Marriott Bonvoy Bevy® American Express® Card

Earn rewards on stays at Marriott Bonvoy properties, at U.S. supermarkets and restaurants worldwide plus enjoy other premium cardholders perks like Marriott Bonvoy Gold Elite status and the opportunity to earn an annual free night reward.

Marriott Bonvoy Bevy® American Express® Card

- Rewards

- points_per_dollar

- Welcome Bonus

- bonus_miles bonus_miles_disclaimer

- Annual Fee

- annual_fees

Key Features

descriptionEditor Analysis:

- Earn up to 18.5X Marriott Bonvoy points for every dollar spent at hotels participating in Marriott Bonvoy (full details below).

- Earn signup_reward Marriott Bonvoy® bonus points after you use your new card to make signup_bonus_spend_amount in purchases within the first six months of card membership.

- Earn 1 Free Night Award after spending $15,000 on eligible purchases on your card in a calendar year.

- This probably isn't the card for the casual Marriott Bonvoy spender thanks to its AnnualFees annual fee. See Rates and Fees

Membership does, indeed, have its privileges. But it also comes with a substantial up-front price tag.

The Marriott Bonvoy Bevy™ American Express® Card is a classic example of a credit card with eye-popping rewards and perks that CAN be a terrific addition to your wallet, but you will only want to fill out an application if your lifestyle and spending habits allow you to take full advantage of the card benefits and cover the AnnualFees annual fee. American Express is a CardRatings advertiser. See Rates and Fees

Marriott Bonvoy Bevy(TM) American Express(R) Card rewards

The Marriott Bonvoy Bevy™ American Express® Card rewards program is strong. You earn:

- Up to 18.5X Marriott Bonvoy points for every dollar spent at hotels participating in Marriott Bonvoy: Earn 6X points on eligible Marriott Bonvoy purchases made with the card and up to 10X points from Marriott Bonvoy for being a Marriott Bonvoy member; plus 2.5X points from Marriott Bonvoy with Gold Elite status, a complimentary benefit of the card

- 4X points per dollar on worldwide restaurant and U.S. supermarket purchases – up to $15,000 in combined spending annually – after that, it’s 2X points per dollar

- 2X points per dollar on all other eligible purchases

But the real "grabber" here is the welcome bonus of signup_reward Marriott Bonvoy® bonus points after you use your new card to make signup_bonus_spend_amount in purchases within the first six months of card membership.

Marriott Bonvoy Bevy(TM) American Express(R) Card benefits

While the Marriott Bonvoy Bevy™ American Express® Card rewards program will likely generate excitement, the benefits package is a bit more pedestrian.

Marriott Bonvoy Bevy(TM) American Express(R) Card cardholders are automatically given complimentary Marriott Bonvoy Gold Elite status. This comes with perks such as 2 p.m. checkout, 25% bonus on points, room upgrades and enhanced Wi-Fi during your stay at participating hotels.

While Gold Elite status is nice, you’ll find additional perks with Platinum Elite, Titanium Elite and Ambassador Elite status. You gain these higher statuses by using your card for Marriott hotel stays. When you are approved for your Marriott Bonvoy Bevy® card, you will automatically receive credit for 15 elite nights toward reaching those higher statuses.

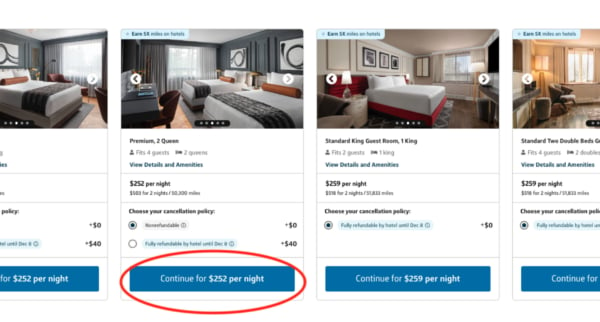

Your Marriott Bonvoy Bevy(TM) American Express(R) Card membership qualifies you for a free night’s stay at participating hotels (up to 50,000 points), but this is only after you spend at least $15,000 on your card during a calendar year. It’s a nice little perk but some similar cards offer a free night without requiring the minimum expenditures.

On the other hand, every time you use your card to stay at a participating Marriott Hotel, you receive 1,000 bonus Marriott Bonvoy points. If Marriott is your hotel of choice for business or pleasure, this can add up nicely. Bookings must be done directly through Marriott. Third-party bookings are not eligible for this bonus.

As with many cards of this type, you can get additional cards to use on the same account at no additional charge. There are also no foreign transaction fees associated with the card, so it’s good for traveling to destinations near or far. See Rates and Fees.

How does the Marriott Bonvoy Bevy(TM) American Express(R) Card compare to other cards?

Marriott Bonvoy Bevy(TM) American Express(R) Card vs. Marriott Bonvoy Brilliant® American Express® Card

discontinued

It’s important to first address the elephant in the room. Marriott Bonvoy Brilliant® American Express® Card comes with a AnnualFees annual fee. However, Brilliant® also comes with some significant perks not included with Bevy®. These include a $300 annual dining credit and an anniversary free night stay valid at a property costing up to 85,000 Marriott Bonvoy points. See Rates and Fees.

Brilliant® also comes with 25 elite nights credited per year toward reaching higher card status. And with Brilliant®, you start at the Platinum level, which gives you an extra 5X points per dollar spent on all qualified hotel stays. You can also enroll for a free Priority Pass™ Select membership, gaining you airport lounge access around the world.

The rewards structure is almost identical, although Brilliant® earns signup_reward Marriott Bonvoy® bonus points after you use your new card to make signup_bonus_spend_amount in purchases within the first six months of card membership. Cardholders can earn 6X Marriott Bonvoy® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy; 3X points at restaurants worldwide and on flights booked directly with airlines; and 2X points on all other eligible purchases. Additionally, earn up to 21X points for every $1 spent on eligible purchases at hotels participating in Marriott Bonvoy: 6X points with the Bonvoy Brilliant card; up to 10X points from Marriott Bonvoy for being a Marriott Bonvoy member; and up to 5X points from Marriott Bonvoy with the 50% Bonus Points on Stays, a benefit available with your complimentary Platinum Elite status.

While Bevy® is more suited to making everyday purchases, Brilliant® is best suited to those who enjoy frequent luxury travel.

Marriott Bonvoy Bevy(TM) American Express(R) Card vs. Chase Sapphire Preferred(R) Card

discontinued_disclaimer

Though not a true hotel credit card, the Chase Sapphire Preferred(R) Card is still a valuable option to consider as it earns bonus rewards on travel purchases and the rewards earned with the card can be used for hotel redemptions. Plus, the card also comes with up to $50 in statement credits each account anniversary year for hotel stays through Chase Travel℠.

Its annual_fees annual fee is also much more manageable. So, if you’re looking for something with a bit more flexibility, and comes with a lower price tag, this might be a good fit for you.

Is the Marriott Bonvoy Bevy(TM) American Express(R) Card worth the annual fee?

A AnnualFees annual fee is no small thing, however, the Marriott Bonvoy Bevy™ American Express® Card rewards program is structured in such a way that you can cover it through normal spending if you make it your card of choice for travel and food. See Rates and Fees

Even though the welcome bonus is a one-time windfall, regularly using the card for airline travel, Marriott hotel stays, at restaurants and U.S. supermarkets should have you coming out ahead each year. The more you use your card, the more the rewards add up.

Who is a good fit for the Marriott Bonvoy Bevy(TM) American Express(R) Card?

Frequent travelers for whom the Marriott family of hotels are their lodging of choice are a great fit for the Marriott Bonvoy Bevy™ American Express® Card. Those who don’t mind an annual fee and the perks that come with it, but who aren’t quite ready to commit to a luxury option are good candidates for this card.

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.

Marriott Bonvoy Brilliant® American Express® Card: See Rates and Fees; Marriott Bonvoy Bevy™ American Express® Card: See Rates and Fees

Jump to Section