When it comes to credit cards, getting too set in your ways can cost you.

Credit cards are a dynamic and competitive market. As such, the landscape is always changing. The card with the best deal one year may offer less attractive terms the next year, while new offers may come along offering better opportunities.

On the whole, Americans deal with this ever-changing credit card market by being active consumers. They regularly shop for new cards, which gives them a chance of staying aware of whether better terms might be available.

However, according to a new CardRatings.com survey, older Americans differ greatly from other age groups in how actively they approach the credit card market. Especially in environments like today’s, when interest rates are changing rapidly, that difference may be costly.

Most age groups are active credit card shoppers – with one exception

A CardRatings.com survey found that most Americans are actively looking for new and better credit card terms. Out of 1,868 American adults surveyed, 63% said they planned to apply for a new card within the next year.

In almost every age group, most respondents said they planned to apply for a new card within a year. The one exception was the 65-and-over age group.

People in the 35-44 age group are most likely to be shopping for a new card. Nearly 81% of this age group said they plan to apply for one within the next year.

In contrast, just under 26% of people 65 and older plan to apply for a new card within the next year.

Are these older credit card customers too complacent about their credit cards, or simply confident that they’ve already made the right choice?

A closer look at the survey data and the nature of the credit card market suggests that it may not pay to take anything for granted.

Older Americans are most unsure whether they have the right card

To some extent, it’s natural for people to settle into long-established choices as they get older. Over the years, people gain more experience with different products, and have a stronger sense of which ones are right for them.

However, that type of certainty may not be such a good thing with products that change as much as credit cards. Over time, a variety of credit card terms may change, including:

- Annual fees

- Late fees

- Rewards programs

- Interest rates

As a result, the terms you signed up for initially may no longer be the ones you’re now getting. Also, other cards on the market are changing their terms, and new entrants may emerge.

So, unless you actively test the market now and then, you have no way of knowing whether you’re still getting the best deal.

➤ SEE MORE:Best credit card sign-up bonuses

Some of this uncertainty is reflected in the survey results. Most respondents in the 65-and-over age group say they aren’t sure whether there are better cards out there. The 53% of this age group that says they are unsure whether there are better credit card options available is the highest degree of uncertainty of any age group.

Nineteen percent of the 65-and-over age group say they believe there are better card options available. Add in the 53% who are unsure and that makes 72% of this age group that feels there’s at least a possibility that they could do better than their current credit card.

And yet, only 26% of this cohort plans to apply for a new card within the next year. Clearly, too many older Americans are settling for less than the best from their credit cards. That decision could prove critically costly for people on a tight retirement budget.

Credit card needs may change as you move into retirement

As noted previously, frequent changes in credit card terms make it a good idea to check the market regularly for better deals. Another reason is that the way you use your credit cards may change as you move into your retirement years.

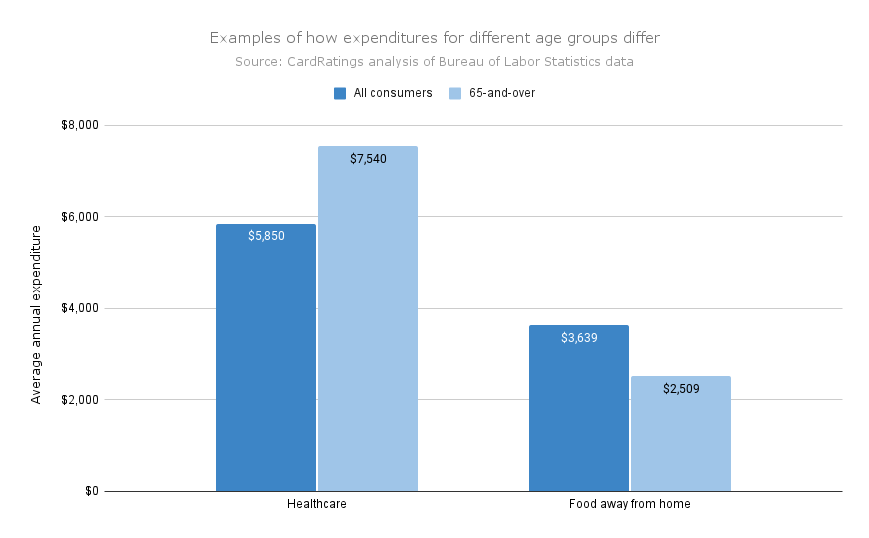

For one thing, spending habits change over time. The following are two examples, based on data from the Bureau of Labor Statistics:

As the chart shows, older people tend to spend more on healthcare than adults in general. On the other hand, they spend less eating out than adults as a whole.

These are just two examples of how spending habits change as people age. The point is that the types of things a person tends to buy most might impact their choice of credit card rewards programs. This is one reason why the best card for an individual might change as that person ages.

Another difference is that people tend to carry less debt in their later years. A CardRatings.com analysis of data from the Federal Reserve Bank of New York and the Census Bureau found that per capita credit card debt typically peaks when people are in their 40s. It then declines steadily as people grow older.

The extent to which a person carries a credit card balance should also affect their choice of a card. People who carry larger balances should be very concerned with the interest rate they pay. For people who carry little or no balance, factors like fees and rewards should be more important. Since older people tend to carry smaller balances, this might affect their decisions about credit cards.

Finally, the CardRatings survey found that older Americans typically have higher credit scores than other age groups. This can affect what credit cards and rate deals you qualify for. So, it’s a good idea to shop for a new deal occasionally if your credit score improves as you grow older.

➤ SEE MORE:Best credit cards for retirees

Interest rate changes make this a key time to shop for a card

All of the above are general reasons why it doesn’t pay for older consumers to get too complacent about their credit card choices. In addition, there is a specific reason why this is a particularly good time to take a fresh look at what different cards are offering.

According to the Federal Reserve, the average rate charged on credit card balances has risen by nearly 7% since the middle of 2020. When rates move that rapidly, different credit cards respond differently, with some raising rates more than others.

So if you chose a credit card because it had the best rate three years ago, things may have changed a lot since then. That means it makes sense for consumers of all ages to take a fresh look at credit card deals.

➤ SEE MORE:Best credit cards of 2026

CardRatings.com commissioned Op4G to conduct a national survey of 1,868 cardholders in September, 2023.