Why you should trust CardRatings.com

At CardRatings.com we discuss the most up-to-date news and trends within the credit card space. Since we first pioneered the concept of online credit card reviews in 1998, our team of financial experts has provided comprehensive and unbiased credit card reviews for more than 175 cards, plus hundreds of additional resource articles to help educate everyday cardholders so they can feel more confident about their card choices. All our content is written and reviewed by industry experts. Though our content may occasionally contain references to products from our partners, we maintain strict editorial integrity and advertiser relationships and compensation never influences ratings, reviews or featured products. The difference between editorial content and advertising must always be clearly stated. Learn more.

Chase has once again extended its Pay Yourself Back program, which is a good thing, and it retained some of the everyday redemption options that could make this a valuable option for some cardholders, including some co-branded cardholders.

The guide below explains the full Pay Yourself Back program and how you can leverage it. Remember that, usually, the best value for your Ultimate Rewards points will be transferring to a travel partner, but best overall value doesn’t mean it’s YOUR best option; everyone has different needs and expectations for their credit card rewards.

What is Chase Pay Yourself Back?

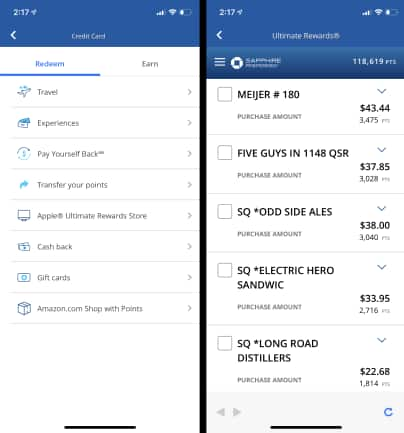

The Chase Pay Yourself back program is a kind of statement credit opportunity for specific purchases. Much like the CardNamediscontinued allows you to redeem miles to erase travel purchases from your statement, the Chase Pay Yourself Back program allows you to redeem Ultimate Rewards points to erase certain categories of purchases from your statement.

To take advantage of the offer, cardholders simply need to log into their account, navigate to the Pay Yourself Back portal and you’ll see your eligible purchases listed alongside the number of points necessary to cover that purchase. Check the purchases you’d like to cover with Ultimate Rewards points and click “Continue” at the bottom to move the process forward.

1. You can only Pay Yourself Back for purchases made within the past 90 days. A small countdown number appears next to a purchase as your days to redeem for that purchase are running out.

2. You can only Pay Yourself Back for purchases in particular categories and those categories are dependent on the card(s) you have.

3. It could take 2-3 business days for the credit to appear on your account. It could take one or two billing cycles for those credits to appear on your monthly statement. Remember, you will still need to make at least your minimum monthly payment on your card.

What cards are eligible for Pay Yourself Back?

When Pay Yourself Back first hit the scene in May 2020, it was only available to CardNamediscontinued and CardNamediscontinued cardholders. Later that year, however, Chase announced an expansion of the program to some cards within the Ink family of small business cards as well as to the Freedom family of cash-back cards. All of these earn Ultimate Rewards points even though several are marketed as “cash back” cards.

More recently, Chase expanded Pay Yourself Back to include a few co-branded cards: All Southwest Airlines co-branded cards (consumer and business), all United Airlines co-branded cards (consumer and business) and the CardNamediscontinued.

One note, while Chase no longer accepts applications for the Ink Plus® business card or Chase Freedom® card, existing cardholders are also eligible for the Pay Yourself Back program. (Information related to Ink Plus®, Chase Freedom® and Chase Freedom FlexSM card has been collected independently by CardRatings and was neither provided nor reviewed by Chase)

Here are the details on still-available cards:

Is Pay Yourself Back worth it?

Yes, Pay Yourself Back can be worth it, but that doesn’t mean it’s the best value for your points. With the devaluing of the Pay Yourself Back redemption options for the Sapphire cards, redeeming your points for anything other than charitable donations will mean you’re getting less than the base travel redemption value for those points. It will equal redeeming your points for cash back.

There is, of course, nothing wrong with a getting a base value back on your rewards if that’s what you want to do. Credit card rewards are yours to use and if you feel good about the redemption, it’s the right redemption for you. Just know that there are strategies to maximizing your rewards value

➤ LEARN ABOUT MAXIMIZING ULTIMATE REWARDS:Guide to Chase Ultimate Rewards

The conversation is a little different when it comes to the United cards option. At a value of 1.5 to 1.75 points per cent, this could be a great redemption to cover your annual fee. The CardNamediscontinued requires a AnnualFees annual fee, but you could redeem just 30,000 United points to cover that fee. That’s likely a far better value than redeeming those points for airfare – especially considering that annual fee secures you access to United Clubs for the year.