Chase’s Pay Yourself Back program can be a straightforward, valuable way to redeem your rewards for a value greater than the standard one cent per point you get when you redeem for cash. Chase launched these rotating offers in 2020, allowing you to take a statement credit for certain areas of spending at values ranging from 1.25% to 1.5% depending on which card you hold and the redemption opportunity offered. This can open up some valuable redemption opportunities depending on the categories being offered and how you spend.

The guide below explains the full Pay Yourself Back program and how you can leverage it. Remember that, usually, the best value for your Ultimate Rewards points will be transferring to a travel partner, but the best overall value doesn’t mean it’s your best option; everyone has different needs and goals for their credit card rewards.

What is Chase Pay Yourself Back?

The Chase Pay Yourself back program is a way to take a statement credit for eligible purchases at a value of at least a penny per point, and sometimes more. Similar to the Capital One Venture Rewards Credit Carddiscontinued, which allows you to redeem miles to erase travel purchases from your statement, the Chase Pay Yourself Back program allows you to redeem Ultimate Rewards points to erase certain categories of purchases from your statement.

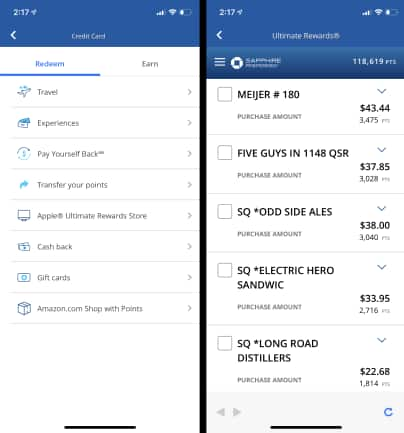

To take advantage of the offer, cardholders simply need to log into their account, navigate to the Pay Yourself Back portal, and they’ll see their eligible purchases listed alongside the number of points necessary to cover that purchase. Check the purchases you’d like to cover with Ultimate Rewards points and click “Continue” at the bottom to move the process forward.

A couple of important rules to note:

A couple of important rules to note:

1. You can only pay yourself back for purchases made within the past 90 days. Only the eligible purchases from the last 90 days will show when you choose the Pay Yourself Back option.

2. You can only pay yourself back for purchases in particular categories, and those categories are dependent on the card(s) you have.

3. It could take up to three business days for the credit to appear on your account. It could take one or two billing cycles for those credits to appear on your monthly statement. Remember, you will still need to make at least your minimum monthly payment on your card.

What cards are eligible for Pay Yourself Back?

When Pay Yourself Back first hit the scene in May 2020, it was only available to Chase Sapphire Reserve(R) and Chase Sapphire Preferred® Card cardholders. Later that year, however, Chase announced an expansion of the program to all cards within the Ink family of small business cards, except the Ink Business Premier(R) Credit Card, as well as to the Freedom family of cash-back cards. All of these earn Ultimate Rewards points even though several are marketed as “cash back” cards.

Chase has since expanded Pay Yourself Back to include a few co-branded cards: All Southwest Airlines co-branded cards (consumer and business), all United Airlines co-branded cards (consumer and business), the Disney Visa cards, and the Aeroplan® Credit Card.

As of April 2025, Pay Yourself Back on some cards in the United co-branded family of cards can only be used on eligible United airfare purchases of $50 or more, or used toward the card’s annual fee. The values will vary depending on the particular card, but can be worth up to 1.75 cents per point.

Here are the details on some of the eligible cards:

Is Pay Yourself Back worth it?

Pay Yourself Back can be worth it, but that doesn’t mean it’s the best value for your points. With the devaluing of the Pay Yourself Back redemption options for the Sapphire cards, redeeming your points for anything other than charitable donations or a promotional category will mean you’re getting less than the base travel redemption value for those points. It will equal redeeming your points for cash back. There is, of course, nothing wrong with getting a base value back on your rewards if that’s what you want to do. Credit card rewards are yours to use, and if you feel good about the redemption, it’s the right redemption for you. Just know that there are strategies to maximize your rewards value.

Frequently asked questions about Chase Pay Yourself Back

How long does it take for Chase points to show up in my account?

Ultimate Rewards earned during a billing cycle from spending will typically show up in your account the following billing cycle after which they were earned. For cards that earn Rapid Rewards, it can take up to 30 days for the points to post. For Ultimate Rewards earned through a new cardholder bonus, it can take from six to eight weeks for the points to be deposited into your account.

How to earn points with Chase Pay

The Chase Pay app was discontinued in 2019; however, you can use Zelle, which is integrated into the Chase app, to make and receive payments.

What purchases are eligible for Pay Yourself Back?

Eligible categories vary by card and change periodically, but often include things like grocery stores, dining, and select charities. You can typically only redeem points for transactions made within the last 90 days.