The “quarter-life crisis” or the general feeling of finding your footing in early adulthood is a real thing. While many millennials gracefully navigate career changes, family planning, and rising costs, others might feel a push to shake things up.

Some millennials, facing these transitions, might respond by splurging on a dream vacation, picking up an extreme new hobby, or… signing up for a new credit card.

Okay, that last one might not be too alarming, but according to a CardRatings’ survey, it’s a significant financial reality. Millennials are more likely than other age groups to feel a need to get a new credit card.

The possible reasons behind this trend are worth examining. They carry important lessons for millennials, and for older and younger age groups as well.

Credit card FOMO peaks in early middle age

Most Americans get their first credit cards as young adults. By the age of 30, two-thirds of Americans have at least one credit card. However, as they start to get a little older, they are more likely to question whether there may be better credit cards out there than the ones they already have.

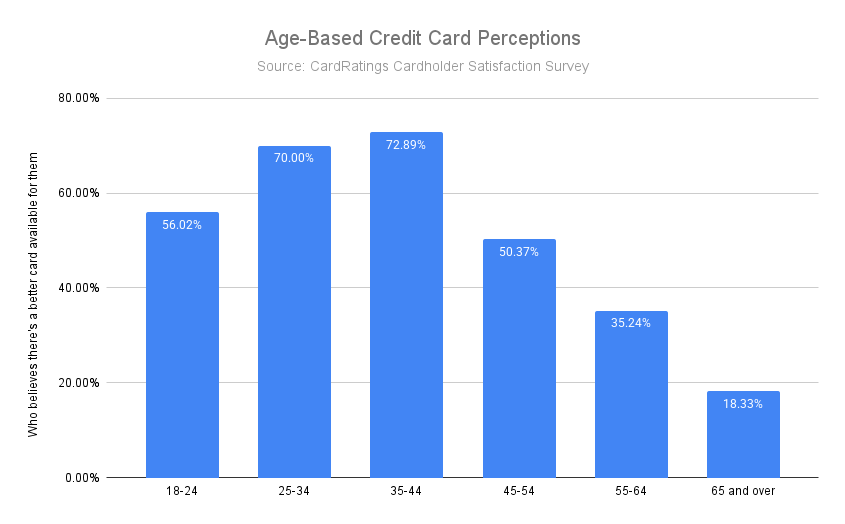

Only 56% of survey respondents aged 18-24 said they felt there was a better credit card on the market than the ones they already had. By the time they reach 25-34, this rises to 70%. Then the percentage peaks at nearly 73% for the 35-44 age group.

After that, the fear of missing out starts to subside rapidly. Just 50% of people in the 45-54 age group believe there are better credit card options out there for them. This drops to 35% for the 55-64 age group, and just 18% for people 65 or over.

The following chart shows this progression:

As young adults move towards middle age, they become increasingly convinced that they’re missing out on better credit card options. However, after they reach their mid-40s, they start to become more content with the credit cards they have.

Why do people think they could do better as they reach middle age?

It would be all too easy to look at this progression as a kind of middle-age restlessness. After all, people reaching their late-30s and late-40s seem to be very concerned that they could do better than their current credit cards. However, this may well be a logical conclusion rather than any kind of early mid-life crisis.

For one thing, financial needs can change pretty rapidly as you move from your 20s to your 30s. As your income improves, you may be able to afford bigger-ticket items. This may affect how you want to earn and use rewards, so a different credit card may be the right fit.

Your payment habits may also change. Young people living paycheck to paycheck may often find themselves carrying a credit card balance. This may cause them to view a low interest rate as the most important attribute of a credit card. Someone whose finances are more settled might pay off their balances each month. For them, low interest rates might start to matter less than rewards and other privileges.

Another thing that happens over time is that people become more aware of alternatives. You have experience with more credit cards and can also compare notes with your peers. This makes you more aware of what you want from a credit card and of what options are available on the market.

Finally, as people age, they’ve often had more of an opportunity to establish a positive credit history. This allows them to qualify for a wider field of credit cards. They may be right to perceive that they could do better than the credit cards they signed up for originally.

Finances change throughout adulthood but tend to happen especially fast in early middle age. According to the Federal Reserve’s Survey of Consumer Finances, the biggest jump in income typically occurs as a person moves from the under-35 to the 35-44 age group. It makes sense that people in the latter age group would be most likely to feel they could now qualify for better options.

Takeaways for different age groups

Understanding how changes in finances might influence the credit cards people choose has relevance for all age groups – not just that 35-44 age group that is most likely to be eyeing other options.

Credit card tips for young adults

The fact that consumers tend to see more and better credit card options as they move into middle age means young adults should keep three things in mind as they start working with credit cards:

- Recognize the value in building good credit. A credit score may seem like a fairly abstract concept to someone first starting out. The reality is that having a good credit score can translate to being eligible for credit terms that bring tangible financial benefits – lower interest rates, better rewards, etc. Knowing that some older consumers have earned access to more and better credit offers should motivate younger adults to work towards building good credit.

- Learn how to be a critical financial consumer. Even if you have credit cards, keep an eye on the marketplace. Recognize which credit card terms are most important to you, and compare other offers with the terms you currently have.

- Don’t get set in your ways too soon. Don’t assume once you’ve been approved for a couple cards that you’re set for life. Your needs and circumstances may change, so be open to looking for cards that better suit your evolving financial situation as the years go by.

Takeaways for middle-aged adults

Middle-aged adults should take a couple of pointers from the way their peers tend to feel they could find a better credit card:

- Keep your eyes open. As you move into your peak earning years and build a longer credit history, you may qualify for more options. Also, the ways you spend money and pay your bills may have changed, making different cards a better fit. Check the marketplace every now and then to make sure you’re still getting the best terms for your needs.

- Have a good reason for signing up for any new card. While you should be open to new offers, don’t automatically sign up just because you can qualify. Think about how you would use any new card, and whether its terms would be an improvement over what you already have.

➤ SEE MORE:Best credit cards of February 2026

Takeaways for older adults

Finally, while these consumers seem to become more content with their credit cards as they move toward their retirement years, there are a couple of things they should keep in mind:

- Don’t be taken for granted. Just because you’ve been a loyal customer of a certain credit card for many years doesn’t mean you’re committed for life. The credit card business is very competitive and always evolving. Your current provider may not feel it necessary to offer you improved terms, but a different card issuer might be eager to.

- Anticipate changes to your financial situation. Retirement can significantly change your financial circumstances and your spending habits. That may make different credit card terms a better fit for your situation.

So, is the tendency of people in their late 30s and early 40s to believe they could find better credit card options a sign of an early mid-life crisis? More likely, it’s a recognition of changing financial circumstances. That’s something people of all ages need to be aware of and ready to respond accordingly.