Americans have a long-standing habit of running up credit card debt late in the year and then dealing with the bills after the holiday season. To those who follow those old familiar ways, the coming months might bring a shock.

A combination of factors make those post-holiday bills harder than ever to digest. Without special planning, a growing number of Americans might find their holiday-season debt impossible to get rid of in the new year.

This is similar to overindulging around the holiday season. It’s almost inevitable that it’s going to happen. Having a plan for limiting how much you indulge and then how to deal with it after the holidays is the key to keeping yourself in check.

It’s the same with credit card debt. Have a plan before the holiday season starts, and then follow through after the feasting and partying are over.

Americans paid down less of their balances early this year

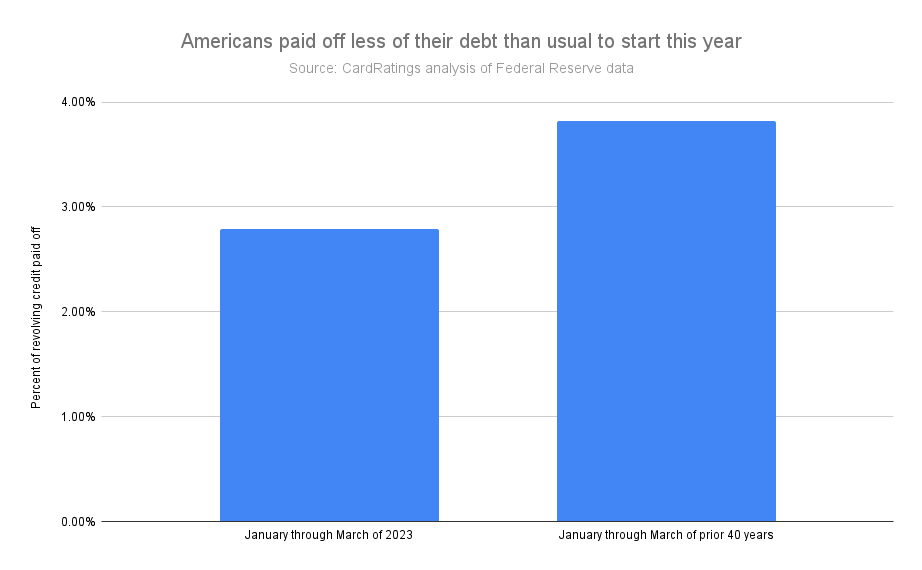

There are a few reasons why credit card debt might be more difficult to manage than usual this year. For starters, Americans paid off less of their balances at the beginning of 2023.

A look at the historical averages of changes in revolving credit debt (most of which are credit card balances) helps tell the story of how Americans have handled this debt.

The following chart shows the month-by-month average flows of debt for the 40 years prior to this one.

Because this chart shows the net flows into or out of debt, the negative numbers show when people on average are paying down balances, and the positive numbers show when they are adding to them.

The resulting picture tells a story that will be familiar to many households. The year begins with a period of paying down debt. That’s when people are dealing with the bills from the previous holiday season. Beginning in April, people start taking on a moderate amount of debt rather than paying it down. This continues for several months until debt accumulation accelerates sharply in November and December – the traditional holiday spending season.

This year though, consumers got rid of a smaller portion of their debt than usual to start the year. Here’s how the percentage of balances paid down for January, February and March this year compare to the historical averages:

Paying down less debt than usual to start 2023 is a part of the reason why Americans are heading into this year’s holiday season with more credit card debt than ever.

Balances have soared to record heights

You could probably tell from the first of the two charts in the prior section why Americans have a debt problem. A few months of paying down debt isn’t enough to make up for taking on debt for most of the year – especially not with the annual holiday debt binge in November and December.

With even less effort than usual to pay down debt this year, the total burden has reached a record high. The Federal Reserve Bank of New York recently reported that credit card debt hit a record high of $1.079 trillion in the third quarter of 2023. This total has risen by more than $150 billion in just the past year.

Higher debt balances mean larger payments on each credit card bill. And that’s before adding interest on those balances.

Interest rates have risen along with balances over the past three years

As you’ve probably noticed, it’s not just credit card balances that have been rising in recent years. The interest rate charged on those credit card balances has been rising right along with balances.

Since mid-2020, the average rate charged on credit card balances has risen by nearly 7% to 22.77%. Project that onto a total credit card debt balance of $1.079 trillion and it represents a potential interest cost on credit card debt of over $245 billion a year.

That would be bad enough, but interest rates may still rise some more. The Federal Reserve’s latest set of economic projections suggest that it expects to raise rates again at its Dec. 12-13 (2023) meeting.

That’s another reason why this year’s post-holiday credit card bills figure to be the steepest ever.

➤ LEARN MORE:Why the Fed may not be done raising rates

Many consumers will add late fees to the total

Debt can be the type of problem that feeds on itself. As balances and interest rates rise, it becomes tougher to pay the bills. Then, consumers who start missing payments have to deal with late fees and interest penalties.

This is happening in growing numbers. Payment delinquency rates on consumer debt are up and are highest for credit card debt.

Not only are credit card customers who are late with payments penalized, but other customers with low credit scores might also pay the price. The higher delinquency rates go, the more credit card companies are likely to raise their rates for high-risk customers.

➤ LEARN MORE:How to avoid credit card interest and fees

Record balances figure to grow by year end

Record credit card balances, rising interest rates and a growing number of late fees all figure to make this year’s post-holiday credit card bills higher than ever. As bad as things look now, the problem is likely to get worse by the time January rolls around.

Remember that first chart in this article, showing typical month-by-month flows into credit card balances? Historically, the most debt has been taken on in November and December.

So, credit card balances have already hit a record high, and the biggest surge of the year is probably still ahead of us.

Keeping your bills under control

The national numbers described in this article show that rising credit card bills are a common problem. However, there are things you can do to take control of your situation to reduce or even eliminate this threat.

Here are five suggestions:

- Budget before you borrow. Before you go holiday shopping, figure out an amount you can spend that you will be able to pay back within the first couple months of 2024. That way you can prevent short-term spending from becoming a long-term problem. Our credit card monthly payment calculator can help.

- Choose the right card for the job. Credit cards each have different features and terms. Figure out which card is best for how you intend to use credit this holiday season. If you expect to carry a balance on your account for several months, make sure you choose the card with the lowest interest rate. If you expect to pay off your balance quickly, lean towards a card that offers the best rewards for the type of spending you plan to do.

- Look to refinance credit card debt. A personal loan or a balance transfer card can be a means of shifting high-interest credit card debt to a cheaper alternative. If you pursue this approach, just make sure you do it as part of a broader debt-reduction plan rather than as a means of freeing up your credit limit for more spending.

- Always make more than the minimum required payment. Low minimum payments only seem affordable, but in reality, they drag out your repayment period so your credit card debt costs you more in the long run.

- Put yourself on a sustainable debt diet. As with the extra indulging the holiday season tends to bring, you need an approach to borrowing that will help you work off the problem and then prevent it from coming back. Start the new year with a budget for 2024 that will leave you with a lower debt balance by the time that year is over. That’s one way to set yourself up for a successful year financially.

Being sensible about holiday spending shouldn’t take any of the joy out of the season. In fact, feeling in control of your spending and borrowing should help you avoid some of the stress that can overshadow the festive spirit.