If you’ve ever felt like your favorite rewards credit card is gently nudging you toward a night out, you’re not imagining things. The Amex Resy partnership is basically a “treat yourself” reminder, but it’s one with rules, deadlines, and just enough fine print to keep things interesting.

A key feature of the Amex Resy partnership is its dining benefits, which include exclusive access, statement credits, and curated dining experiences through Resy, enhancing the overall value for cardmembers.

Whether you’re new to Amex Resy benefits or just trying to squeeze a little more value out of your credit cards, here’s exactly how to make the most of your Amex Resy credits throughout the year.

What is the Amex Resy credit, and how does it work?

Overview of Resy and the Amex partnership

Resy is a restaurant reservation platform known for its curated list of trendy, chef-backed dining spots. American Express has partnered with Resy to offer cardholders statement credits that provide savings on eligible dining purchases. Enrollment is required to activate these benefits and receive statement credits, as well as access exclusive dining perks.

Not all Amex cards include this benefit, and the amount of credit varies—some cards offer quarterly credits, others biannual or monthly. It’s important to enroll and track your benefit period to maximize value throughout the calendar year.

Which Amex cards offer Resy credits

Resy credit Amex options include premium cards from the issuer that earn Amex Membership Rewards points, as well as co-branded credit cards from Delta Air Lines. For most cards, these credits are structured by calendar year, so it’s important to track your usage within each annual cycle to maximize value. The chart below shows the Amex Resy credit options through various travel credit cards and how much they’re worth.

Amex Resy benefit

American Express Platinum Card(R) discontinued_disclaimer

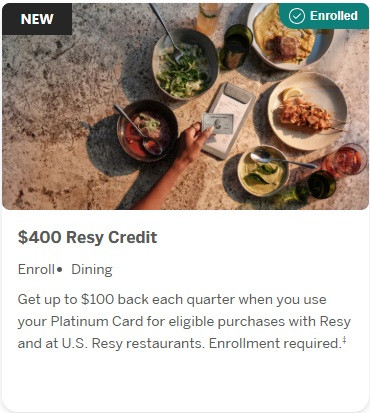

$400 annually, applied as quarterly credits of $100

American Express Platinum Card(R) discontinued_disclaimer

$100 annually, applied as biannual credits of $50

American Express Platinum Card(R) discontinued_disclaimer

$240 annually, applied as monthly credits of $20

American Express Platinum Card(R) discontinued_disclaimer

$120 annually, applied as monthly credits of $10

American Express Platinum Card(R) discontinued_disclaimer

$240 annually, applied as monthly credits of $20

American Express Platinum Card(R) discontinued_disclaimer

$120 annually, applied as monthly credits of $10

Terms may apply. Enrollment required.

How to get the most out of Amex Resy credits

Enroll in your Amex account

Before you start dreaming about perfectly seared scallops or homemade pasta, make sure your Resy credit is actually turned on. Enrollment isn’t automatic – you have to “activate” the benefit in your Amex online account or app.

To unlock the benefit, you must also link your eligible card to your Resy profile, which is required to access exclusive dining experiences and ensure your purchases qualify.

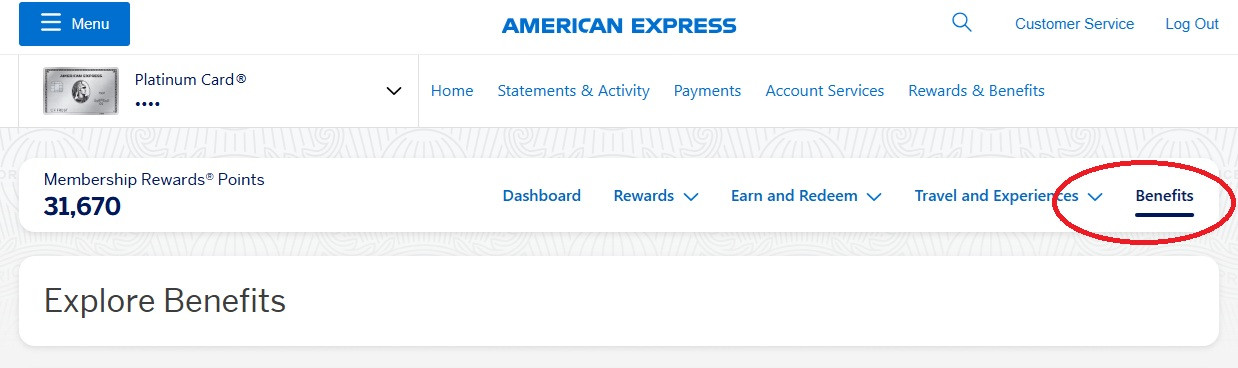

You can do this by heading to your Amex credit card account and maneuvering to the section that shows your cardholder benefits. If you’re trying to activate the Amex Platinum Resy benefit on a desktop, for example, you’ll navigate to the benefits section on the right-hand side of your online account.

From there, you’ll scroll down to the Amex Resy benefit itself, click on the benefit, and hit the button that says “enroll.” Once you do that, you’ll receive an email from Amex that confirms enrollment and see a green “enrolled” notice in your account with a checkmark. Only eligible Resy purchases made with your linked card will trigger the credit.

Search for dining options in your area

Whether you want to use the Amex Gold Resy credit, you have the Amex Platinum, or you’re trying to use credits on a co-branded Delta credit card, the process for finding eligible restaurants is the same. Cardholders gain access to exclusive reservations at Resy restaurants. You can use the Resy app or the Resy website to search for restaurants in your area or any city you plan to visit.

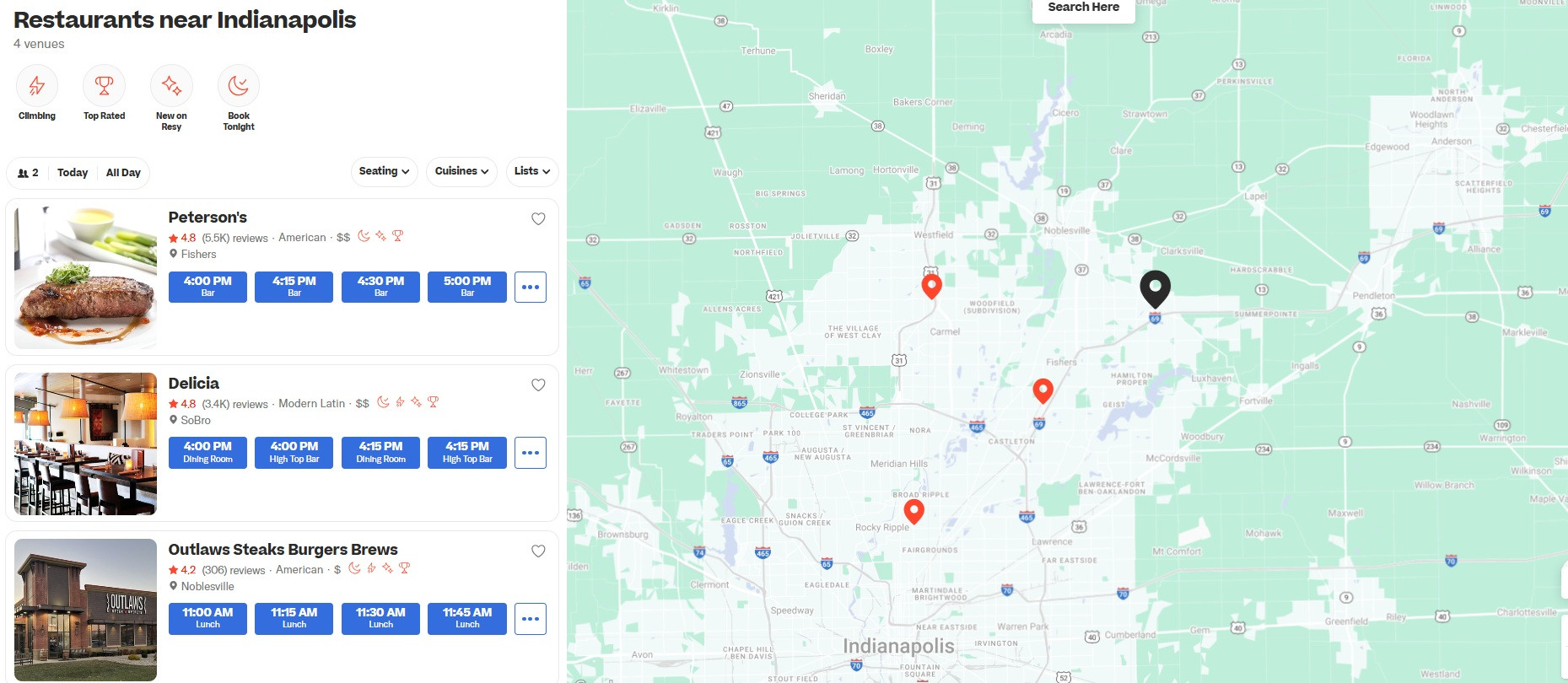

Resy lists some popular cities you can search in, but you can also look for restaurants anywhere else. With global dining access, you can book at the most sought-after restaurants around the world, enjoying unique culinary experiences reserved for cardholders. I personally like to use the map function to search for restaurants near home or where I’m traveling. As you can see in the screenshot below, there are limited Resy options where I live in Noblesville, Ind.

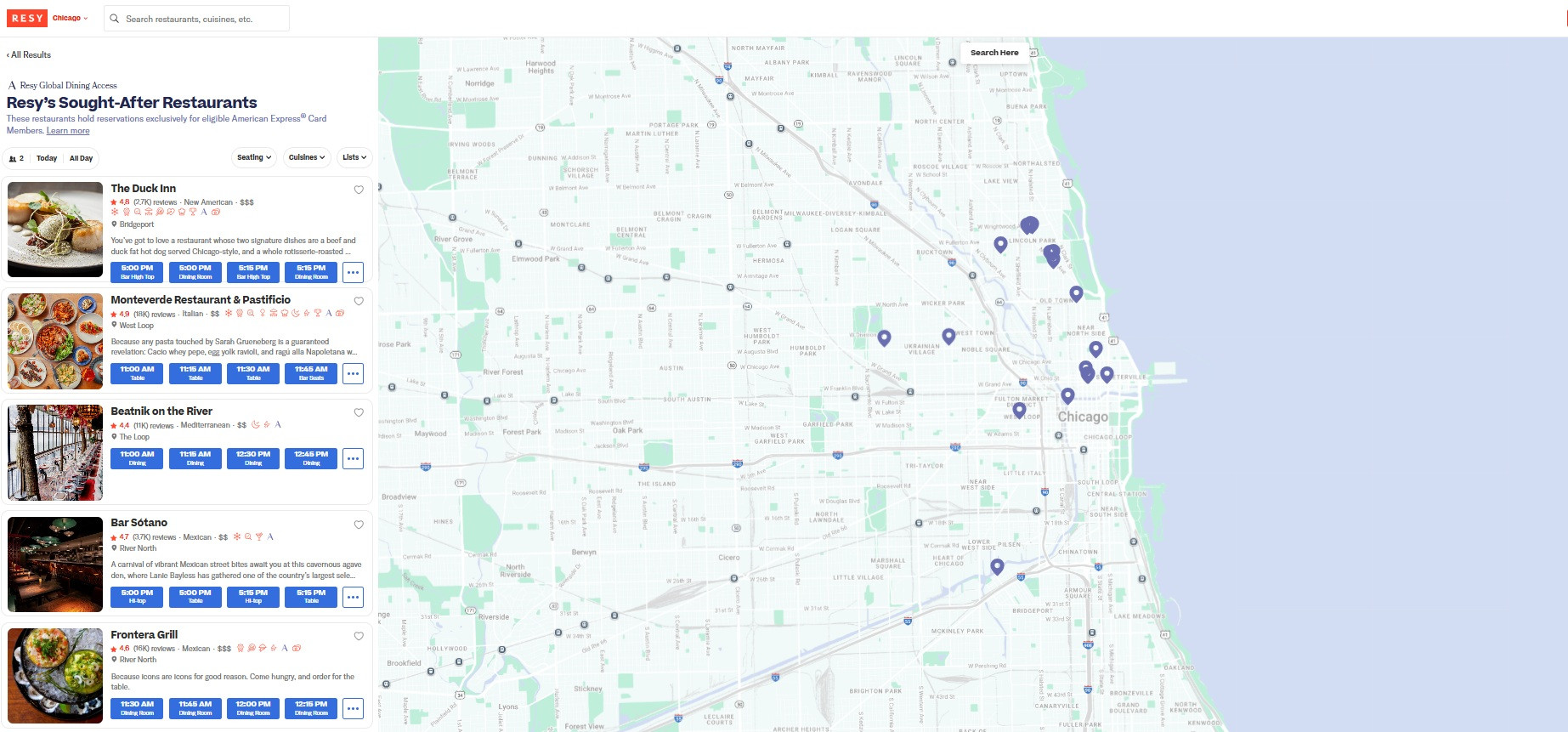

However, some nearby cities have considerably more options, including Louisville, Kentucky and Chicago, Ill., as seen below.

Once you find a restaurant to dine in, you can make a reservation—including exclusive reservations available to eligible cardholders—or show up for walk-in dining (if reservations aren’t required). You’ll get the Resy credit for eligible purchases either way, provided you enrolled in the benefit and pay your bill with your Amex credit card.

Pair up cards to maximize benefits

If you have multiple Amex cards that offer Resy credits, you can stack their value by spacing out meals. These cards offer statement credits for eligible Resy purchases, allowing you to maximize your dining rewards. For example, you could hit your favorite dining spot early in the month to use the monthly credit on a co-branded Delta credit card, then head back to the same eatery later in the month to use the Amex Platinum Resy credit.

You could also pay for one meal with both cards using a favorable split. For example, you could request one person to be on their own bill to use a $20 monthly Resy credit, then charge the remainder of the bill to your Amex Platinum card.

Gift card strategies most people miss

Here’s the sleeper tip seasoned cardholders swear by – trying to trigger the credit with gift card purchases. Many Resy-partner restaurants sell gift cards, but only Resy-branded gift cards—those purchased through American Express or at participating restaurants and clearly marked as Resy-branded—may qualify for the Resy credit. This distinguishes them from other types of gift cards, which may not be eligible for the statement credit.

This trick is especially handy when:

- The quarter or month is ending, and you don’t have time to dine out

- You want to “bank” future meals without wasting your credit

- Your favorite restaurant books out every Saturday until the year 2041

Before buying, make sure the gift card is processed directly by the restaurant and not a third-party platform. If the charge runs through the restaurant’s merchant account, it typically works.

Tips for users in rural or smaller cities

If your local dining scene leaves a lot to be desired, or if nearby options available through Resy aren’t your cup of tea, several strategies can help you make the most of this benefit regardless. Consider the following tips.

- Expand your search radius. If where you live is light on Resy options, the next town over may have a Resy partner you didn’t know about.

- Use the gift card trick. Even if a restaurant isn’t on Resy in your city, you can buy a gift card from one in a nearby metro area.

- Plan ahead for travel. Heading out for a conference, wedding, or vacation? Use your credits there. Many rural cardholders use Resy credits during trips in order to save on travel costs.

Remember that Amex Resy benefits don’t roll over

Also, remember the golden rule of all sorts of credits offered by Amex credit cards. If you don’t use your full quarterly, monthly, or biannual amount by the deadline, it expires – forever, dramatically, and without apology.

This means you’ll need to be proactive to get the most out of Amex Resy benefits throughout the year. Consider setting a reminder on your phone, scheduling dinner reservations ahead or writing Resy credit expiration warnings on your calendar so you don’t forget to use them.

➤ SEE MORE:Smart shopper’s guide: How to boost your Amex points with Rakuten rewards

Frequently asked questions

How does Amex Resy credit work?

When you enroll your eligible card and use it at a participating Resy restaurant, Amex automatically issues a statement credit for the credit amount(s) you’re eligible for. You don’t need to book reservations through Resy unless an eatery requires them. Just pay with your enrolled card, and the credit should be posted shortly after.

How long does it take Amex Resy credits to post to your account?

Most credits appear within a few days, but Amex officially says it may take up to a week. If it’s been longer, double-check the merchant was eligible and that you used the correct Amex card.

What is Resy?

Resy is a restaurant reservation platform known for its curated, often high-demand dining options and its partnership with American Express. Resy provides insider access to exclusive dining experiences and helps users unlock access to top restaurants that are often difficult to book. In many cities, it’s the go-to app for discovering new restaurants and booking sought-after dining reservations.

With features like Priority Notify, Resy alerts users when tables open at popular restaurants, giving them a better chance to secure hard-to-get reservations. Eligible cardholders can also take advantage of a personal dining concierge service, which offers tailored dining experiences, priority notifications, and exclusive reservation opportunities both locally and globally.

Bottom line

Maximizing your Amex Resy credits isn’t rocket science, but their ever-expiring nature can make them tricky to use. You have to be proactive if you want to lock in every dollar of value throughout the year, and that could mean loading up on gift cards or trying restaurants in new cities.

Also remember that using your Amex Resy credits isn’t just about saving money — it’s also a way to discover new dining experiences, try cuisines you might normally skip, and make everyday meals feel a little more special. By planning ahead, exploring partner restaurants, and keeping an eye on expiration dates, you can turn this credit card perk into a full-fledged culinary adventure.