Must have small business credit cards for Insurance Agents

Who Can Get One | Why Do You Need One | Which is Best for Me | Application info | Compare Offers

Business credit cards come with a variety of features, perks, structures and rewards. All that variety means that there’s a small business credit card out there for traditional mom-and-pop store owners to short-term rental owners to ride-sharing drivers and everyone else making a side hustle work for them.

Here’s the even better news: Just because you run a small business, doesn’t mean your business credit card should be without large rewards. Whether you’re looking for capital to get up and running or long-term cash-back rewards for the office supplies you purchase the most, small business credit cards can be a major tool for all small business owners. Small business credit cards often offer features that help business owners better manage their expenses and cash flow, too, keeping your day-to-day business as usual.

“Sounds great,” you may be saying, “but do I even qualify for a small business card?” We are so glad you asked…

CardRatings wants to help you understand the ins and outs of small business cards and narrow down your many options. The goal is to help you find the card that is right for you in terms of the features it offers, the rewards that you can easily earn (and will actually use!) and the overall best value for your business.

So let’s get started:

Who can get a small business credit card?

It’s a broad group of people who can qualify for a small business card given that you don’t necessarily need an Employer Identification Number (EIN) to qualify. Credit card issuers consider each application on its own merits, so don’t assume you don’t qualify. Do keep in mind that your personal credit history will likely be what is used to determine your eligibility and/or credit limit on a business card before you’ve built up a credit history for your business.

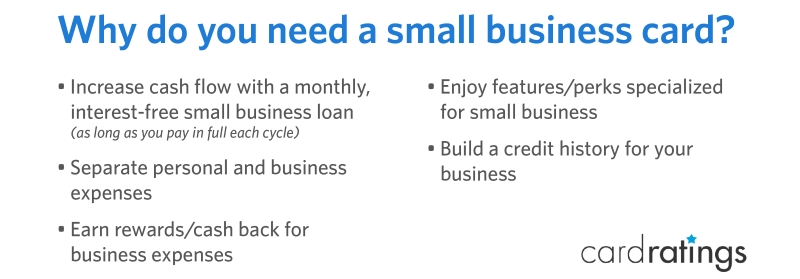

Why do you need a small business card?

In a phrase: lots of reasons. Probably the most important reason, however, is that it allows you to keep your personal expenses separate from your business expenses. Not only does that separation make your day-to-day bookkeeping easier, it will also come in handy come tax time each year. Check out a few other reasons you could use a small business card in your business’ toolbox.

How do you choose the right small business card?

Choosing a small business card requires you to ask questions similar to those you ask when shopping for a personal/consumer card. You’ll want to assess your spending, both the typical amounts as well as where you do the bulk of your spending; decide what type of rewards — cash back, miles or points — will be most beneficial to you; and crunch the numbers to see whether you can offset an annual fee. Here are a few more questions you’ll want to ask:

What information do you need to apply for a small business credit card?

You’ve done the homework, you know what you want and you’re ready to apply. Now what? Just like with consumer cards, these days you can apply for small business credit cards online. Many times, you’ll get an immediate or nearly immediate answer. When you sit down to apply, there’s a variety of info you’ll want to have available related to your business. Remember, though, that just because you don’t have all that business-specific info doesn’t mean you won’t qualify for a business credit card. For instance, if your business doesn’t have a tax ID number (EIN), you can enter your personal social security number instead. In general, try to have the following information handy when you apply: