Feeling the pressure of holiday shopping season?

Maybe that’s not such a bad thing.

Seriously. They say pressure makes diamonds, and there is some evidence that feeling a little pressure might make you a better holiday shopper.

A new CardRatings.com survey found that women feel more pressure when it comes to holiday shopping than men. The same survey also found ways in which women are smarter holiday shoppers than men.

➤ RELATED CONTENT: Survey: 5 habits of highly effective holiday shoppers

This article will discuss some of the differences the survey found in how women and men approach holiday shopping. It will also explain why the approach women take might be more financially sound.

For many (especially women) the holidays bring pressure to spend more

Maybe it’s the spirit of generosity the season brings. Or maybe it’s the influence of relentless holiday advertising.

Either way, many Americans feel pressure to spend more on gifts than they should. The survey found that more than one-third of respondents (36%) feel pressure to spend more than they can comfortably afford.

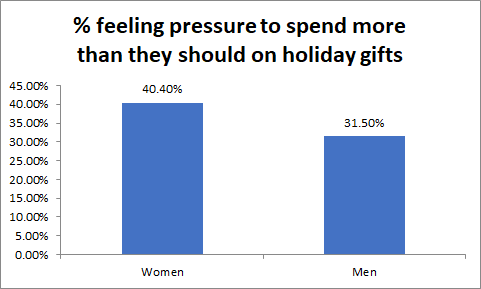

This pressure seems to be especially hard on women. As shown by the chart below, a greater percentage of women feel pressure to spend more than they can comfortably afford on holiday gifts.

If you feel the urge to spend more, you’re not alone. However, that doesn’t mean you should give into that urge.

What matters in the end is not the pressure you feel about holiday shopping, but how you respond to that pressure.

This year, many plan to resist the pressure and spend less

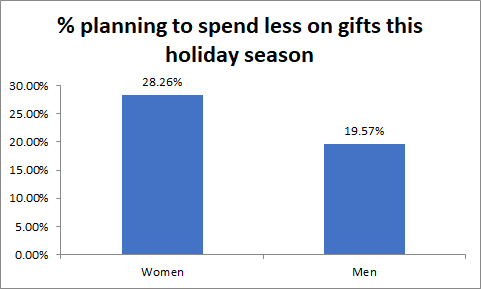

For many, 2021 will be the year to resist the pressure to spend more. Nearly 48% of respondents said they intend to spend the same this year than last year, and 24% actually intend to spend less.

With inflation running at its highest rate in more than 30 years, spending the same as last year is likely to mean buying less.

While the survey found that a greater percentage of women feel pressure to spend more, as the chart below shows, women are actually leading the charge to defy inflation by spending less this year.

At a time when prices are running high, spending less on gifts is a sound financial move. It leaves more of your budget for essentials which may be costing more than ever.

Men spend more money, women reach more people with gifts

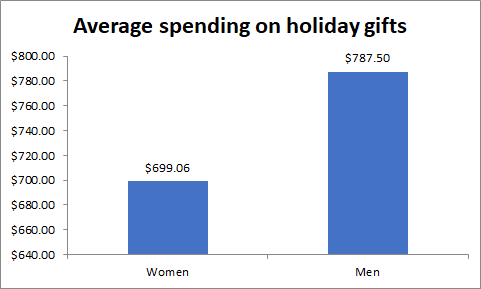

Men are likelier than women to say they intend to spend more this year in comparison with last year, and they also tend to spend more in dollar terms.

Male survey respondents estimated their spending on holiday gifts at an average of $787.50, while female respondents estimated theirs at an average of $699.06.

Despite spending more money though, men spread their gift-giving among fewer recipients. The survey found that women intended to buy gifts for an average of 7.75 people this holiday season, compared with 6.81 people for men.

If it’s the thought that counts, the way women spend less but give to more people may be a more cost-effective way of spreading holiday cheer.

In other words, gifts don’t have to be extravagant, just enough to let someone know you were thinking of them.

Women are more likely to get a jump on holiday shopping

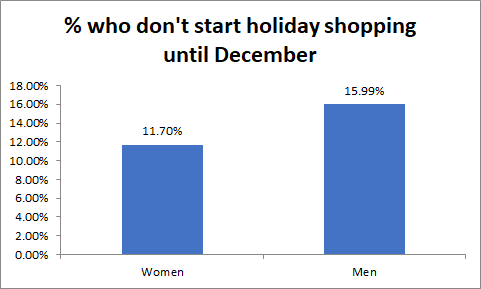

Another edge women have over men when it comes to holiday shopping is that they are less likely to leave it untill the last minute.

The survey found that men are more likely to put off starting their holiday shopping till December:

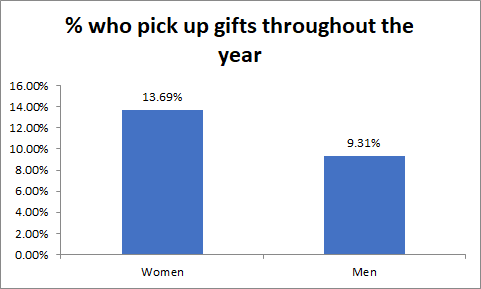

Meanwhile, women are more likely than men to be opportunistic about buying gifts when they see them throughout the year:

A late start to holiday shopping can mean missing out on Black Friday and Cyber Monday deals, not to mention the opportunity to snap up bargains throughout the year.

Also, shopping too close to the holidays creates deadline pressure. This can lead people to ignore their budgets just to get the job finished.

Finally, another problem with concentrating your spending all at the end of the year is that it can leave you with a credit card balance that you can’t pay off all at once. This is likely to result in you paying more interest.

Taking extra time to shop for gifts not only reduces the deadline pressure, but it also gives you a better opportunity to pay for those gifts soon after buying them. This means less money has to go towards paying interest, and more can go towards the actual gifts.

Women prefer debit cards, men prefer credit

Debit or credit?

Chances are, you’ll be asked that question a lot while holiday shopping. The survey found that just over three-quarters of respondents use either a debit card or a credit card as their primary method of paying for holiday gifts. Other methods include cash, checks and gift cards.

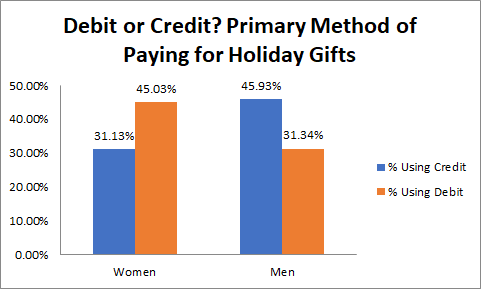

What’s interesting is that men and women are likely to answer the “debit or credit” question differently, as shown by the chart below:

For women, debit cards are the primary method of payment. 45% of female respondents said they are most likely to pay for holiday gifts with a debit card, compared with 31% who mostly use a credit card.

Those numbers are almost exactly reversed when it comes to men. Just over 31% of men said debit cards were their primary method of paying for holiday gifts, compared with 46% who mostly use credit cards.

What’s the difference? Using a debit card means paying for gifts with money you already have. Using a credit card means borrowing the money.

If you don’t pay off the money you borrow by the end of the next credit card billing cycle, you will probably have to pay interest on it.

By using debit cards more often than credit cards to pay for holiday gifts, women give themselves a better chance to avoid those interest charges. That’s one more way women seem to be more cost-effective holiday shoppers than men. That said, women are also missing out on potential credit card rewards using this method of payment.

Of course, how you shop for holiday gifts isn’t predetermined by your gender. Both men and women can adopt the smart shopping habits discussed in this article, such as:

- Resisting the pressure to spend more

- Looking for more cost-effective gifts

- Getting an earlier start on holiday shopping

- Avoiding carrying a balance on your credit card

These responsible financial habits can not only make the holiday season brighter, but also allow the cheer to last even when the bills start coming due in the new year.

About the Survey

Data used in the above article come from a survey of 1,001 consumers conducted by Op4G for CardRatings.com. This total included 515 female adults and 486 male adults. Survey design and data analysis was done by CardRatings.com.