Chase Freedom Unlimited® review

This card stands out as a versatile and reliable choice for everyday spending. Its strength lies in its simplicity, offering consistent rewards across all purchases. This makes it a great option for those who prefer a straightforward approach to earning rewards, without the need to track rotating categories or complex bonus structures. It's designed to seamlessly integrate into your daily life, providing a consistent return on your spending, no matter where you shop.

card_name

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- Earn a signup_reward bonus after you spend signup_bonus_spend_amount on purchases in your first three months from account opening.

- Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service; and 1.5% on all other purchases.

- Chase Freedom Unlimited® is offering a 0% intro APR for intro_apr_duration from account opening on purchases and balance transfers, then RegAPR.

- There isn't an annual fee, but you'll be on the hook for foreign transaction fees if you use Chase Freedom Unlimited® while abroad.

Since Chase Freedom Unlimited® first appeared on the scene it has been among the top flat-rate cash-back cards on the market. But Chase upped the ante years later announcing an all-new rewards structure that moves the card into the tiered cash-back rewards category and includes up to 5% cash back in some categories of purchases.

Let’s jump into the details:

Chase Freedom Unlimited® rewards

For new cardholders, Chase Freedom Unlimited® cardholders earn tiered rewards in a number of categories:

- Enjoy 5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more.

- Earn 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service.

- Earn 1.5% on all other purchases.

Suddenly, what has been a consistent top flat-rate cash-back rewards card becomes a top tiered-rate cash-back rewards card. These rewards categories mean many people will be able to see their cash back add up even more quickly than in the past.

Chase Freedom Unlimited® benefits

The ease of racking up rewards with Chase Freedom Unlimited® is perhaps its most appealing feature, but it’s far from the only reason the Chase Freedom Unlimited® card could be a welcome addition to your wallet. Cash-back credit cards certainly aren’t a new idea, but there are some aspects of Chase Freedom Unlimited® that make us sit up and take notice.

To start, the at least unlimited 1.5% cash back on every purchase is a fairly high return for a no-annual-fee card and that’s before you even take into account the additional tiered categories.

The redemption options are also a nice benefit in and of themselves.

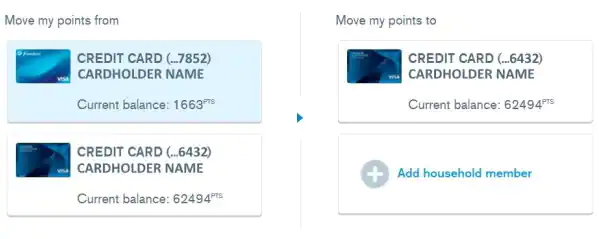

One hundred points equals $1, so even taking the lowest earning rate of 1.5 points earned per $1 spent, you’ll accumulate 100 points after you spend $67. Obviously, that gets even better if you’re spending on restaurants at three points per $1 or on travel through Chase Travel at five points per $1. Many cash-back reward cards restrict when you can cash in your points – as in, you need to accumulate enough points to redeem them in $25 increments or something similar. With Chase Freedom Unlimited®, there are no thresholds to meet in order to redeem your points for cash. Those redeemed points can equal cash deposited directly into an eligible checking or savings account or, since they are points through Chase Travel, they can be used to purchase travel, gift cards, products or services or they can be combined with Chase Travel points you earn using other cards on the system, possibly making them worth even more.

That’s why, while we like Chase Freedom Unlimited® on its own, it’s even better if you pair it with another Chase Ultimate Rewards card such as Chase Freedom Flex℠ and/or Chase Sapphire Preferred® Carddiscontinued. Here’s why:

- When paired with Chase Freedom Flex℠, you can earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Then use your Chase Freedom Unlimited® for purchases in all other categories to cash in at the 1.5% cash back on every purchase outside those bonus categories. (Information related to Chase Freedom FlexSM has been collected independently by CardRatings and was neither reviewed nor provided by the card issuer.)

- When paired with the Chase Sapphire Preferred® Card, you can transfer your points between the two cards. Since Chase Sapphire Preferred® Card cardholders receive more value when they redeem points through Chase Travel℠, the points you earn with your Chase Freedom Unlimited® (and Chase Freedom Flex℠ for that matter) are worth more.

- Of these three cards, only the Chase Sapphire Preferred® Card charges an annual fee, so if you’re going to carry that card anyway, you won’t be losing any money to add the other two to your wallet and points-earning strategy.

Chase Freedom Unlimited® travel benefits

Widely known as a cash back credit card, most people don’t think of the Chase Freedom Unlimited® when it comes to travel. Like we covered above, however, since rewards can be redeemed through Chase Travel, some people use the Chase Freedom Unlimited® like a travel card as well. With that said, there are a few travel perks people should be aware of when it comes to this card. The main Chase Freedom Unlimited® travel benefits include:

- Trip cancellation/trip interruption insurance, offering reimbursement up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable passenger fares, if your trip is canceled or cut short by covered situations like sickness or injury.

- Travel and emergency assistance services, which provides you with legal and medical referrals or other travel and emergency assistance when you run into a problem away from home.

- Auto rental collision damage waiver, providing you with coverage for theft and collision damage for most cars in the U.S. and abroad. In the U.S., this coverage is secondary to your personal insurance.

- Roadside dispatch if you have a roadside emergency – anything from a tow or a jump start to a tire change, lockout service, winching or gas delivery. Roadside service fees will be provided when you call and will be billed to your card.

Chase Freedom Unlimited® foreign transaction fee and other potential drawbacks

The Chase Freedom Unlimited® credit card is a solid choice for anyone looking for cash back rewards. However, it’s not perfect. One of the biggest drawbacks of the card is its foreign transaction fee (foreign_transaction_fee on all purchases made in a foreign currency). If you frequently travel outside of the United States or often make online purchases in a foreign currency, you may be better off going with another option, such as the Chase Sapphire Preferred® Card, which doesn’t charge this fee. To put things in perspective, if you took an international trip and used your Chase Freedom Unlimited® card for $3,000 worth of purchases, you’d be looking at an extra $90 in fees.

What’s more, while the unchanging tiered structure of the Chase Freedom Unlimited® card is part of its appeal, you could earn larger rewards by selecting a card with rotating or bonus earning categories. For instance, the Chase Freedom Flex℠ card offers quarterly bonuses that can provide up to 5% cash back for spending in categories such as groceries and gas. Now, the updated rewards earning for Chase Freedom Unlimited® goes a long way toward alleviating this drawback; however, it’s possible it’s going too far. There are a lot of new details and categories with Freedom Unlimited®, which means it’s great for earning rewards, but it also means you have more details and strategy to keep up with.

Chase Freedom Unlimited® credit score

To qualify for approval for the Chase Freedom Unlimited® you should have good to excellent credit. Chase doesn’t specify the exact number you’ll need to qualify, and additional factors from your application and credit history could also affect your approval chances. The credit bureau Experian, however, says those with good credit usually have FICO scores of at least 670, with excellent scores starting at 800. Please note, though, that these numbers can vary between different bureaus.

How do cardholders rate the Chase Freedom Unlimited® card?

CardRatings commissioned Slice MR in November 2024 to survey 1,666 cardholders nationwide. Responses were given on a scale of 1-10 and respondents’ ratings were then averaged under broad topics. Here are the results for the CardName:

| Cost Effectiveness | 8.30 |

| Rewards Satisfaction | 7.97 |

| Customer Service | 8.07 |

| Website/App Usability | 8.17 |

| Likelihood of Continuing to Use | 8.83 |

| Recommend to a Friend/Colleague | 8.32 |

| Overall Rating | 8.35 |

Survey results by question

Respondents rated their personal experience with the card_name, answering questions on a scale from 1-10. The results for each question can be found below:

How does Chase Freedom Unlimited® compare to other cards?

Chase Freedom Unlimited® vs. CardName

discontinued

The big perk with the CardName is that it doubles your cash back each time you pay your credit card bill. Here’s how it works: With the Citi card you’ll earn unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. (Citi is a CardRatings advertiser)

With the Chase Freedom Unlimited® card, you earn a bit less at the base rate, 1.5% on everything that doesn’t qualify for one of the higher category-earning rates, but the rewards are automatic. Each time you swipe your card, you’ll earn at least that 1.5%. It’s as simple as that.

Additionally, both cards have a 0% percent introductory period, but they differ on what that applies to. Chase Freedom Unlimited® extends that offer to purchases and balance transfers. With the Citi card, you can look forward to balance_transfer_duration_months of 0% intro APR on balance transfers, then RegAPR.

Chase Freedom Unlimited® vs. Capital One Quicksilver Cash Rewards Credit Card

discontinued

With uncapped rewards earned on every purchase the Chase Freedom Unlimited® and Capital One Quicksilver Cash Rewards Credit Card are both excellent no-annual-fee credit cards. They both offer 1.5% cash back as a base rewards rate on all purchases, though Chase Freedom Unlimited® also offers 5% on travel through Chase and 3% at restaurants and drugstores. Quicksilver offers a limited time bonus of $300 in welcome bonuses! Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first three months from account opening.

For redemption options, both cards have the ability to redeem cash back at any time with no minimums and to redeem for gift cards. Where the Chase Freedom Unlimited® card sets itself apart is with the ability to redeem points on Amazon.com with the Chase Shop with Points feature as well as to redeem points for travel through Chase. Another big difference to note is that the QuickSilver card does not charge a foreign transaction fee, a unique perk for a cash-back credit card – especially one with no annual fee. To learn more about how these cards line up, check out our in depth Chase Freedom Unlimited® vs. Capital One® Quicksilver comparison.

Is Chase Freedom Unlimited® a good card?

Chase Freedom Unlimited® is designed for people who aren’t crazy about the idea of keeping up with rotating cash-back categories, but who do spread their spending out among multiple categories and like the flexibility of the option to redeem points through Chase Travel It’s also good for people who want the ultimate complement to round out the other Chase Ultimate Rewards cards in their wallet.

It’s likely not the best choice, however, for people who use their card for international travel or who relish the opportunity to strategically use their credit cards to rack up maximum rewards in categories that change quarterly.

Frequently asked questions

Does card_name have foreign transaction fees?

Does card_name earn Ultimate Rewards?

What credit score do you need for card_name credit card?

Our Methodology

Survey methodology: CardRatings commissioned Slice MR in November 2024 to survey 1,666 cardholders nationwide. CardRatings’ website analytics from Jan. 1, 2024-Oct. 31, 2024 were used to determine a selection of the most popular cards. Responses to 10 questions were given on a scale of 1-10. For nine of these questions, respondents’ scores were averaged under broad topics. The overall rating represents an average of respondents’ responses to their overall rating of each card.

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.