Editor’s Note: This article originally published July 28, 2021. Some information may no longer be up to date.

You may be vaccinated, and the economy may be reopening; however, the pandemic may not be done messing with your finances.

For millions of Americans, the pandemic has had financial impacts that could be felt for years to come. Recovery from this damage may not be immediate, but it can start now if you know what steps to take.

The pandemic was tougher on some people’s finances than others

“The pandemic has financially affected people very differently,” points out Jennifer Bethel, a professor of finance at Babson College in Wellesley, Mass. “Whereas some people have emerged stronger than they were pre-COVID, others have struggled.”

To Bethel’s point, many people who were able to continue working throughout the pandemic saw their finances benefit. They spent less because of health restrictions, but may have received government stimulus checks on top of their normal wages.

However, the story is very different for people who lost their jobs, or stopped working out of concern for infection, lack of childcare or other reasons. At the worst point for the job market, more than 25 million fewer Americans were working than had jobs just before the pandemic began.

Even now, after several months of recovery, there are still 7 million fewer Americans working than there were in February 2020.

Note that once people get back to work, a period of joblessness can have financial effects that linger for years.

Women may feel the worst long-term financial hit

Women in particular may be vulnerable to lasting financial setbacks due to the pandemic. That’s because they were more likely to lose their jobs when the crisis hit.

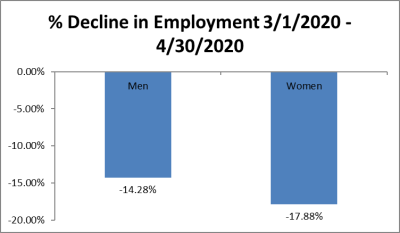

In March and April of last year, nearly 18% of women lost or quit their jobs, compared with just over 14% of men. While the decrease in employment for men and women is now closer to even, the financial damage does not magically clear up once a person gets back to work.

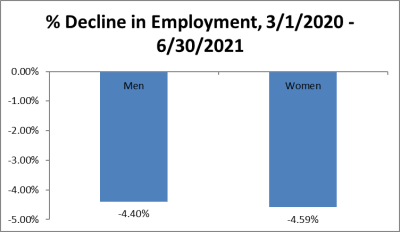

Though the total decline in employment for men and women is now similar…

…women’s employment took a harder hit in the first months of the pandemic

Long-term financial damage from the pandemic

Whether they were out of work for just a few months or for more than a year since the pandemic started, Americans may struggle with long-term damage to their finances.

Regarding people who lost their jobs or were furloughed, Bethel observes that this may have impacted consumers in multiple ways: “They were forced to drain their emergency savings, use retirement funds, and suspend or renegotiate loan payments. Some have had to take on more debt. It may take this group years to fully recover financially.”

Recovering from a period of job loss is made all the more difficult because it means people have lost valuable time that otherwise could have been spent building household savings.

“Under the best circumstances, it can be challenging to build one’s emergency savings and save for retirement,” says Bethel. “To dig out of debt, replenish accounts, and begin saving again for the future will require significant financial sacrifice over a number of years for many people.”

Here are some of the ways a period of joblessness can have a domino effect on a person’s finances:

- Lost earnings. Once a paycheck stops coming in, people find their current bills harder to pay and also may have to delay important expenses.

- Higher debt levels. As lost pay makes it harder to make ends meet, credit card debt can creep up, and payments on student loans, mortgages and other debt may be delayed.

- Damaged credit. Breaking the normal pattern of borrowing and repayment can hurt your credit score. This may make credit harder to get and more expensive in the future.

- Lost pay raises. Being out of work for an extended time means missing out not only on the wages you were earning previously, but also on pay raises you might have earned since then. Since future pay raises are somewhat based on your existing rate of pay, any missed raise has a potential long-term impact on your pay rate.

- Lost advancement opportunities. Being out of work means you miss opportunities for promotion that might have occurred during your period of joblessness. It also puts you at the back of the line behind more-tenured employees when you do return to work.

- Lost retirement savings. Being out of work may mean having to stop saving for retirement, plus missing out on employer matching contributions in some plans. Since the amount you can put into a retirement plan is typically capped every year, these are savings opportunities you may not get back.

Post-pandemic credit scores

An essential step towards assessing the damage the pandemic has done to your finances is to check your credit score. This can be an eye-opener.

“People are often surprised that credit scoring companies consider only factors that reflect consumers’ borrowing behavior to determine scores,” says Bethel. “They generally do not include items such as bill-paying history or financial account balances.”

Suppose you were able to use savings to keep up with your bills while unemployed, and then went back to work at a wage equal to or greater than what you were earning before. You might assume your credit is as good or better than it was before. However, your credit score might be lower.

“Many people who have suffered financially during COVID feel their credit score, which is based solely on borrowing, does not reflect their pre- or post-pandemic financial strength,” says Bethel. This is because things like making less use of credit or even cancelling a credit card can count against your credit score.

There is some recognition by the financial industry that credit scores should take a broader view of assessing creditworthiness. Dr. Bethel explains: “Some credit bureaus offer products that consider not only the traditional borrowing factors but also non-credit factors, such as whether consumers pay their phone and utility bills on time. By including a more comprehensive range of factors, traditional borrowing factors are down-weighted, and factors that reflect general financial behavior are included.”

The tricky part is to get potential creditors to recognize these broader methods of assessing your financial condition. As long as the most widely used credit scores are based solely on borrowing behavior, that behavior will remain a key to rebuilding your finances after COVID.

Rebuilding your finances after COVID

If your finances have been damaged by COVID, here are four steps you can take to rebuild them:

- Use your leverage in the job market. Employers are having a hard time getting workers to come back to work. As of the end of May 2021, there were over 9 million job openings in the United States – the greatest number since the Bureau of Labor Statistics began keeping stats on job openings back in 2000. That means employees have bargaining power when it comes to asking for a raise or seeking a higher-paying job.

- Get current with your payments. If you’ve fallen behind, the first thing to do when you get back to work is to catch up on your loan and credit card payments. This is a key step toward rebuilding your credit score.

- Prepare for payment resumptions. Some student loan, rent and mortgage payment were temporarily suspended because of the pandemic. Make sure you are ready for these payments to be resumed.

- Use credit wisely. Credit agencies like to see you using credit regularly, as long as you also make your payments on time. Borrowing and repaying a moderate amount on your credit cards each month helps build the kind of usage and payment history that should boost your credit score. Limit your credit card borrowing to an amount you can repay each month so as to avoid interest charges.

In so many ways, the pandemic has had far-reaching effects on society. Putting your finances in order is one big step toward putting this troubled period behind you.