Delta SkyMiles® Reserve American Express Card review

Complimentary airport lounge access, an excellent welcome bonus offer opportunity, and the chance to earn bonus miles each year make this a great choice for regular Delta passengers.

Delta SkyMiles® Reserve American Express Card

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- Earn signup_reward bonus miles after you spend signup_bonus_spend_amount in eligible purchases in your first six months.

- Enjoy complimentary access to The Centurion Lounge when you book a Delta flight with your card.

- Earn 3X miles on Delta purchases and earn 1X miles on all other eligible purchases.

- The annual fee is steep at AnnualFees, so this isn't the card for the casual Delta customer. To truly offset the fee, you'll need to take full advantage of all the perks, benefits and bonus earning opportunities available. See Rates and Fees

Delta Reserve(R) Credit Card from American Express benefits

If you fly often and Delta is your preferred airline, the Delta SkyMiles® Reserve American Express Card might be the card for you. It’s jam-packed with luxurious benefits that can enhance your travel experience and help you save money. American Express is a CardRatings advertiser.

The first benefit to catch your eye will likely be the welcome bonus. First-time cardholders can earn signup_reward bonus miles after you spend signup_bonus_spend_amount in eligible purchases in your first six months.

On an ongoing basis, cardholders can earn:

- 3X miles per dollar spent on Delta purchases

- 1X mile on all other eligible purchases

Some other major benefits include:

Companion certificate

Enjoy a Companion Certificate on a Delta First, Delta Comfort, or Delta Main round-trip flight to select destinations each year after renewal of your card. The Companion Certificate requires payment of government-imposed taxes and fees of between $22 and $250 (for itineraries with up to four flight segments). Baggage charges and other restrictions apply. Delta Basic experiences are not eligible for this benefit.

Status boost

Receive $2,500 Medallion® Qualification Dollars with MQD Headstart each medallion qualification year and earn $1 MQD for each $10 in purchases on your card with MQD Boost to get closer to status next medallion year.

Delta Sky Club access

Cardholders receive complimentary access to more than 50 Delta Sky Club locations when catching a same-day Delta-Marketed or Delta-Operated flight. Once inside the club, you can relax and enjoy complimentary drinks, food and high-speed Wi-Fi.

You will also receive 15 visits per Medallion® Year to the Delta Sky Club® when flying Delta and can unlock an unlimited number of visits after spending $75,000 in purchases on your card in a calendar year. Plus, you’ll receive four one-time guest passes each medallion year so you can share the experience with family and friends when traveling Delta together.

Centurion lounge access

You’ll also receive complimentary access to the Centurion Lounge or Escape lounges when flying Delta. These lounges offer complimentary signature cocktails, food prepared by local chefs and high-speed Wi-Fi. Some locations even offer spa services, conference rooms and luggage lockers. You can bring up to two guests at a price of $50 per person.

Global Entry/TSA PreCheck reimbursement

Avoid long customs and security lines by applying for Global Entry or TSA PreCheck membership. These programs allow you to skip the regular security and customs lines at the airport. If you apply and pay with the Delta Reserve(R) Credit Card from American Express, you’ll receive up to a $120 statement credit. (Enrollment required)

Free checked bags

When you use your card to book a Delta fight, your first checked bag will be free. This also applies to eight additional passengers flying under the same reservation. For a family of six, this represents a per roundtrip savings of up to $420.

Travel insurance

If your trip is paid entirely with your card, you may qualify for trip interruption or cancellation insurance. This means that if your trip is canceled or shortened due to the weather, sickness or another eligible event, you can be reimbursed up to $10,000 per trip, and up to $20,000 per year.

20% back on in-flight purchases

While flying Delta, you can receive a 20% discount in the form of a statement credit when you pre-purchase an eligible meal or purchase these in-flight items: audio headsets, alcoholic beverages and food.

Discounts on Delta flights

Eligible card members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

Resy credit

Cardholders can enjoy up to $240 each year in Resy credit. Earn up to $20 per month in statement credits on eligible Resy purchases using your enrolled card (enrollment requirement).

Rideshare credit

You can earn up to $10 back in statement credits each month on U.S. rideshare purchases with select providers after you pay with your Reserve card (enrollment required).

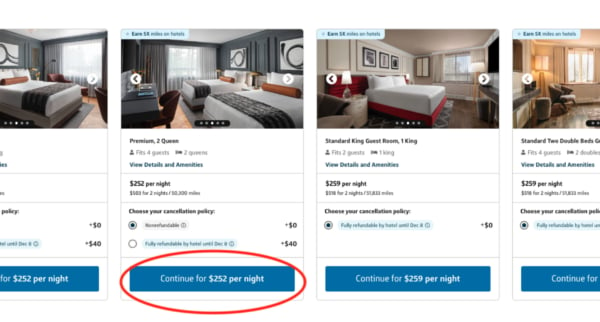

Delta Stays credit

Cardholders can earn up to $200 back in the form of a statement credit annually on eligible prepaid Delta Stays bookings made on delta.com.

Delta Reserve(R) Credit Card from American Express annual fee – is it worth it?

Although the annual fee for this card is AnnualFees, it might be worth it for someone who travels a lot with Delta. If you take advantage of the plethora of benefits the card offers, you can quickly offset the annual fee. See Rates and Fees.

For example, if you earn the welcome bonus and visit a Centurion or Escape Lounge while you travel, that would be more than enough to offset the annual fee within the first year of opening the card.

However, if you don’t travel often or if Delta isn’t your favorite airline, the fee likely isn’t worth it.

How does the Delta Reserve(R) Credit Card from American Express compare to other cards?

Delta SkyMiles® Reserve American Express Card vs. Delta SkyMiles® Platinum American Express Card

discontinued_disclaimer

If you fly Delta often but not enough to justify the Delta SkyMiles® Reserve American Express Card‘s hefty annual membership fee, here’s another option to consider.

The Delta SkyMiles® Platinum American Express Card has a AnnualFees annual fee, and it’s better for earning miles on everyday purchases. You can earn 3X miles per dollar on purchases made directly with hotels; 2X miles per dollar spent at restaurants worldwide (including takeout and delivery in the U.S.), and 2X miles per dollar spent at U.S. supermarkets. This is in addition to 3X miles earned per dollar spent directly with Delta, and 1X mile on all other eligible purchases. See Rates and Fees.

The Delta SkyMiles® Platinum American Express Card offers some of the same benefits as the Reserve card, such as an annual companion certificate. However, with the SkyMiles® Platinum card, you don’t get complimentary access to Delta Sky Club lounges.

Delta SkyMiles® Reserve American Express Card vs. The Platinum Card® from American Express

discontinued_disclaimer

If you prefer a card that offers a ton of ways to earn travel rewards, The Platinum Card® from American Express could be a better fit.

The Platinum Card® from American Express has a much higher fee of AnnualFees but offers a ton of premium perks. To begin with, you may be eligible for as high as signup_reward Membership Rewards® Points after you spend signup_bonus_spend_amount in eligible purchases in your first six months. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the card, your score may be impacted. Plus, the card comes with several credits, such as up to a $200 airline fee credit for incidental charges with a pre-selected airline and more. Enrollment required for select perks. See Rates and Fees.

With the Platinum Card®, you can earn 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel® (including Fine Hotels + Resorts® and The Hotel Collection bookings); 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year; and 1X point on all other eligible purchases.

Lastly, eligible card members have access to the Global Lounge Collection®, an airport lounge program that includes over 1,550 airport lounges worldwide, with access to Centurion Lounges, 10 complimentary Delta Sky Club® visits when flying on an eligible Delta flight (subject to visit limitations), Priority Pass™ Select membership (enrollment required), and other select partner lounges (as of 07/2025).

Is the Delta SkyMiles® Reserve American Express Card a good card?

The Delta SkyMiles® Reserve American Express Card is a good card if you fly with Delta frequently and can take advantage of its many perks. If you spend a lot of money on Delta flights and want to reach an elite status quickly, it is worthy of your consideration.

However, if you fly often but Delta isn’t your preferred airline, you’ll likely benefit more by picking a more flexible premium travel rewards card.

Frequently asked questions

Is the card_name hard to get?

Is the card_name worth it?

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.

To see the rates and fees for the American Express cards in this post, please visit the following links: Delta SkyMiles® Platinum American Express Card (See Rates and Fees); Delta SkyMiles® Reserve American Express Card (See Rates and Fees); The Platinum Card® from American Express (See Rates and Fees)

Jump to Section