Are the high prices where you live causing you to reach for your credit card just to make routine expenses or make ends meet?

A new CardRatings study found that may be the case in certain high-cost areas of the country, especially in states where incomes do not adequately compensate for the cost of living. The study found that states with the highest costs of living tend to have the highest levels of credit card debt, measured both in dollar terms and as a percentage of income.

The study looked at other factors from state to state such as median earnings, employment conditions and educational attainment to see how they affected credit card debt. To varying degrees, these factors do influence credit card debt, but not as much as differences in the cost of living from state to state.

Expensive states lead to higher credit card balances

Inflation generally has been very low in recent years, but like many aspects of the economy, it can depend a great deal on where you look. The cost of living is much higher in some states than in others.

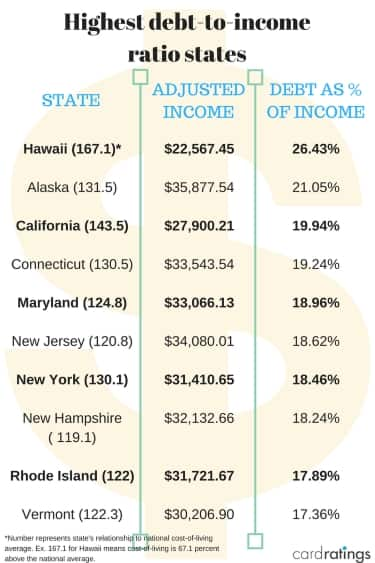

Using figures from The Council for Community and Economic Factors, the CardRatings study ranked all 50 states from the most expensive (Hawaii, where the cost of living is 67 percent above the national average) to the least expensive (Mississippi, where prices are generally 14 percent below the national average). The study then used statistics from Experian on average credit card balances by state to compare debt levels to the cost of living. Finally, CardRatings calculated each state’s credit card debt-to-income ratio based on median state incomes adjusted for the cost of living and typical state tax burdens.

It turns out that if you live in an expensive state, this might be causing you to take on more credit card debt. The average credit card balance in the 25 most expensive states is $5,727, compared with $5,133 in the least expensive states.

Of course, your ability to handle debt depends somewhat on how much money you make, which is why CardRatings also looked at credit card debt-to-income ratios. This showed that more expensive states tend to create higher debt burdens when compared to incomes in spite of generally higher salaries. The 25 most expensive states had an average adjusted debt-to-income ratio of 17.5 percent, compared with 14.3 percent for the 25 least expensive states.

There are only two states where the adjusted credit card debt-to-income ratio exceeds 20 percent: Hawaii and Alaska. Notably, these rank respectively as the first and third most expensive states in the union. The second most expensive state, California, is not far behind in terms of credit card debt burden, at 19.9 percent.

There are only two states where the adjusted credit card debt-to-income ratio exceeds 20 percent: Hawaii and Alaska. Notably, these rank respectively as the first and third most expensive states in the union. The second most expensive state, California, is not far behind in terms of credit card debt burden, at 19.9 percent.

If a high cost of living can cause you to run up credit card debt, then the flip side is that a low cost of living can help you keep debt under control. The 15 states with the lowest adjusted credit card debt-to-income ratios all have costs of living below the national average, as do 24 of the 25 states with the lowest such debt ratios. One tip seems to be that if you are concerned about credit card debt, consider living in a state where the cost of living is relatively low.

Income is not always a mitigating factor

Some might argue that high-cost areas often compensate by offering higher wages. In fact, when you look at the 10 states with the highest costs-of-living, you find that eight of those 10 also make the list of the highest median salaries in the country. However, if this were enough to offset the higher credit card debt burdens that tend to go with high-cost areas, the adjusted debt-to-income ratios of more expensive states would be more in line with the rest of the nation. The fact is, debt burdens are generally higher as a percentage of cost-adjusted income indicates that higher wages are not generally enough to offset higher living expenses.

➤ MORE: View the full state rankings here (PDF)

Let’s look at some examples: Maine and Washington. Both have an average cost of living that is moderately above the national average. In Washington, the added expense is more than offset by the fact that the state has one of the highest median wages in the nation, at $43,400. In Maine, however, the average wage of $35,380 is much lower than in Washington, and a little lower than the national average. Thus, wages in Maine are not typically high enough to compensate for the extra cost of living.

As a result, even though in dollar terms people in Washington actually have higher credit card balances on average than people in Maine, as a percentage of income adjusted for cost of living and taxes, the burden of this debt is actually a lot lower in Washington. The adjusted credit card debt-to-income ratio is 14.3 percent in Washington, and 16.6 percent in Maine.

The takeaway here is that is important to look at both income and cost of living when considering a career move. A high cost of living can be tolerated if a high enough wage goes with it, as it seems to in Washington, for instance, but if income does not make up for a high cost of living, such as it fails to do in Maine, you could find yourself struggling with credit card debt. By the way, it is also wise to compare incomes on an after-tax basis. For example, one advantage Washington has in addition to high wages is that it has no state income tax.

The job market also affects debt levels

The study also found a relationship between unemployment rates and credit card debt burdens. States with higher unemployment rates tend to have higher credit card debt burdens, both in dollar terms and as a percentage of adjusted income.

Specifically, the 25 states with the highest unemployment rates had an average credit card balance of $5,625, while the 25 states with the lowest unemployment rates had an average balance of $5,235. As a percentage of adjusted income, the credit card burden averaged 16.4 percent in high-unemployment states, and 15.4 percent in low-unemployment states.

Alaska, which as previously noted has one of the highest costs of living in the nation, suffers from the added challenge of having the highest unemployment rate, at 7 percent. This likely contributes to the fact that the state’s residents have the highest credit card balances at an average of $7,552, and the second highest credit burdens as a percentage of adjusted income at an average of 21.1 percent.

Contrast this with North Dakota, which has the nation’s lowest unemployment rate at 2.2 percent. There, the average credit card balance is just $4,599 (second lowest in the nation) and its percentage of adjusted income is 11.6 percent (lowest in the nation).

This relationship between unemployment and credit card debt suggests that people are relying on their credit cards to replace lost income during periods of unemployment., not an altogether unexpected situation. Given the expense of credit card debt, however, this is a dangerous habit. Better to cut expenses immediately if you become unemployed rather than trying to maintain the same standard of living, and better yet, when you are working try to build up an emergency fund equal to at least three to six months’ worth of living expenses.

Is a college education a pathway to debt?

A final relationship this study looked at was the relationship between educational attainment and credit card debt.

As a first step, the study found that there was no significant relationship between credit card burdens in states with relatively low proportions of high school graduates and those with relatively high proportions. Credit card debt levels were roughly the same in both dollar and percentage terms.

The picture changed noticeably, however, when the study turned to looking at college degrees. It seems that the more college graduates (bachelor’s degree or better) a state has, the heavier the debt burdens are.

In the 25 states with the lowest percentages of college graduates, the average debut burdens were $5,143 and 14.7 percent of adjusted income. In the 25 states with the highest percentages of college graduates, those figures jump to $5,716 and 17.1 percent.

This suggests that student loan debt could be a factor. Students graduating with heavy loan burdens are resorting to using their credit cards to meet some of their living expenses, which will likely only prolong their debt problems since credit card debt is generally much more expensive than student loan debt.

Solutions include reining in your lifestyle expectations until your student loan debt is under control. Large numbers of young adults these days are doing this by living with their parents for a few years after graduation. Also, if you have a government loan it might help to look into forbearance programs which limit the amount you have to pay to a certain percentage of your income.

Looking at the study in total, it seems that several factors impact average credit card debt burdens, but cost of living is especially significant. Given how expensive credit card debt is, this can become a vicious cycle – a high cost of living can cause you to run up credit card debt, and then the interest on that debt makes your living expenses even higher.

One way to help keep your credit card debt under control is to live in an area with a reasonable cost of living, or at least one where you can earn enough to make up for the cost of living. All in all, living within your means is simply easier in states where it costs less to make ends meet.