The $93 billion credit card market is massive and growing, but it’s probably not because of millennials.

Maria Kagianas, a 20-year-old college student from Homer Glen, Ill., is one of those millennials who doesn’t have a credit card to pull out of her wallet.

“I have a debit card that is satisfying my current needs as a college student,” Kagianas said. “While living a more hectic college lifestyle than most students my age might, keeping track of additional credit card payments is another potential deadline to miss. Although I would like to start building my credit, I do not want to start hurting it either.”

A new survey commissioned by CardRatings and conducted among more than 2,000 adults online by Harris Poll finds Kagianas is emblematic of her debt-wary generation that is possibly also debt-weary thanks to record student loan burdens. The survey found millennials, 18- to 34-year olds, are using credit cards quite differently than older generations. They are more likely than older adults to believe they have thin credit files, and millennials who do have a personal credit card are significantly less likely than those 35 and older to have a rewards credit card (72 percent vs. 87 percent).

A new survey commissioned by CardRatings and conducted among more than 2,000 adults online by Harris Poll finds Kagianas is emblematic of her debt-wary generation that is possibly also debt-weary thanks to record student loan burdens. The survey found millennials, 18- to 34-year olds, are using credit cards quite differently than older generations. They are more likely than older adults to believe they have thin credit files, and millennials who do have a personal credit card are significantly less likely than those 35 and older to have a rewards credit card (72 percent vs. 87 percent).

The CardRatings survey found millennials have:

- Fewer credit cards. The millennial generation is less likely to have a personal credit card when compared to the older adult population. While just 14 percent of adults ages 35-plus don’t have personal credit cards, that number rises to 29 percent when zeroing in on those who are 18-34 years old.

- Thinner credit profiles. Millennials are more likely than their older counterparts to describe their credit score as “limited/no credit history/score.” The survey shows 14 percent of 18- to 34-year-olds describe their credit profile this way, while only 2 percent of adults ages 35 and older say the same.

One doesn’t need a wallet stuffed with plastic to have great credit, but avoiding credit cards entirely can pose its own problem, especially for those just leaving the nest.

Information used to calculate credit scores includes the number and type of accounts; the “age” of credit accounts, which simply means how long a consumer has had them open; and other factors such as payment history and debt balances.

Having a so-called “thin” or non-existent credit history can affect financial transactions for years to come:

- Homebuying. A thin credit file makes mortgages harder to get and monthly payments more expensive. Consumers can turn to government-backed FHA loans, which are attractive for their more lenient credit requirements compared to private lenders and low down payment requirements – just 3.5 percent of the purchase price. Just be aware the FHA appraisal does add a small layer of complexity to the home buying process, which could be a negative in highly competitive real estate markets. In April, credit scoring company TransUnion reported that 40 percent of millennials who want to purchase a home “may not have the credit to do so.”

- Being the boss. Financing a small business often involves using credit, even if it’s just a small business credit card to keep expenses separate. While poor credit doesn’t automatically preclude a consumer from gaining business credit, the U.S. Small Business Administration says those with spotty credit will have fewer choices among lenders or face not being able to borrow money at all.

- Savings. There is a small loss of potential income based on foregoing the free rewards (cash back, travel miles) that come by using cards for everyday spending and avoiding interest charges by paying in full each month.

- Cars. Solid credit is a must in order to finance a car at the best rates. Considering that a vehicle is the classic “depreciating asset” (worth less after purchase) any rise in the cost of financing matters to the bottom line.

Research from the Consumer Financial Protection Bureau says 26 million consumers are “credit invisible” and 19 million have “unscorable credit records.”

These findings were echoed by a 2016 New York Times analysis of Federal Reserve data. Government records show younger Americans with credit card debt is at a record low, the same level it was in the 1980s.

Getting rewarded

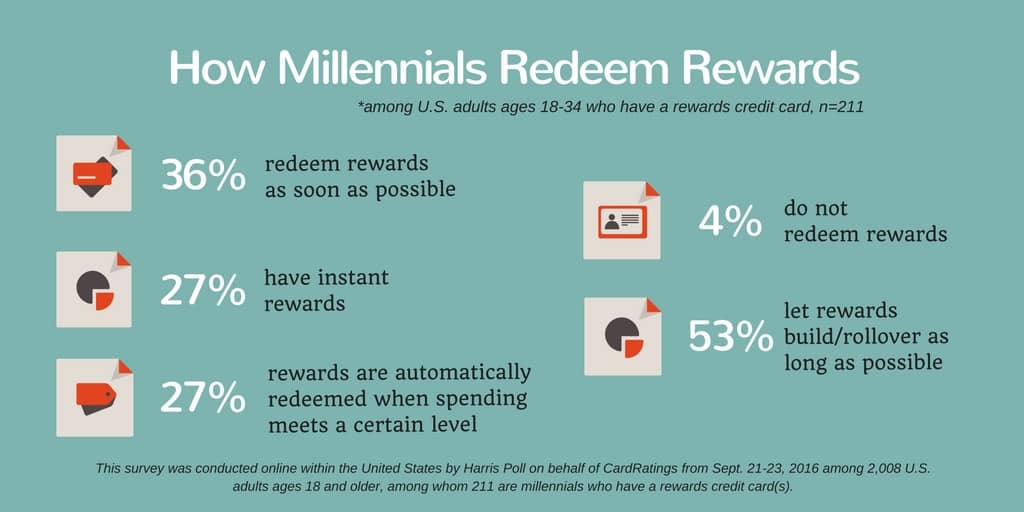

Generational differences hold firm when it comes to the popular “rewards” credit cards as well. Among those who have a personal credit card, millennials are less likely to have a rewards card than those ages 35-plus (72 percent vs. 87 percent ); however, millennials who did report having at least one rewards credit card are more likely than those ages 45-plus to redeem potential perks and rewards instantly (27 percent vs. 9 percent).

- Among those who have personal credit cards, 28 percent of millennials do not have a rewards credit card vs. just 13 percent of those ages 35 and older.

- That gap narrowed when it came to redeeming rewards: Among those who have a rewards credit card, only 4 percent of millennials leave rewards on the table (do not redeem them) compared to 6 percent of those ages 35 and up, but, interestingly, 27 percent of millennials with rewards cards have instant rewards on their cards compared to just 9 percent of those 45 and older with rewards cards. That could imply that millennials are using more retail cards than the older adult population since retail cards often feature regular upfront discounts for users such as cents off a gallon of gas or a percentage off your clothing purchase when you use your card.

- Among those who have a rewards credit card, millennials are nearly twice as likely as those ages 45 and older, 27 percent vs. 14 percent, to say their rewards are automatically redeemed when spending meets a certain level (for example, an automatic statement credit when cash back rewards reach $25).

- Thirty-six percent of millennials with rewards cards redeem rewards as soon as they become available compared to 20 percent of adults ages 45-plus.

This may be of interest to issuers everywhere as the competition to attract new customers continues to heat up. MasterCard alone added 143 million cards in the past year according to its SEC filings. Savvy consumers should take advantage of this competition and make sure they are using the rewards they’ve earned.

Jose Ramirez, another millennial who has his debit card in high rotation, said he’s not yet applied for a single credit card. The 20-year-old from Sacramento, Calif., said if he were to apply, though, his criteria would be trust first – is it from “an organization I can trust to stay steady in the market”? – and then “a very good customer loyalty program.”

After that? “A competitive APR [annual percentage rate] and incentives such as loyalty points and cash-back rewards and perks,” Ramirez said.

What’s holding him back? Ramirez: “I don’t currently see a need for it at this point in my life. Another reason is because I have known people in the recent past that have experienced credit card fraud and the stress that comes with correcting it so I try to avoid the issue entirely.”

Is he right on the fraud question? Yes and no. The major advantage of a credit card is that in the case of fraud, the account is not tied to cash like savings and checking accounts. Imagine a thief draining all available cash versus all available credit: both scenarios are bad, but just one is potentially devastating.

In a positive step for consumers, however, debit cards have begun to mimic the fraud protection levels of credit cards, so that outcome is now less likely than it used to be. Still, many consumers might not know the burden is more on them when it comes to debit cards because of differing laws.

The key difference is that credit cards have to abide by the Fair Credit Billing Act, or FCBA, which limits liability to $50 and most issuers guarantee $0 fraud liability. Debit card issuers are governed by the Electronic Funds Transfer Act (EFTA), which covers “ATMs, debit cards, direct deposits, point of sale transactions, transfers initiated by phones and pre-authorized withdrawals from checking or savings accounts.”

The EFTA requires consumers to pay close attention to reporting fraud quickly or risk “unlimited loss” – a scary proposition. The act gives consumers 60 days to act.

Here’s a breakdown of possible liability:

- If a lost or stolen ATM or debit card is reported within two days, it’s a $50 limit.

- Alert the bank within 60 days of receiving the statement, the limit is $500.

- Once a report is made, the liability is zero.

Building (and knowing) credit

The CardRatings survey also covered perceptions around creditworthiness. After all, lack of knowledge of credit scoring prevents some consumers from shopping around for the best rates, thinking they might have to take the first offer even if it isn’t the best.

Millennials are less likely than older adults to believe they have “excellent” credit, the survey said:

- 37 percent compared to 61 percent of adults ages 45-plus.

- And 10 percent of millennials were “not at all sure” of their credit, compared to 4 percent of adults ages 35-plus.

A major part of building up credit is its responsible use, and that means not carrying large balances month-to-month. Here’s what the CardRatings survey found on this front:

- 75 percent of millennials who have a personal credit card carry over a balance month-to-month vs. 55 percent of adults 55-plus who have a personal credit card.

- No gender gap. Gender does not seem to factor into which millennials carry over a balance month to month as 74 percent of millennial men vs. 76 percent of millennial women who have a personal credit card are doing so.

- Nearly 1 in 5 millennials (19 percent) who have a personal credit card say they carry over a balance of $5,000 or more month to month, and 13 percent carry a balance of $10,000 or more month to month.

Using balance transfers

Keeping credit utilization low – the amount of credit used as compared to that which is available – is part of a strong credit score. FICO, a credit scoring bureau, reports that about 30 percent of a person’s credit score, in fact, is determined by how much they owe.

Experts, including The Money Coach, Lynnette Khalfani-Cox, also say debt-burdened consumers should take advantage of the great balance transfer offers out there – it’s a powerful way to pay down balances quickly because of zero interest for the introductory term, often from 12-18 months based on current offers. That means every penny of payments goes toward reducing the principal debt.

Millennials seem to understand the utility of the balance transfer, but that knowledge isn’t necessarily converting into action.

In the CardRatings survey, 60 percent of American millennials who have a personal credit card say they would be very or somewhat interested in getting a balance transfer card to pay off debt sooner and/or at a lower interest rate if they had debt to pay off, compared to just 33 percent of older adults ages 55-plus. Just 4 percent of millennials who have a personal credit card, however, say they have gotten a balance transfer credit card to pay it off sooner and/or to get a lower interest rate.

Survey Methodology

This survey was conducted online within the United States by Harris Poll on behalf of CardRatings from Sept. 21-23, 2016 among 2,008 U.S. adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables, please contact Brad Bennion at bbennion@quinstreet.com.