Credit cards can help you manage cash flow by essentially allowing you to take out interest free loans, but only if you fully understand and use your credit card’s interest-free grace period. Working within the grace period means that you don’t have to worry about interest rates rising because you won’t pay interest on your purchases and you can take full advantage of the perks, rewards, security and benefits of a credit card without concerns about interest charges. Keep reading this guide to credit card grace periods for full details.

Key takeaways

- A credit card grace period is the time between the end of your credit card billing cycle and when your bill is due

- Most credit cards offer interest-free grace periods on purchases

- Grace periods could save you hundreds or thousands in credit card interest

- Not all types of credit card transactions qualify for an interest-free grace period

What is a credit card grace period?

A grace period is the time between your credit card statement closing date and when your bill is due. In most cases, banks consider that an interest-free period. Assuming you pay off your balance in full during the grace period, which means before the due date, you won’t accrue interest.

A grace period is a significant, but often overlooked credit card benefit. Consider this: If you take full advantage of the grace period by purchasing a big ticket item right at the beginning of your billing cycle, you could take advantage of what amounts to a 0% loan for over 50 days (length varies depending on the length of your grace period and when you made your purchase in your statement cycle). As a result, this technique can improve your cash flow.

“It absolutely pays to time your purchases,” says Lynnette Khalfani-Cox, author of the New York Times bestseller “Zero Debt: The Ultimate Guide to Financial Freedom.” “So, if you know that you’re getting a grace period where there’s no interest charged, you want to make those large-ticket purchases right up front – and not wait until the end of the cycle.”

How long is a credit card grace period?

The CARD Act of 2009 requires credit card issuers to send your bill at least 21 days before the due date, but there’s no requirement that those 21 days be interest-free. Still, most major issuers consider that span between your statement closing date and your billing cycle due date to be an interest-free grace period. Unfortunately, the cards most likely to NOT offer an interest-free grace period are those marketed to lower credit score clients.

However, assuming your card offers that 21-day interest-free period, that means if you make a purchase on March 1 and your statement closes on March 27, your due date will be no earlier than April 17, giving you more than six weeks to pay off that March 1 purchase interest-free.

Still, while certainly helpful, the CARD Act doesn’t protect you against everything. Many consumers realize that if you don’t pay your balance in full by the due date, the bank will charge you interest (also known as finance charges) and you will forfeit your grace period (see more detailed explanation below). But there are also instances when a credit card grace period doesn’t apply at all, even for cards that offer one on purchases.

BONUS TIP!

Several major card issuers offer 25 day grace periods, a nice extension beyond the 2- day required minimum. Four extra days may not sound like much, but can prove quite helpful, especially if you experience an unexpected financial challenge, such as a job loss.

Cash advances and balance transfers don’t offer grace periods

Most people use their credit cards for standard, everyday purchases and, therefore, can take full advantage of an interest-free grace period. If you’re looking to get cash from your credit card – a cash advance – or do a balance transfer, however, you might be in for a surprise.

That’s because cash advances and balance transfers typically begin accruing interest on the date of the transaction.

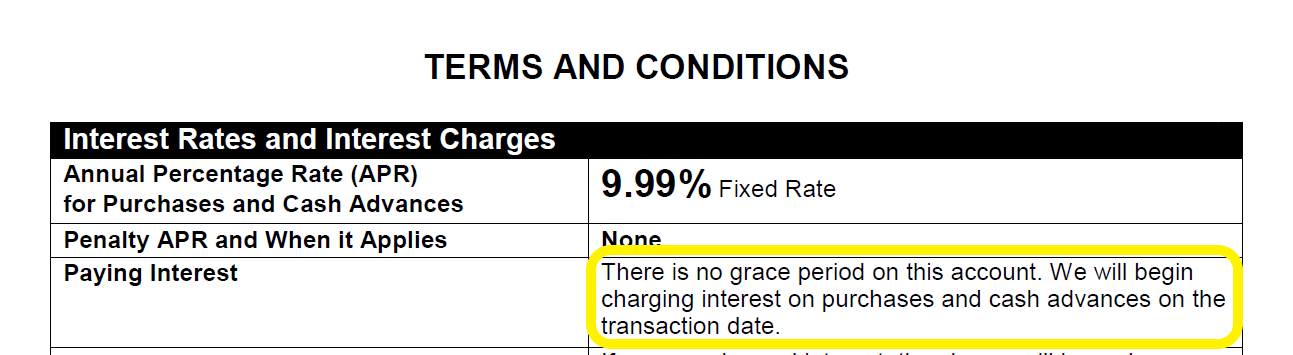

As you might expect, this verbiage is disclosed in the fine print. After recently reviewing one popular card offer from Capital One, I found the following statement (this type of statement is common with all major card issuers):

We will begin charging interest on cash advances on the transaction date.

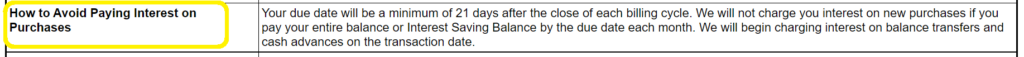

Similarly, upon reviewing documents for a Citibank card, I found grace periods addressed in a different section of the terms and conditions called the Schumer Box. Under the subheading “How to Avoid Paying Interest on Purchases,” I found:

We will begin charging interest on cash advances and balance transfers on the transaction date.

I’ve yet to discover a card that offers a grace period on either cash advances or transfers in the 25 years that I’ve covered the industry, so my advice is to not waste your time digging through the fine print on this one. Instead, just assume this rule is written in stone for every card issuer (if you find an exception, please email me and I promise to make you famous!).

BONUS TIP!

If you take advantage of a 0% balance transfer offer, the lack of grace period a concern since you won’t be charged interest during that 0% interest period regardless on the amount you transfer.

But be sure to follow rule #1 when it comes to transfers and do NOT to make any new purchases on the card after you have completed the transfer as you will no longer enjoy a grace period on purchases (since you will be carrying a balance). One notable exception would be a transfer offer that also features a 0% promotional rate on purchases. Often, the best balance transfer credit card offers also feature a 0% rate on new purchases as well.

Can I lose my grace period?

As mentioned above, your grace period will end abruptly if you don’t pay your balance in full (i.e. to the penny) every month.

“If you only make the minimum payment or a partial payment, you will see some interest charges posted to your account at the end of the grace period,” Khalfani-Cox explains.

Americans carried a balance on 53% of all active credit card accounts in the fourth quarter of 2021, according to the American Bankers Association. In other words, at least 53% of card accounts do not have grace periods in effect.

If you don’t pay off your balance in full, you will then begin to carry or revolve a balance and become a “revolver” in industry-speak. Needless to say, the card industry prefers revolvers over credit card deadbeats, which are consumers that pay off their balance each month.

Not paying off your balance in full means you will lose your grace period for that billing cycle and, most likely at least the next one as well. Even If you only carry a balance once a year, for example on your January statement after some extra spending for holiday gifts, you will forfeit your grace period at that time.

BONUS TIP!

Don’t panic if you lose your grace period on occasion. You can normally restore your grace period, although not instantly. Card issuers typically require that you pay your balance in full for two billings cycle to restore your grace period.

The offer mentioned above from Citibank has the following language (in the fine print):

You also won’t have a grace period on Purchases again until you pay the Adjusted New Balance in full by the payment due date 2 Billing Periods in a row.

How do I find out my grace period?

Curious how long the grace period on your card is? Every credit card, including solicitations (that is, mailed credit card offers), is required to disclose its grace period. You can normally find the length of the grace period in an easy-to-read format (i.e. not small font) by looking at the Schumer Box mentioned above.

The law requires card issuers to include a Schumer Box, named after Sen. Charles Schumer, with every consumer card solicitation (note that the rules are different for small business cards). The box will look more like a table and will have several headings. Look for a heading labeled something similar to “How to Avoid Paying Interest on Purchases.”

As another example of possible language to look for, Bank of America has the following two sentences under their heading that defines how long their grace period is:

Your due date is at least 25 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the due date each month.

If you can’t find the Schumer Box or have lost the initial printed terms and conditions mailed with every new credit card, you can always call customer service to inquire.

Final thoughts

Interest-free grace periods unfortunately don’t get the attention some other benefits that “have more sizzle” do. I suspect this has to do with lack of consumer awareness and the confusion that seems to surround grace periods and credit card interest overall.

Regardless, you don’t need a math degree to understand grace periods and putting forth a little bit of effort can yield great dividends. The bottom line is that effectively utilizing your card’s grace period can potentially save you hundreds, if not thousands, in interest charges and improve your cash flow.

I sincerely hope these tips are helpful to you and would love your feedback on how you’ve been able to leverage grace periods to your advantage. Who knows, I may include a tip from you in a future article!