Grants and scholarships are the best way to pay for college because they don’t come out of your pocket and don’t need to be paid back in the future. The reality though is that, for most students, borrowing money is necessary for paying at least some of their college expenses.

Fortunately, government-sponsored student loans make money for education accessible for many (with the caveat that it must be repaid, of course). Even so, there may be some expenses you need to fill in with credit card borrowing.

In many parts of the country, households struggle with both student loan and credit card debt. A new CardRatings’ study identified where households have particularly high levels of both types of debt.

Knowing how to finance college efficiently – including which type of borrowing is best for different situations – is a key to keeping your debt burden manageable, and managing that debt effectively can make your life easier for many years to come by minimizing the amount of money to be paid back in the future.

On the other hand, make the wrong choices and you could owe much more money when you graduate, which could take several years longer to pay off. Plus, the strain that debt can put on your credit record might impact important aspects of your life; getting a job, being accepted as a tenant, buying a car, or qualifying for a mortgage may all depend on having good credit.

“Financing all or part of a college education is necessary for most students across the country,” explains Laura Lamontagne, Ph.D, associate professor of economics at Framingham State University. “Usually, the best way to borrow money for college is by federal student loans. However, this might not always be a possibility if a student does not qualify for federal aid or needs additional funding for education expenses.”

There are plenty of places in the United States where households are struggling with especially-high levels of both student loan and credit card debt (more on where it’s highest below). To help you avoid that type of problem, however, let’s first review the different characteristics of student loan and credit card debt and provide guidelines for when each type of borrowing is appropriate for getting through college.

Cost advantage of student loan debt

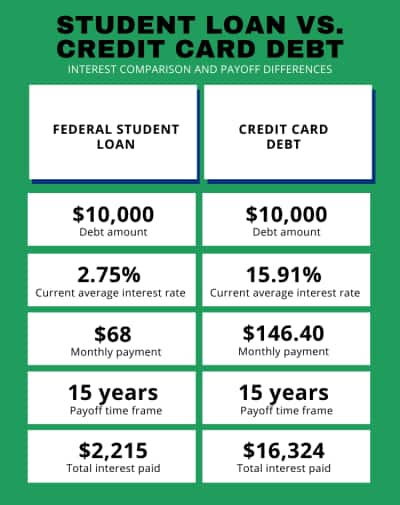

According to the Federal Student Aid office of the U.S. Department of Education, the interest rate on undergraduate student loans for the 2020-2021 school year was 2.75%.

That difference would amount to an extra $1,316 per year in interest cost on every $10,000 in debt if you borrowed on a credit card instead of via a federal student loan.

At a 2.75% student loan interest rate, you could pay $10,000 of student loan debt off in 15 years with a monthly payment of $68. In contrast, at the typical credit card rate of 15.91% it would take a monthly payment of $146.40 to pay $10,000 in debt off in 15 years.

To look at it another way, if you made that same payment of $146.40 on a student loan with a 2.75% interest rate, you’d pay it off in six years and three months instead of 15 years.

The actual figures might differ according to circumstances. For example, there is a 1.057% fee on new student loans, but this applies just once, as opposed to an interest rate that is charged as long as you owe money. On the other side of the ledger, some colleges charge a processing fee if you pay your bill using a credit card.

No matter how you slice it, student loans have a major cost advantage over credit cards when it comes to long-term borrowing for college expenses.

“I strongly believe that students should avoid using credit card debt to finance their education at all possible costs,” stresses Lamontagne. “Credit cards have substantially higher interest rates and start to accrue interest the month following a purchase if the balance is not paid in full. Most student loans are not subject to monthly payments and don’t accrue additional interest until after graduation. This allows students to focus on their education rather than stress about snowballing credit card debt.”

Why you may want a credit card for some college expenses

Given the significant cost advantage of student loans, why would you consider using a credit card for some college expenses?

There are three situations where a credit card might make more sense than a student loan:

- Unexpected near-term expenses. Applying for a loan and waiting for approval is likely to take weeks. On the other hand, if you have a credit card you can pay for something immediately. That can come in handy for expenses that come up unexpectedly and can’t wait.

- Ineligible expenses. Student loans cover a wide range of expenses associated with attending college, but you may encounter some expenses that are not eligible for payment with a student loan. Or, you may have already reached the amount of money for which you were deemed eligible. In either case, a credit card could be an option for covering expenses that a student loan won’t.

- Short-term borrowing. If you expect to be able to pay off a debt quickly, a credit card can actually be a cost-free form of borrowing. For example, interest on a credit card balance is not assessed until the next statement cycle, so if you can pay off your credit card balance sooner than that you can avoid any interest costs. Also, some credit cards offer 0% interest for a limited period of time, so this can be a cost-free way of borrowing if you pay off the balance within the time limit.

- Building a credit history. Responsibly using a credit card is an one of the best ways to build up a solid credit score. Your student loans won’t impact your credit score until you begin paying them off after graduation, which means having them won’t do anything to build a credit score before then; having and responsibly using a student credit card, however, will. You could leave college with a few years worth of credit history (also good for your score) as well as a track record of paying your bills on time, which could make things like getting an apartment, a car loan or even a new cellphone easier.

“Holding a credit card for emergencies is a wise move for most students,” adds Lamontagne. “If an unforeseen expense such as a car repair arises, a credit card can be a lifesaver.”

➤ LEARN MORE:How to get a student credit card

Checklist: When should you use a student loan vs. credit card?

The choice of how to pay for college expenses often comes down to weighing the cost advantage of a student loan against the flexibility of a credit card.

Here is a checklist of questions that can help you think through this decision:

- How quickly do you need the money? If you have time to apply for a loan and wait for approval, a student loan is likely to be the cheaper option. If the need is more urgent, a credit card may be your only option.

- Does the expense qualify for a student loan? Check student loan guidelines to make sure the expense you need to meet is eligible for financing with a student loan.

- Do you qualify for enough student loan money to cover the expense? Even if the expense could be eligible for a student loan, you may already have maxed out the amount you can borrow for the school year in question.

- Is this borrowing essential to getting a degree? Along with the essentials, a lot of optional expenses come up during your time at college. Before you commit to anything, think through how necessary any expense is to getting your degree. It may be that the wisest choice is neither a loan or a credit card, but simply avoiding some spending.

- Is there room in your credit card limit for this expense? Credit cards have limits, so before you decide to use one for any expense, check the balance you owe against your credit limit to see how much room you have left to borrow. You should also consider what other upcoming expenses you’ll need to fit within that credit limit.

- How long will it take you to pay off what you intend to borrow? If you expect money to become available within a few weeks but just need to pay for something sooner, a credit card may be your best option. Not only is it faster than a loan, but if you can pay off the balance within the month it should also be a cost-free way to borrow.

- What is your credit card rate? Not all credit card rates are the same, and younger borrowers often have to pay higher rates. The higher the interest rate, the more you should shy away from using your credit card. A high rate may also be a sign that you could benefit from shopping around for a better credit card.

- What are the fees associated with each option? Sure, you might be able to pay your tuition with a credit card, but have you considered the fees your school charges?

➤ LEARN MORE:How to juggle student loan and credit card payments

Student loan debt and credit card debt often go hand-in-hand

With that understanding about the different types of debt common for college students and their families, it’s time to look at where in the country those high levels of both student loan debt and credit card debt exist. CardRatings.com studied household debt levels based on information from the Federal Reserve Bank of New York and Equifax. The numbers show there is often a direct relationship between student loan debt and credit card debt.

Looking at average household debt levels state-by-state, CardRatings finds that areas of the country that have high levels of student loan debt also typically have high levels of credit card debt.

For example, most states with above-median student loan debt burdens per household also have above-median credit card burdens.

These states, and the District of Columbia, have particularly high levels of both student loan and credit card debt:

- District of Columbia. It’s no surprise that student loan debt is a hot-button political issue when the nation’s capital has the highest average amount of that debt per household. It also has the second-highest level of credit card debt per household.

- Maryland. With the third-highest student loan debt and fourth-highest credit card debt in the nation, Maryland has some of the same challenges as the neighboring District of Columbia.

- New Jersey. Households in this state rank fifth for average credit card debt, and seventh for average student loan debt. Those are not top-10 lists on which anyone wants to be included.

- Colorado. Juggling student loans and credit card debt is not confined to the East Coast. Colorado households rank eighth for average student loan debt, and ninth for average credit card balances.

- Connecticut. This state also ranked in the top ten for both types of average debt per household, with the seventh-highest amount of credit card debt and the 10th-highest amount of student loan debt.

While the numbers suggest that both student loans and credit cards are part of the mix for families paying for college, the two types of borrowing have very different characteristics.

There’s an important lesson in all this: never make financial decisions hastily. While you may feel pressured to meet an immediate expense, the cost of that decision may be with you for years. Take the time to make the right decision.