Marriott Bonvoy Brilliant® American Express® Card review

Credit cards with large annual fees might not seem worth it at first glance; however, most times when you dig into the card details, you'll see that the benefits far outweigh the cost of the card. Learn more about this card and find out whether the annual fee is worth it for you.

Marriott Bonvoy Brilliant® American Express® Card

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- Earn signup_reward Marriott Bonvoy® bonus points after you use your new card to make signup_bonus_spend_amount in purchases within the first six months of card membership.

- Each card renewal year, get up to $300 (up to $25 per month) in statement credits for eligible purchases made with the card at restaurants worldwide.

- In addition to numerous hotel perks, this card offers several great benefits for frequent fliers as well, such as airport lounge visits and Global Entry or TSA PreCheck membership reimbursement (enrollment required).

- The annual fee isn't for everyone. If you don't frequently stay at Marriott hotels, or you don't think you'll use the other benefits offered by the card, you might have a tough time offsetting the cost of the card.

Marriott Bonvoy Bevy® American Express® Card

discontinued_disclaimerMarriott Bonvoy Brilliant(R) American Express(R) Card benefits

The Marriott Bonvoy Brilliant® American Express® Card annual fee is hefty– AnnualFees– and so you would expect that a card like this would come with a lot of benefits. Does it live up to the hype, or is it a huge and crushing disappointment? American Express is a CardRatings advertiser. See Rates and Fees.

In short, yes, we think that the Marriott Bonvoy Brilliant® lives up to the hype. At least, it should for fans of the Marriott hotel chain and their many, many brands.

There are a lot of benefits that come attached to this card. Let’s run through some of its biggest assets:

- It has a very generous rewards program, but we’ll talk more about that in the next section.

- Earn signup_reward Marriott Bonvoy® bonus points after you use your new card to make signup_bonus_spend_amount in purchases within the first six months of card membership.

- Each card renewal year, get up to $300 in statement credits per calendar year (up to $25 per month) in statement credits for eligible purchases at restaurants worldwide.

- Free Night Award. What’s this, you ask? Receive one Free Night Award every year after your card renewal month. Award can be used for one night (redemption level at or under 85,000 Marriott Bonvoy points) at a participating hotel. Certain hotels have resort fees.

- A $100 Marriott Bonvoy property credit. With your card, you can book a special rate for a two-night minimum stay at The Ritz-Carlton or St. Regis and get up to $100 in credit for qualifying charges.

- Enjoy access to Priority Pass™ Select, which offers unlimited airport lounge visits around the globe regardless of the airline or class you are flying.

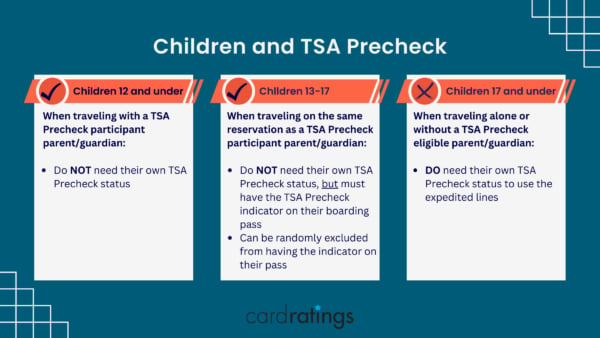

- Go through airline security easier. Receive either a $120 statement credit for Global Entry every four years or a statement credit for up to $85 for TSA PreCheck every 4.5 years.

- Car rental loss and damage insurance. When you use your card to reserve and pay for the entire rental, you can say "no thanks" to the collision damage waiver at the rental company counter, and you will be covered for any damage or theft to the rental vehicle.

- Baggage insurance plan. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage.

- Trip cancellation and interruption insurance, up to $10,000 per trip and up to $20,000 per eligible card.

- Cell phone protection. You can be reimbursed for your costs to repair or replace your damaged or stolen cell phone up to $800, subject to a $50 deductible, for two approved claims per 12-month period when your prior month’s wireless bill was paid utilizing an eligible card account.

- No foreign transaction fees.

- Enrollment required for select benefits.See Rates and Fees.

Marriott Bonvoy Brilliant(R) American Express(R) Card rewards

As we said earlier, the rewards are generous. In a nutshell, this may be a hotel credit card, but you also get rewards on airline purchases, restaurants and whatever is on your shopping list, whether it’s socks or shampoo or furniture.

Here’s a breakdown of the rewards…

- 6X Marriott Bonvoy® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy

- 3X points at restaurants worldwide and on flights booked directly with airlines

- 2X points on all other eligible purchases

- Up to 21X points for every $1 spent on eligible purchases at hotels participating in Marriott Bonvoy:

- 6X points with the Bonvoy Brilliant card

- Up to 10X points from Marriott Bonvoy for being a Marriott Bonvoy member

- Up to 5X points from Marriott Bonvoy with the 50% Bonus Points on Stays, a benefit available with your complimentary Platinum Elite status

Marriott Bonvoy Brilliant(R) American Express(R) Card annual fee

So, about that fee. This is probably obvious, but we’ll spell it out. If you’re a fan of the Marriott brand, and you think you’ll get a lot of use of the card, you’ll probably feel that the AnnualFees fee isn’t a big deal. Of course, we’ll state the obvious right now: if you never stay at the Marriott and never plan to, then you should look for another card.

If you often stay at Marriott hotels or its timeshare properties and you plan to take advantage of some of the other card perks like unlimited airport lounge visits or Global Entry membership, it shouldn’t be too difficult to offset the cost of this card. For instance, that $300 statement credit mentioned above almost offsets half the cost of the annual fee alone. Figure in that credit and the Free Night Award after a year of having the card, you can effectively wipe out the entire annual fee.

So, again, if you’re a fan of Marriott or plan on taking an annual family vacation at a Marriott hotel or resort, the card could pay off big for you, and the fee might not be that big of a deal.

If you’re more of a Holiday Inn or Comfort Inn sort of person, or you generally sleep on friends’ sofas when you travel, there are surely some other travel rewards credit cards that you’ll find more to your liking.

How does the Marriott Bonvoy Brilliant(R) American Express(R) Card compare to other credit cards?

Marriott Bonvoy Brilliant® vs. Chase Sapphire Reserve(R)

discontinued

If you aren’t much of a Marriott fan, you might find Chase Sapphire Reserve®, a more general travel rewards credit card, more to your liking. That said, there are some important differences to be aware of.

The Chase Sapphire Reserve(R) has a steep annual fee of AnnualFees, which is a bit more than the Marriott Bonvoy Brilliant® card’s annual fee.

Each card has a welcome bonus offer for new cardholders. With Chase Sapphire Reserve(R), you’ll receive 125,000 bonus points after you spend $6,000 on purchases in the first three months from account opening.

Both cards offer a reimbursement of up to $300 in statement credit each account anniversary (though eligible purchases for that credit do differ), which can help to offset the annual fee.

Both cards also offer complimentary airport lounge visits worldwide.

And there is no foreign transaction fee for either card, making them both great cards to have when you’re traveling internationally.

As far as ongoing rewards goes, Chase Sapphire Reserve® cardholders earn 8X points on all purchases through Chase Travel℠, including The Edit℠; 4X points on flights and hotels booked direct; 3X points on dining worldwide; and 1X points on all other purchases.

Marriott Bonvoy Brilliant® vs. The Platinum Card(R) from American Express

discontinued

The Platinum Card® from American Express does a little better with points for flying and lodging but the rewards are a bit less generous on general purchases. You’ll receive 5X Membership Rewards® points on all flights and prepaid hotel bookings through American Express Travel® (including Fine Hotels + Resorts® and The Hotel Collection bookings); 5X points on flights purchased directly from airlines or through American Express Travel® on up to $500,000 on these purchases per calendar year; and 1X point on all other eligible purchases.

In terms of statement credits, the Marriott Bonvoy Brilliant® offers up to $300 in statement credits per calendar year (up to $25 per month) in statement credits for eligible purchases at restaurants worldwide. Meanwhile, the Platinum Card® provides up to $200 a year in statement credits to cover incidental airline fees charged on the card with a pre-selected airline (enrollment required). There are, in fact, numerous additional statement credits with the Platinum Card® for everything from certain gym memberships to hotel stays. See our full review for more details.

The Platinum Card® has a hefty AnnualFees annual fee; the Marriott Bonvoy Brilliant® has a sizable annual fee as well. Still, you want to look at each card carefully beyond the annual fees. If you travel extensively and enjoy the Marriott brand, then you are probably better off with the Marriott Bonvoy Brilliant®. If you travel extensively but aren’t wedded to any hotel brand, the The Platinum Card(R) from American Express may be the way to go. See Rates and Fees.

Is the Marriott Bonvoy Brilliant(R) American Express(R) Card a good card?

As you’ve no doubt figured out, especially if you’ve read all of this and haven’t just been skimming, if you regularly stay at Marriott properties, and you plan to continue doing so, then, yes, you can make the case that the Marriott Bonvoy Brilliant® American Express® Card is a great card. There are a lot of perks and benefits that come with the card that help offset the annual fee and then some. Just make sure you’ll utilize these perks; otherwise, this is an expensive card to hold.

If your cousin Brenda manages a Ramada Inn, and so you’re always going there because she hooks you up with her employee discount, and you last went to a Marriott in 1992 and aren’t really sure if you’ll ever go again, unless Brenda ever applies to work at a Marriott, in which case, sure, you’d happily go there… then, well, sure getting this credit card would probably not be a brilliant idea. But, again, if you’re a frequent traveler, and you often stay at a hotel owned by Marriott, and you’re interested in the Marriott Bonvoy Brilliant® benefits, then you probably have an easy decision ahead of you.

Frequently asked questions

How much does the card_name cost per year?

What credit score do you need for the card_name?

What is the credit limit for the card_name?

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.

To see the rates and fees for the American Express cards in this post, please visit the following links: The Platinum Card® from American Express (See Rates and Fees); Marriott Bonvoy Brilliant® American Express® Card (See Rates and Fees)

Jump to Section