The credit card debt Americans owe has risen for four straight years, and may be on track to rise again this year. That’s no accident. In a way, that’s exactly how credit card companies planned it.

The low minimum payments most credit cards charge are designed to stretch your debt out for a long time. That way, you pay more interest. Worse, low minimum payments increase the chances that you’ll spend more on your card than you pay off each month, so your debt – and your interest payments – keep going up.

If you want to stop credit card companies from maximizing their profits at your expense, you should recognize how minimum payments work so you can take a different approach to your monthly payments.

Understanding how minimum payments affect your debt is a crucial part of personal finance, helping you make more informed decisions about managing your money.

What is a minimum payment on a credit card?

The minimum payment on a credit card is the minimum amount you have to pay on each bill to avoid penalties. This minimum payment amount is listed on your credit card statement or billing statement each billing cycle. It’s typically a very small amount when compared to the total balance or outstanding balance that you owe—and that’s just the problem.

Low minimum payments can lull consumers into thinking their credit card debt is very affordable. However, while that low payment may make it easy for you to pay your monthly bill, it can cost you dearly in the long run. The minimum monthly payment is the minimum amount required to keep your account in good standing, and credit card issuers are required to disclose this on your billing statement.

Credit card companies use a variety of methods to calculate minimum payments. The card issuer determines the minimum payment formula, and details can be found in the credit card’s terms and conditions. Here are three common methods:

- A flat percentage of the total balance or statement balance, typically between 1% and 3%

- A fixed amount, such as $25 or $35

- Calculated based on a combination of interest accrued during the month plus a small percentage, such as 1%, of the outstanding balance

In many cases, these calculation methods will result in a minimum payment that is a very small percentage of your balance. While affordable monthly payments may sound good in the short term, when you take a closer look at your credit card’s terms and your billing statement, you can see how costly they are in the long run.

➤ SEE MORE:What happens if you only pay the minimum on your credit card?

The hidden truth about minimum credit card payments

The main downside to low monthly minimum payments is that they only make a very small dent in the balance you owe. Making only minimum payments can negatively affect your credit history and credit score over time, as you carry a balance and accrue more interest. This causes your debt to drag on longer, so you’ll pay more interest.

In fact, at today’s interest rates, the majority of your payments are going toward interest rather than paying down the principal amount you owe. The remaining balance continues to accrue interest, and if you only make the minimum payment, you are charged interest on the remaining balance each month.

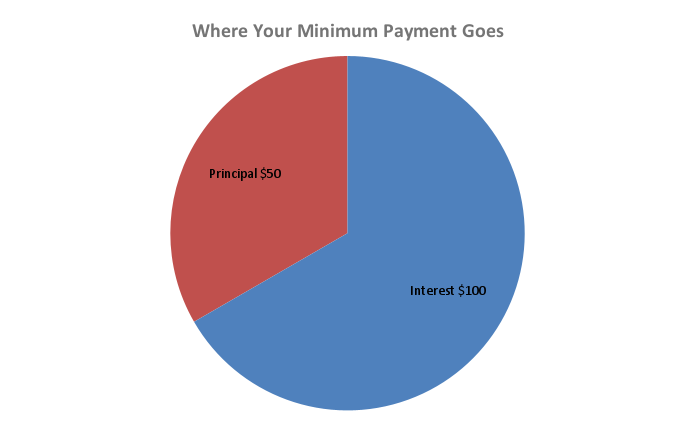

In mid-2025, the CardRatings Credit Card Rate Survey found that the average credit card interest rate was a little over 24%. At a 24% interest rate, using a common minimum payment formula of interest plus 1%, the minimum payment on a $5,000 credit card balance would be $150. Allocated between interest and principal, here’s a breakdown of where that $150 payment would go:

This means two-thirds of your payments would be going towards interest. Just one-third would go towards reducing the amount that you owe.

Thinking about it another way, under this formula, the principal portion of your payments represents just 1% of the balance. That means it would take years to pay off your entire balance. The minimum payment warning on your billing statement shows how long it will take to pay off the entire balance if you make only the minimum payment each month. All the while, you’d be steadily paying interest, which keeps the credit card company happy.

Not only does paying your balance off at a rate of 1% a month cause it to drag on, but the reality is often much worse than that. There’s a good chance you’ll spend more than 1% of your balance with the credit card each month. That means your principal would actually keep rising, even while you made your payments every month. Paying only the minimum balance each month means you will not pay off the full balance, and interest will continue to accrue.

Rising payments don’t just cause you to pay more interest. They can also drag down your credit score. Late payments or paying less than the minimum balance can result in a late fee and may be reported to credit bureaus, impacting your credit history.

The problems caused by low minimum credit card payments are widespread because Americans have historically paid off more credit card debt than they’ve spent on their cards in just three months out of every year. That means in nine out of twelve months, they’re taking on more credit card debt than they’re paying off. Low minimum payments are a big reason for this.

This is a particular concern now. As of the end of last year, the percentage of American credit card customers who were making just the minimum payment on their credit cards was the highest on record. While making the minimum payment can keep accounts in good standing in the short term, over a few months, it can become a major factor in long-term debt accumulation. The minimum credit card payment required can vary depending on the card issuer and the terms of your account.

➤ FREE TOOL:Credit card interest calculator

Four strategies to manage credit card debt

Here are four strategies to try if you want to avoid the problems caused by low minimum credit card payments:

- Pay your balance off in full whenever possible. If you do this by the due date every month, you can avoid paying interest altogether. Keeping your balance low relative to your credit limit or total credit limit is important for maintaining a healthy credit utilization ratio and overall credit health.

- Always try to pay more than the minimum. Don’t be limited by the minimum. If you can afford to pay more, doing so will save you money in the long run and help improve your credit utilization ratio. Lenders consider your credit utilization ratio as a major factor when deciding whether to lend money.

- If you have multiple credit card balances, pay the most on the one with the highest interest rate. If you have to juggle multiple payments, be sure to pay at least the minimum on each card. If you have any extra money left over, add it to the payment for the card with the highest interest rate. Making multiple credit card payments each month can help reduce your balance faster and improve your credit utilization ratio.

- Consider a balance transfer card to pay down debt faster. Many of these cards allow you to pay 0% interest for a limited time. Balance transfers can be used to consolidate debt and take advantage of lower interest rates. This can accelerate your debt reduction. It’s especially effective if you can pay off the debt within the 0% interest period and avoid building up balances on your other credit cards.

Additionally, making fewer purchases can help you reduce your credit card debt and free up more available credit, which benefits your credit utilization ratio and overall credit health.

Frequently asked questions about credit card minimum payments

Why is it more difficult to get out of debt when only paying the minimum payment?

Making only the minimum payment each month on your credit card means your debt will be paid off very slowly, and if you keep spending, your balance may even grow. Your credit card statement includes a minimum payment warning showing how long it will take to pay off your balance and the total interest you’ll pay if you only make minimum payments. This highlights why paying more than the minimum is important whenever possible.

Does paying only the minimum payment hurt your credit score?

It can, if continued spending causes your balance to rise. A high credit utilization rate is a negative factor in credit scores. Additionally, late payments or a missed payment can be reported to credit bureaus, which can negatively impact your credit score.

If you pay the minimum, are there interest charges?

Yes. If you do not pay the full balance, you will be charged interest on the remaining amount. Interest will continue to accrue on your balance if you only make minimum payments, making it harder to pay off your debt. Only paying your balance off in full allows you to escape further interest charges.

What happens if you make only the minimum payment on your credit card?

Making the minimum payment on time keeps your account in good standing, as it shows the issuer you are meeting your obligations. If you miss the minimum payment, you may be charged a late fee and your account status could be negatively affected. However, making only the minimum payment means you’re likely to pay interest for a long time, which will cost you more money.

➤ SEE MORE:Why payment history is such an important part of your credit score

The bottom line – when should you pay only the minimum?

Paying just the minimum can cost you money and hurt your credit. While making the minimum payment each month keeps your account in good standing and avoids late fees, paying the entire balance is the best way to avoid interest charges and manage debt effectively. So, paying only the minimum should be the exception rather than the rule.

You should only pay the minimum if you cannot afford to pay any more. If that’s the case, you should look to curb your credit card spending until you can pay more than the minimum.

Also, it’s okay to pay only the minimum on one card if you’re devoting all your available money toward paying down the balance on a higher interest card. The goal should be to pay down that higher-interest debt so you can devote more money to your other credit card balances.

Bottom line, the minimum credit card payment is the least you can pay to avoid penalties, but paying more—or ideally, the entire balance—can save you money in the long run. Paying only the minimum allows the credit card company to maximize its profits from you. That’s a good deal for them, but bad for you.