August is hot – and not just because the thermometer says so.

August is a hot month for credit card spending. Historically, it’s been one of the biggest months for taking on credit card debt. This trend has grown in recent years, as August’s share of total new credit card debt has become even greater than it has historically, with millions of dollars added to consumers’ balances each year.

One factor in all this August spending is back-to-school shopping. With parents heading out to stores to equip their kids for the coming school year, it’s a good time to look at the effect of back-to-school shopping on credit card debt. Before making back-to-school purchases, consider your overall financial situation to avoid taking on more debt than you can manage.

Understanding how spending in August can affect your credit card bills for months to come may help you make decisions that ease the burden of that debt.

➤ SEE MORE:Teachable moments from back-to-school-shopping

The back-to-school effect on credit card debt

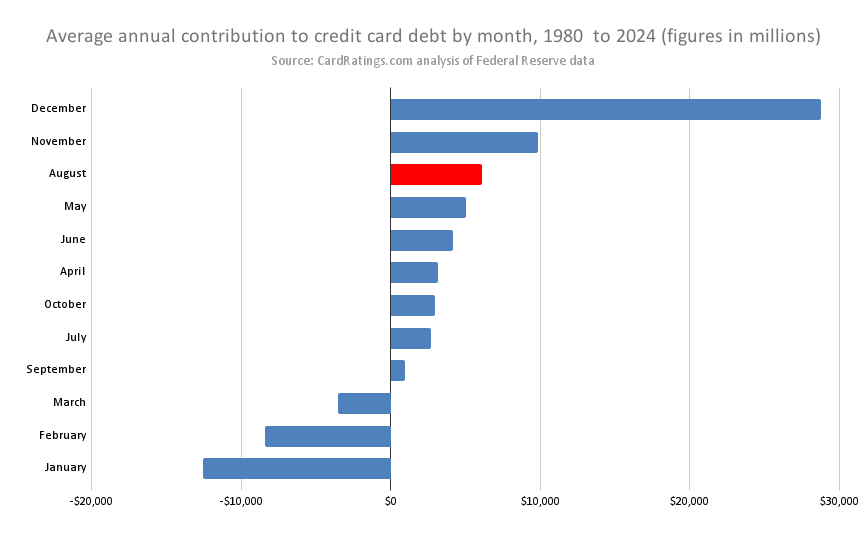

The Federal Reserve keeps data on flows into and out of revolving debt, the vast majority of which is credit card debt. We broke those flows down by month for every year since 1980 to see how much each month typically contributes to new credit card debt each year.

The chart below ranks those average monthly amounts of new debt by size:

Not surprisingly, December is traditionally the month when Americans take on the most credit card debt. November ranks second. This is probably what you’d expect, given the holiday shopping season. The few months when Americans typically pay off more credit card debt than they take on are those with net new debt figures in negative territory (with bars on the left side of the vertical axis). These are the three months at the bottom of the chart – the first months of the year, when people try to pay their holiday bills, often by following a repayment plan to manage post-holiday debt.

Those seasonal credit card spending and payment habits are well known. What may be less expected is that August ranks as the third biggest month for credit card debt. Summer travel may account for some of that, but that doesn’t explain why credit card debt is so much heavier in August than in June or July.

In terms of spending habits, one thing that distinguishes August from those other months is back-to-school spending. Increased expenses during this time, such as school supplies and clothing, contribute to higher credit card debt. The back-to-school effect may explain why August traditionally ranks as the third biggest month for credit card debt.

The impact of back-to-school spending on credit card debt is especially noteworthy now, for two reasons:

- The impact of August spending on credit card debt has grown in recent years. For the period covered by the chart, August represents 21% of the total annual new credit card debt. Over the past four years, this share has jumped to 30%.

- Credit card rates remain elevated, making this debt even more expensive. Historically, the average interest rate charged on credit cards has been 15.26%. Now, that rate is over 22%. So, households that follow the pattern of taking on credit card debt for back-to-school shopping will pay even more than usual for it.

Before you start your back-to-school shopping, it would be wise to consider a few options you have for reducing how much it will add to your credit card debt.

Budgeting with a credit card

According to a study by Deloitte, Americans will pay an average of $570 on back-to-school spending for each student enrolled in kindergarten through grade 12. Participating in extracurricular activities adds an average of $532 per student.

So, for a household with two kids in school who both participate in extracurricular activities, that would make an annual total of $2,204 in school needs. If you borrow from a credit card to pay for that, at today’s rates, interest would add to the cost at a rate of $490 per year. That could push the total expense to $2,694.39.

If you want to shave a little (or a lot) off that cost, one key is careful budgeting. A budget is a helpful tool for managing back-to-school expenses, as it allows you to track your income and spending, and plan ahead to avoid overspending.

Follow these steps:

- Assess your child’s needs. Plan carefully for what your child really needs. Separate necessities from luxuries. Don’t go overboard on supplies. You can always go back and buy more during the school year if the need arises.

- Research prices. Before you start shopping, do some research on prices. Even if you plan to shop in person, researching prices online can point you in the right direction. There’s a lot of sales hype at this time of year, so compare bottom-line prices to figure out what is the cheapest option.

- Stick to the plan. Make a list, and don’t stray from it. This is no time for impulse buying. Following your budget can help you save money on back-to-school shopping by keeping your spending in check.

Choosing the right credit card for back-to-school shopping

Besides budgeting, another way a little preparation can help you minimize the effect of back-to-school shopping on your credit card is to choose the right card for the job.

What are the best credit cards for back-to-school shopping? That depends on how you use them:

- If you expect to carry some of your back-to-school shopping debt on your card balance for a while, choose the card with the lowest interest rate.

- If you expect to pay your balance off promptly, choose the card with the most generous rewards. In particular, lean towards cards with elevated rewards for retailers where you’re likely to do your back-to-school shopping. This may include department stores, clothing stores and possibly sporting goods stores. Taking advantage of cards that offer specific benefits for back-to-school shopping can help you earn more rewards and build your credit history.

Whether it’s minimizing the interest expense or getting the most back for what you spend, choosing the right card can help make your back-to-school shopping as efficient as possible. Managing your available credit wisely also allows you to maximize the benefits your credit cards offer.

➤ SEE MORE:Back-to-school shopping: How to use credit card rewards to cut costs

How to pay off credit card debt

Finally, once your back-to-school shopping is done, there are things you can do to minimize the long-term impact of credit card spending.

There are a few different tactics for paying off credit debt efficiently. The more of these you can apply, the easier it will get:

- Always make at least the minimum payment on all your credit cards to avoid late fees and damage to your credit score.

- Always try to pay more than the minimum required payment.

- If you’re carrying more than one credit card balance, direct any extra payments towards the one with the highest interest rate, or use extra funds to repay debt faster.

- Consider the snowball method, where you focus on paying off the card with the smallest balance first while making minimum payments on others, for quick wins and motivation.

- Cash in any unused rewards and apply them to your statement balance.

- Consider refinancing opportunities, such as a personal loan, a debt consolidation loan, or a balance transfer credit card. These options can help with consolidating multiple debts into one and may offer interest savings through lower rates or promotional periods.

- If you’re struggling to make payments, consider credit card debt relief options like a modified payment plan, consolidating debts to reduce monthly payments, or negotiated debt settlement.

Over time, these strategies can help you eliminate credit card debt and improve your financial health.

Smart back-to-school shopping is a little like schoolwork. Preparation such as budgeting and choosing the right credit card are similar to studying before a test. The way you pay off your debt is like the final exam and can go a long way towards determining how well you do.