The time until the next recession may be running out. Have credit conditions in your state improved much since the last recession?

The time until the next recession may be running out. Have credit conditions in your state improved much since the last recession?

While nationally the economy has been in an expansion for 10 years now, some states have made much more progress during the good times than others. This might leave the weaker states teetering on the brink of disaster when the next recession comes.

Since 2011, CardRatings.com looks at the best and worst states for credit conditions. Regardless of what’s going on with the economy in general, this state-by-state analysis shows some stark differences depending on where you live.

For example:

- The average credit score in Minnesota is 61 points better than the average in Mississippi.

- A house in New Jersey is 21 times as likely as one in North Dakota to be in foreclosure.

- As a percentage of wages, average credit card debt in Louisiana is almost three-quarters higher than in Washington D.C.

- A job-seeker in Alaska is three times as likely to be out of work as one in Vermont.

- The bankruptcy rate in Alabama is nine times as high as in Alaska.

For states on the wrong end of these comparisons, the sobering news is that conditions are likely to get even worse once the record-long economic expansion finally ends.

To assess credit conditions in all 50 states plus the District of Columbia, CardRatings.com looked at five factors this year:

- Average credit scores from Experian

- Foreclosure rates based on figures from Attomdata and the Census Bureau

- Credit card debt as a percentage of wages based on data from Experian and the Bureau of Labor Statistics

- Unemployment rates from the Bureau of Labor Statistics

- Bankruptcy rates based on information from the Department of Justice and the Census Bureau

Below are the best and worst states for credit conditions.

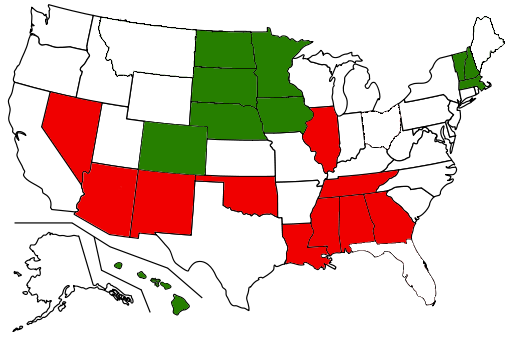

Best states for credit conditions 2019

Here are the top 10 states for credit conditions:

1. North Dakota. This is North Dakota’s third consecutive win in this study. North Dakota has the lowest foreclosure rate in the nation, and ranked among the 10 best states in all five categories used in this analysis.

2. Vermont. At 2.1%, Vermont has the lowest unemployment rate of any state, which bodes well for credit conditions continuing to be strong. Vermont was also rated as among the best five states for average credit score, low foreclosure rate and low bankruptcy rate.

3. New Hampshire. This state ranked better than most in all five categories, including top-five rankings for both average credit score and low unemployment.

4. Minnesota. With an average credit score of 713, Minnesota ranks first in the nation. This strong score makes sense considering Minnesota has the fourth-lowest level of credit card debt as a percentage of wages.

5. (tie) Massachusetts. Though its foreclosure rate is a little worse than that of most states, Massachusetts ranked in the top 10 in the four other categories, including a No. 2 ranking for lowest credit card debt as a percentage of wages.

5. (tie) South Dakota. This state trails only neighboring Minnesota for best average credit score, and also ranks second for having the lowest foreclosure rate. The only area where it is worst than median is for credit card debt as a percentage of wages.

7. Iowa. Being better than median in every category helped Iowa rank well overall. Its biggest strength is having the third-lowest unemployment rate of any state.

8. Colorado. This is another state which ranked better than median across the board, including best-10 rankings for low foreclosure rate and low unemployment.

9. Hawaii. Even though Hawaii is a little worse than most states for credit card debt as a percentage of income, it overcomes this with best-10 rankings for low unemployment and bankruptcy rates.

10. Nebraska. The chief strength of Nebraska is having one of the 10 highest average credit scores in the nation, and it did better than most states in four out of five categories.

Worst states for credit conditions 2019

Ten years into an economic expansion, here are the states that had the most red flags in terms of credit conditions:

51. Nevada. This is the second year in a row Nevada has been found to have the worst credit conditions in the nation. It is below median in all five categories, and among the 10 worst for everything except unemployment rate.

49. (tie) Georgia. It doesn’t help that Georgia is below median in all five categories, but its biggest problems are having the third-highest bankruptcy rate and the fourth-lowest average credit score.

49. (tie) Louisiana. Like Georgia, Louisiana is below median across the board, including having the highest level of credit card debt as a percentage of wages.

48. Mississippi. Oddly enough for a state with generally bad credit conditions, Mississippi has a relatively low foreclosure rate. Unfortunately though, it was among the 10 worst in the four other categories, including having the lowest average credit score of any state.

47. Alabama. With an unemployment rate of just 3.3%, the job market in Alabama is relatively promising. Unfortunately though, it was worse than most states in every other category, including having the highest bankruptcy rate in the nation.

46. New Mexico. Though its bankruptcy rate isn’t as bad as in most states, New Mexico ranked among the 10 worst in all four other categories.

45. Tennessee. The main problem in Tennessee is the nation’s second-highest bankruptcy rate, but it is also worse than median in all four other categories.

44. Oklahoma. Though it still maintains a relatively strong job market, Oklahoma is among the 10 worst states for credit card debt as a percentage of wages and for average credit score.

43. Arizona. At 4.9%, Arizona’s unemployment rate is fifth-worst in the nation, and the state did worse than most in all four other categories as well.

42. Illinois. At 687, the average credit score in Illinois is actually around the middle of the pack. However, with the state having the fourth-worst foreclosure rate and fifth-worst bankruptcy rate in the nation, that average score might be poised for a fall.

Biggest winners and losers for credit conditions

Over the past year, the biggest improvements were shown by the following states:

- Delaware climbed by 11 spots since last year’s study. While it is still below median at 31st overall, this improvement pulled Delaware out of the bottom 10. Significantly, Delaware’s unemployment rate has dropped by 23% since last year’s study.

- For a variety of reasons, the District of Columbia, New York and Rhode Island all made eight-point jumps in the overall rankings since last year’s study.

On the other end of the scale, here were the biggest drops in rankings in:

- Alaska dropped 17 points overall since last year’s study. Among its problems was an 85% increase in its foreclosure rate. Also, Alaska fared poorly for credit card debt as a percentage of income, a new criteria introduced for this year’s study.

- Tennessee dropped by 13 points overall. Notably, while unemployment has continued to improve nationally, it actually got a little worse in Tennessee over the past year.

No matter what condition your credit is in personally, the credit conditions of your neighbors matter a great deal to the general prosperity of the area where you live. This impact could be felt even more acutely the next time the economy slips into a recession.