It’s the most wonderful time of the year – to use credit card rewards.

During the holiday shopping season, as you spend on gifts and celebrations you may be merrily aware of all those credit card rewards points you’re racking up. But do you also realize that this is the best time to cash in those rewards?

Typical patterns of credit card usage suggest that the annual holiday shopping binge makes this the best time to redeem credit card rewards – especially if you use them to pay down your card balances.

Credit card balances typically peak this time of year

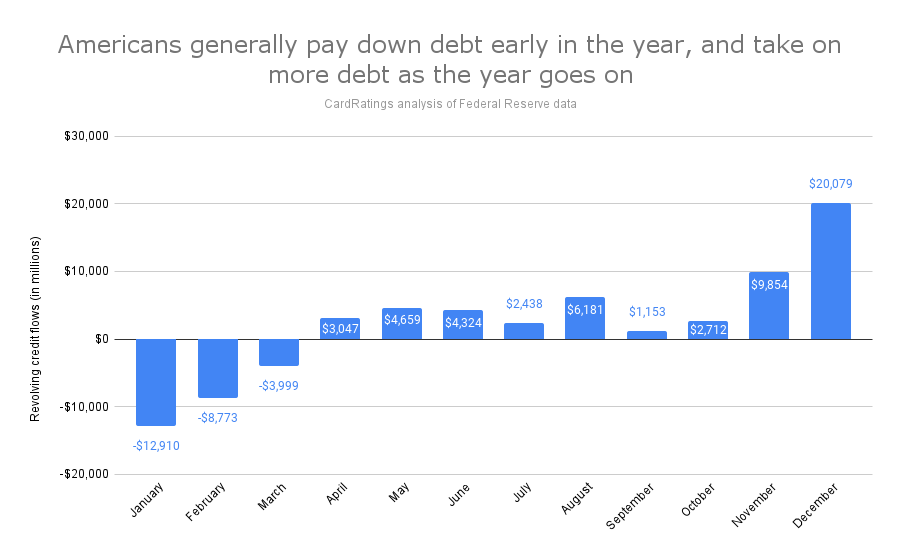

Analyzing historical data from the Federal Reserve to illustrate how Americans typically use their credit cards, the below graph is based on 40 years worth of data on flows into and out of revolving credit balances – most of which is credit card debt. Positive numbers mean those balances are increasing – that is, people are taking on debt. Negative numbers mean balances are decreasing as people pay off debt.

Though your credit card balances probably aren’t measured in millions, you may be familiar with the pattern on this graph. Historically, Americans have typically paid down debt in the first three months of the year. Then they’ve added debt moderately throughout most of the year before borrowing heavily in November and December.

This means credit card balances tend to peak at the end of the year. Along with peak balances come peak interest charges, as interest rates are applied as a percentage of balances. So, there generally couldn’t be a better time than year-end to use credit card rewards to pay down those peak balances, before they cost you too much in interest charges.

➤ SEE MORE:Consumers face record credit card debt this holiday season

Using rewards to pay down balances right after your annual shopping spree should also make your post-holiday bills more affordable. That could allow you to start off the new year by taking a more meaningful bite out of your debt.

Potential savings are increased by high credit card interest rates

Because of the seasonal pattern to how Americans use credit, the end of the year is always a good time to pay down debt with credit card rewards. The added incentive this year is that the potential savings are especially strong because of how high interest rates are.

As of this writing (Dec., 2023), the average interest rate charged on credit card debt was 22.77%. The Federal Reserve has records on the average credit card interest rate stretching back to the end of 1994. In all that time, the average rate has never been higher than it is now.

High interest rates extend the cycle of debt. They mean that more of each payment has to go towards paying interest, rather than towards paying down your balance. One way to break that cycle is to pay down your balance faster. That will reduce the amount of interest you’ll be charged, allowing more of each future payment to go towards further paying down debt.

➤ SEE MORE:Credit card monthly payment calculator

Budgets are tight these days, so the credit card rewards you’ve built up may be one of the few resources you have to take an extra bite out of your credit card balance.

Credit card rewards: Use ’em or lose ’em

Besides being a way to pay down credit card debt just as it reaches its annual peak, using your rewards to pay down debt at the end of each year can also get you in the habit of making sure you use your credit card rewards before they expire.

Credit cards have a variety of policies about how much time you have to use rewards before they expire. It can be hard to keep track of these policies, especially across multiple credit cards. That’s why credit card customers often lose those rewards before they get a chance to use them.

The Consumer Financial Protection Bureau estimates that American consumers lose about $500 million worth of rewards per year due to expiration or account closures. Getting on a regular schedule of using your rewards at the end of each year would reduce the chance of this happening to you.

Applying rewards against your credit card balance

While you could use rewards in a variety of ways, applying them against your credit card balance has extra impact. This is because you not only reduce the amount you owe by the value of the rewards, but you also avoid paying interest on that amount.

This process is most straightforward if you have cash-back rewards. However, even rewards in the form of travel or merchandise can often be redeemed for statement credit. Again, that might prove to be the most valuable way to use them.

➤ SEE MORE:How to redeem credit card rewards

One thing to note about using rewards to pay down your balance: this typically won’t take the place of making the minimum payment on your credit card bill. You still need to make that payment for the period in which you’re redeeming rewards. Otherwise, you’re likely to be hit with a late payment penalty.

Even this requirement can be a blessing in disguise. Redeeming rewards for statement credit in addition to making a regular payment will make sure you’re making an extra reduction of your balance, instead of just replacing one form of payment with another.

Take the time to review and plan your credit card rewards

Going through the process of redeeming your rewards at the end of each year has the added value of keeping you up-to-date on how much different cards pay in rewards and what categories of purchase they reward.

This can be valuable in helping you decide which credit cards should be your go-to cards in the year ahead. It can also help you plan for which cards to use for what types of purchases, to maximize your rewards.

Shopping for rewards credit cards

Finally, taking a fresh look at your rewards each year puts you in a good position to check the market for more generous rewards programs.

If you do, remember the following tips about shopping for rewards cards:

- Pay attention to whether a card charges an annual fee. An annual fee will offset the value of any rewards you earn. When comparing rewards programs, consider the value of the rewards you’re likely to earn net of any fee you’ll be charged.

- The interest rate is especially important if you regularly carry a balance. Paying a higher interest rate can also offset the value of rewards you earn. If you carry a balance, make sure the interest is competitive enough to make the rewards worthwhile.

- Think about how well reward categories line up with your planned purchases. Don’t fall into the trap of letting rewards programs influence you to buy things you wouldn’t normally purchase. You’ll get the most value if you concentrate on earning rewards on things you were going to buy anyway.

- Be selective when applying for a new card. Applying for new credit can have adverse consequences. Before you apply for a new card, make sure it is clearly better or at least significantly different from the ones you already have.

➤ SEE MORE:Best credit cards of March 2026

Credit cards often lure customers in with promises of things they can earn through their rewards programs. If you regularly carry a credit card balance, keep in mind that often, the best reward is reducing your credit card debt.

ON THIS PAGE