Marriott Bonvoy Bold® Credit Card review

This card opens the door to the excellent Marriott Bonvoy rewards program without giving you the burden of an annual fee. You can also enjoy a large welcome bonus specifically designed for new cardholders. Information related to the Marriott Bonvoy Bold® Credit Card has been collected independently by CardRatings and was neither reviewed nor provided by the card issuer.

Marriott Bonvoy Bold® Credit Card

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- This card opens the door to the excellent Marriott Bonvoy rewards program without the cost of an annual fee.

- For a limited time, earn 60,000 bonus points once spending $2,000 on purchases in the first three months from account opening.

- Earn up to 14 Bonvoy points per $1 spent at over 7,000 participating Marriott Bonvoy hotels.

- While no annual fee is nice, the reward points structure for this card is significantly lower than the cards that do carry annual fees in the Marriott Bonvoy family.

Chase Sapphire Preferred® Card

discontinued_disclaimerMarriott Bonvoy Bold® Credit Card essentials

The Marriott Bonvoy Bold® Credit Card offers a strong introductory offer and a solid rewards/benefits structure, as well as additional perks that make the card worth serious consideration – all at no extra cost to you.

For a limited time, new cardholders can earn 60,000 bonus points once spending $2,000 on purchases in the first three months from account opening. Points can be redeemed for free hotel stays, room upgrades, and more.

Beside the bonus, you can earn points on all purchases made with the card.

Earn up to 14 points for every $1 spent at Marriott Bonvoy properties, two points for each $1 spent on other travel-related purchases (airlines, hotels, timeshares, car rentals, travel agencies, campgrounds, buses, taxis, ferries, etc.) and one point for each $1 spent on all other purchases.

In addition to no annual fee and no foreign transaction fees, Marriott Bonvoy Bold® Credit Card has purchase protection, trip delay protection and the added perk of credit for 15 Elite Nights annually, which automatically qualifies you for the Silver Elite level in the rewards program. You can learn more about the benefits of elite level status in our guide to the Marriott Bonvoy program.

What our editors like most about the Marriott Bonvoy Bold® Credit Card

Rewards credit cards with no annual fees almost always grab our attention, but in the case of Marriott Bonvoy Bold® Credit Card, this perk holds even more significance. Marriott Bonvoy has an excellent rewards program, providing the opportunity to earn free nights and services at Mariott Bonvoy properties and their affiliates around the world. However, the other three credit cards in the Mariott Bonvoy family all carry annual fees.

Marriott Bonvoy Bold® Credit Card gives people of more modest spending habits the chance to get their foot in the door of the Marriott Bonvoy rewards program and enjoy some of the same benefits as bigger spenders. One of the perks is credit for 15 Elite Nights annually, which puts you in the Silver Elite level of the rewards program. Silver Elite status earns you 10% more bonus points on stays and eligible Marriott purchases, free late checkout, and more.

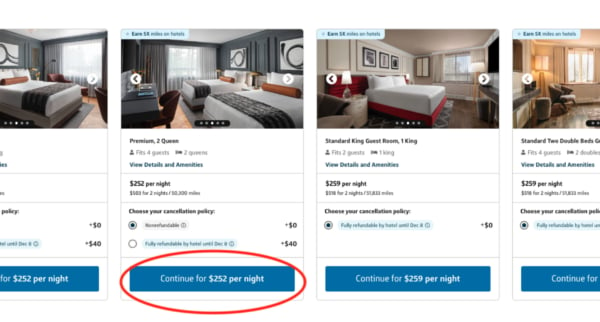

Though not as lucrative as other cards in the Marriott Bonvoy family, the Marriott Bonvoy Bold® Credit Card limited time bonus offer is easily attainable. You can earn 60,000 bonus points when you spend just $2,000 in the first three months you have the card. Those points can easily score you a free night (or several!), depending on the property.

Potential downsides of the Marriott Bonvoy Bold® Credit Card

While no annual fee is nice, the reward points structure for the Marriott Bonvoy Bold® Credit Card is significantly lower than the cards that do carry annual fees in the Marriott Bonvoy family. Knowing your spending habits will help you calculate which card is in your best interests.

Furthermore, as with any branded credit card, you need to decide how deep your loyalty runs to determine whether a brand-specific card is right for you or whether you’d be better served with a more general travel rewards card, such as Capital One VentureOne Rewards Credit Card, which doesn’t restrict your rewards redemption to a particular brand and also doesn’t charge an annual fee.

How does the Marriott Bonvoy Bold® Credit Card compare to other cards?

Marriott Bonvoy Bold® Credit Card vs. Marriott Bonvoy Boundless® Credit Card

discontinued

Right off the bat you’ll notice that the biggest difference between these two cards is that one charges an annual fee and one does not. However, even though the Marriott Bonvoy Boundless® Credit Card charges an annual fee of AnnualFees, you might find that it’s worth it due to the numerous rewards that come with the card.

The Marriott Bonvoy Boundless® Credit Card is offering new cardholders a limited time opportunity to earn 100,000 points after spending $3,000 on purchases in your first three months from account opening. Furthermore, Marriott Bonvoy Boundless® Credit Card cardholders can earn up to 17 points for every $1 spent at Marriott Bonvoy properties, instead of up to 14, as well as 3X total points on up to $6,000 in combined purchases at gas stations, restaurants and grocery stores each year and two points on all other purchases, versus two points on just travel purchases, and one point on everything else with the Bold card. Many of the other benefits are the same, such as no foreign transaction fees and credit for 15 Elite Nights annually. However, the Marriott Bonvoy Boundless® Credit Card does also offer a Free Night Award (valued up to 35,000 points) every year after your account anniversary.

It’s clear that you’ll get more with the Marriott Bonvoy Boundless® Credit Card, but what it boils down to is whether you’re willing to pay a fee for it each year.

Information related to the Marriott Bonvoy Boundless® Credit Card has been collected independently by CardRatings and was neither reviewed nor provided by the card issuer

Marriott Bonvoy Bold® Credit Card vs. Capital One Venture Rewards Credit Card

discontinued

This is another card with an annual fee (AnnualFees), but along with that annual fee comes a lot of flexibility.

To start, the Capital One Venture Rewards Credit Card earns you two miles on every purchase made. So whether you’re spending money at Bonvoy properties or not, you’re earning a flat two miles on every dollar you spend. Additionally, this card earns you five miles on hotels, vacation rentals and rental cars booked through Capital One Travel.

If you want the flexibility to gain miles on all travel purchases, and then to redeem said miles towards any travel purchase, this might be a better card for you. However, if you’re loyal to the Marriott brand, you’re probably better off with the Marriott Bonvoy Bold® Credit Card.

In case flexibility sounds better to you, you might also like to know that the Capital One Venture Rewards Credit Card offers new cardholders a welcome offer of signup_reward miles once you spend signup_bonus_spend_amount on purchases within three months from account opening, equal to $750 in travel. It’s a perk that certainly helps offset the annual fee.

Is the Marriott Bonvoy Bold® Credit Card a good card?

If you plan to do a fair amount of traveling in the coming years and you consider yourself to be a fan of Marriott Bonvoy properties, this card should be an excellent fit for you since you don’t have to worry about paying an annual fee. The Marriott Bonvoy Bold® Credit Card opens the door to the excellent Marriott Bonvoy rewards program with a nifty introductory bonus offer. But at the same time, with no annual fee, you don’t have to worry about earning a certain number of points each year in order to make the card pay for itself.

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.