Citi Prestige® Card review

This card offers luxury credit card perks like airline fee credits and concierge services along with a complimentary fourth consecutive night when you book a three-night hotel stay, making it a great fit for frequent travelers. This card is no longer available to new applicants. Information was collected independently by CardRatings and has not been reviewed by the issuer.

Citi Prestige® Card

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- Earn up to $250 annually in statement credit for your airline fees.

- With Citi Price Rewind, you could receive the difference back if an item goes on sale within 60 days of your purchase.

- Enjoy a complimentary fourth night when you book a three-night stay at any hotel through the Citi Prestige® Concierge.

- This isn't the card for periodic travelers or casual credit card users. There's a steep annual fee, so you'll need to put all the perks and rewards opportunities to use to offset that fee.

American Express Platinum Card®

discontinued_disclaimerCiti Prestige(R) Card benefits

The Citi Prestige® Card is a strong and premium contender in the rewards market, especially if you’re a frequent traveler who appreciates the finer things when you take to the skies or hit the road. Citi is a CardRatings advertiser.

But, before you ask, "Where do I sign up?" you’ll need to get beyond one major mental and financial hurdle: an annual fee of annual_fees.

While that might seem steep, it’s actually a not-uncommon annual fee in the luxury credit card market. For frequent travelers, the math may work out well, especially if you crave luxury touches with your travel and lots of personalized attention and logistical support.

Here’s a look at how the annual fee might pay for itself over the course of a year:

- A $250 annual air travel credit – that’s half the fee already.

- Ability to transfer points to participating travel loyalty programs such as those with Virgin Atlantic, JetBlue and many others.

- Three times the points on air travel and hotels.

- Two times the points on restaurants and entertainment.

- One ThankYou® point per dollar spent on other purchases.

- A 40,000 point welcome bonus after you spend $4,000 in the first three months – redeemable for $500 in airfare or $400 in gift cards.

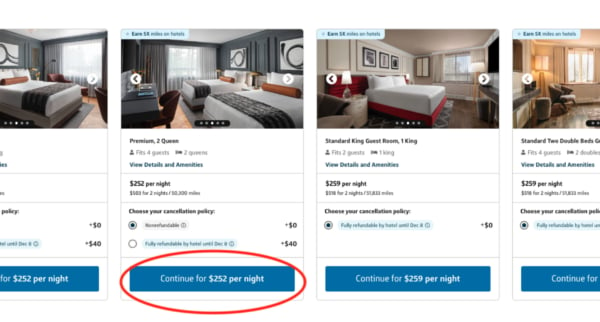

- Fourth night hotel benefit for any hotel stay at hotels booked through the Citi Prestige® Concierge.

- Up to $100 every five years as reimbursement for your application fee for Global Entry or TSA PreCheck.

Other valuable card perks include:

- Complimentary access to hundreds of VIP airport lounges through Priority Pass™ Select.

- Medical help if you fall ill abroad.

- Lost wallet protection.

- ThankYou® Points can be redeemed for cruises, getaways, even live music. If cash is your thing, though, it’s great to have flexibility in terms of also redeeming for cash or gift cards.

- We also love the concept of a "Points Concierge" to whom the company says you can request something specific and also discount redemption options. Who doesn’t like personalized service plus bargain hunting?

- You can use your ThankYou® Points to make a donation to a charity of your choice via pointworthy.com.

Potential downsides of the Citi Prestige(R) Card

If you are a light credit card user or an infrequent traveler, it may not make sense to pay the card’s annual fee. It also pays to read the fine print: The current promotion in bonus points is redeemable for a $500 flight on any airline, the issuer says, or $400 in gift cards. Both seem pretty nice, but if you aren’t in a position to travel and don’t want more gift cards, this bonus may not be a game changer.

This card requires excellent credit in order to qualify, which is another important factor to consider. Applying for a card that doesn’t match your credit profile can be a mistake, potentially driving down your credit score, especially if you are applying for a lot of credit cards at once.

How does the Citi Prestige(R) Card compare to other cards?

Who should get the Citi Prestige(R) Card?

The Citi Prestige® Card is designed for people who travel often and travel well. You’ll need to spend enough on the card annually to rack up the points and offset the annual fee – though you can do some of that just with the $250 annual airline fee credit.

If you’re looking for some nice travel options, but not the hefty annual fee, take a look at some of our other picks for top travel rewards credit cards.

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.

Jump to Section