Besides the good residents of Whoville, investors and consumers had reason to cheer the news on Dec. 13 that the Federal Reserve wouldn’t be raising interest rates at its last meeting of 2023.

The Fed not only spared people from another dose of higher rates, it shared a more optimistic view of inflation than it had previously expressed.

This news was especially welcome because the Fed had originally indicated that it would raise rates one more time this year. Also, the history of rate increases could lead one to suspect that the Grinch has a voice in the Fed’s decisions at this time of year.

The Grinchy history of the Federal Reserve

In all, the Fed has raised interest rates 37 times in the past 20 years. Seven of those rate increases have occurred in December – more than in any other month.

Since rate increases make borrowing more expensive and are intended to slow the economy, raising rates just in time for the December holidays can seem like a trick the Grinch would pull.

Of course, the reality may have something to do with how the Fed’s schedule plays out. The Federal Open Market Committee (FOMC), which is the subgroup of the Fed that makes rate decisions, only has eight regularly scheduled meetings per year. That means it doesn’t meet in every month of the year, though it generally schedules a mid-December meeting.

So, while December rate hikes are especially common, so are December FOMC meetings.

Impact on consumers

Whether you blame the history of December rate hikes on the Grinch, the scheduling pattern or just coincidence, the timing can have a costly impact on consumers.

Many credit cards link their rates directly to the Fed’s rates. So, when the Fed raises rates, you can often expect credit card rates to follow.

➤ LEARN MORE:How does the Federal Reserve impact credit card interest?

Historically, credit card spending has tended to be at its highest in November and December. So, when the Fed raises rates in December, it means credit card companies are likely to charge more on credit card balances just when those balances are at their highest levels of the year.

As it is, even without a December rate hike this time around, consumers are facing steep credit card bills in the new year. Even before the holiday shopping season, total credit card balances were at an all-time high. Also, during 2023 the average rate charged on those balances rose to 22.77%. That’s the highest level recorded by the Fed, whose records on credit card rates go back to 1994.

So why no rate hike this time?

At the FOMC’s September meeting, it released economic projections that showed the Federal funds rate would finish the year at 5.6%. To get there, the Fed would have had to raise rates one more time between then and now.

So why didn’t it? Well, the purpose of raising rates is to cool off inflation, and there’s some evidence that the Fed has made progress towards that goal.

The Consumer Price Index (CPI) rose by only 0.1% in November, after being unchanged in October. Month-to-month CPI numbers can be erratic, but two months in a row with almost no inflation is certainly encouraging.

Also, the Fed recognizes that using rate increases to control inflation is not an exact science. So, it takes an incremental approach to raising rates. Most often, it tends to edge them up a little, and then wait to see what the impact is. As long as inflation seems to be behaving, the FOMC can be content to wait and see if further rate increases are necessary.

The reason for this somewhat cautious approach is that rate increases are not without cost. They act as a drag on the economy, and too much of a drag can cause a recession.

Tellingly, even though the economy had a strong third quarter, the FOMC is forecasting slower growth ahead. The economic projections it released following the Dec. 13 meeting call for just 1.4% growth next year. That doesn’t leave much margin for error. Too heavy-handed an approach to raising rates could push that number into negative territory.

Don’t rule out further rate hikes

Besides not raising rates in its December meeting, the FOMC had more good news in its latest economic projections. It now expects the Fed funds rate to drop from 5.4% to 4.6% next year, and then to 3.6% in 2025 and 2.9% the following year.

Along with those rate projections, the Fed also released more optimistic projections for inflation. Its inflation projections for 2023, 2024 and 2025 are now lower than the expectations it released after its September meeting.

However, those are just projections. The Fed may still make further rate hikes if necessary. In fact, the press release at the close of the latest meeting reiterated that the FOMC “is strongly committed to returning inflation to its 2 percent objective.”

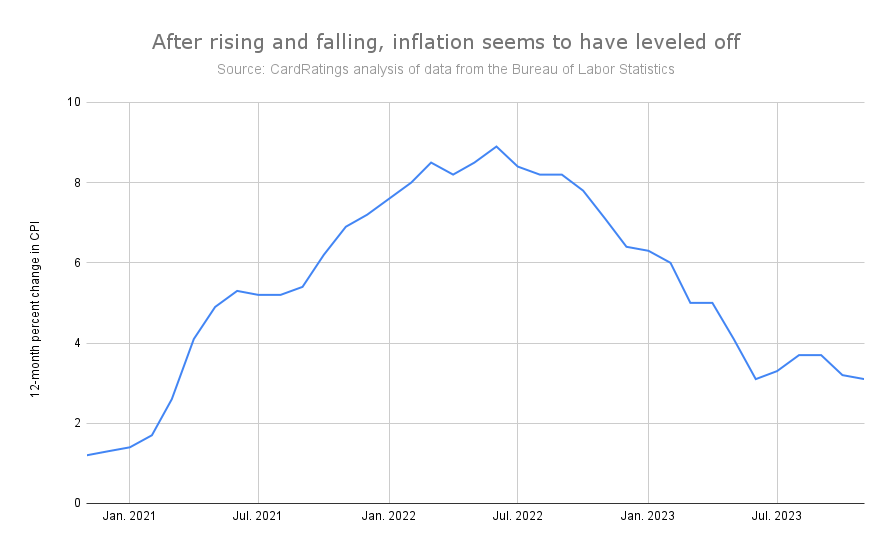

Here’s a look at how the pursuit of that goal is going:

Though the above might look like one of the hills that the Grinch and his dog Max ride over in their sleigh on their way to raid Whoville, it’s actually a chart of inflation over the past three years.

As you can see, the annual inflation rate has calmed down a great deal since peaking at 8.9% in June of 2022. However, it seems to have leveled off lately. It has remained in a range of between 3.1% and 3.7% since June.

That leaves it still clearly above the Fed’s 2% goal. Also, inflation is notoriously resilient. If the Fed sees prices flaring back up again, it won’t hesitate to unleash another rate hike to tamp inflation back down.

If that happens, don’t be too hard on the Fed for raising rates. After all, it has the best of intentions in trying to control price increases. Inflation can be even more damaging to consumers than a recession, and when inflation gets out of control borrowing costs are likely to rise regardless of what the Fed does.

So, the Fed’s heart is in the right place. Remember, it turned out that the Grinch wasn’t so bad in the end.