charges vary by property. Enrollment required for select benefits. See Rates and Fees.

Additionally, the American Express(R) Gold Card, offers new cardholders the opportunity to be eligible for as high as signup_reward Membership Rewards® Points after you spend signup_bonus_spend_amount in eligible purchases in your first six months of card membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the card, your score may be impacted. Those points can be used to book travel directly through American Express or be transferred to partner programs, including Hilton Honors.

As for rewards earning potential, Amex Gold offers 4X points per $1 spent on purchases at restaurants worldwide (on up to $50,000 in purchases per calendar year), then 1X points; 4X points per $1 spent at US supermarkets (on up to $25,000 in purchases per calendar year) then 1X points; 3X points per $1 spent on flights booked directly with airlines or on AmexTravel.com; 2X points per $1 spent on prepaid hotels and other eligible purchases booked on AmexTravel.com; and 1X point per $1 spent on all other eligible purchases.

Is the Hilton Honors American Express Surpass(R) Card a good card?

Yes, the Hilton Honors American Express Surpass® Card is a strong consideration for the wallet of any traveler who often, if not always, stays at Hilton properties when on the road. If you are a frequent traveler, whether it be for business or pleasure, you are a well-suited candidate for this card. It won’t take long to achieve the thresholds needed for some very attractive perks.

Frequently asked questions

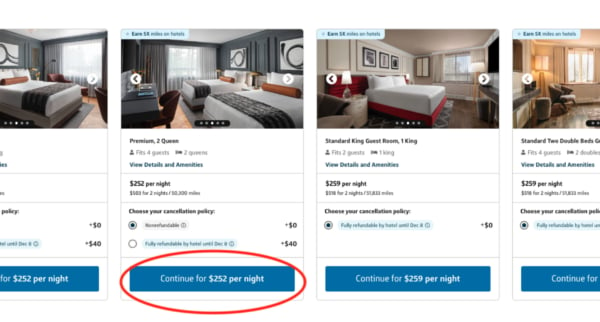

How to redeem a Free Night Reward from Hilton Honors American Express Surpass® Card

How much is the card_name annual fee?

What credit score do you need for the card_name ?

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.

To see the rates and fees for the American Express cards featured in this post, please visit the following links: Hilton Honors American Express Card (See Rates and Fees); American Express® Gold Card (See Rates and Fees); Hilton Honors American Express Surpass® Card (See Rates and Fees)

Jump to Section