How cash back credit cards work is simple: these cards automatically earn cash back each time you swipe your card to make a purchase. How they award that cash, on the other hand, is where these cards get more complicated. Cash back cards typically fall into one of the following categories:

- Flat-rate: These cards award the same cash back percentage for all purchases.

- Tiered: Tiered cards may award different cash back amounts depending on the purchase category. For instance, groceries may earn 6% cash back while gas earns 3% cash back.

- Rotating categories: These cards are similar to tiered cards in that some purchases may be eligible for additional cash back. However, the purchase categories awarding bonus cash back change, usually on a quarterly schedule.

- Cardholder’s choice: This is another variation of a tiered rewards card, but instead of rotating bonus categories selected by the card issuer, cardholders get to choose which categories earn extra cash back.

Keep reading for more about how to use these cards, ways to maximize rewards and when to leave the cash back card in your wallet.

How to earn cash-back rewards with your credit card

With most cash back cards, you can earn rewards in two ways:

- Welcome bonus: Also known as sign-up offers, welcome bonuses come with many – but not all – cash back credit cards. These offers award new cardholders additional cash back after they have spent a certain amount within a specified period of time.

For instance, a card may award $200 in bonus cash back if a new cardholder makes $1,000 in purchases within three months of opening their account. This bonus cash back is in addition to the regular cash back rewards earned with each purchase.

- Everyday spending: Cash back reward cards earn users rewards on every purchase made with the card. Flat rate cards will pay out the same rate, often 1% or 1.5%, regardless of what you buy. Other cards may award additional cash back for specific categories.

As an example, the Blue Cash Preferred® Card from American Express discontinued awards 6% cash back on up to $6,000 in eligible purchases per year at U.S. supermarkets. After hitting that cap, additional purchases made at U.S. supermarkets earn 1% cash back. American Express is a CardRatings advertiser.

There are some restrictions on cash back earnings though. As a general rule, you won’t earn rewards on fees, balance transfers or purchases that are refunded.

Compare Top Cash Back Credit Cards

Compare

What credit score do you need for a cash back credit card?

The good news is that you can get a cash back credit card with virtually any credit score. In the past, you needed very good or excellent credit to access these cards, but card issuers have now made it possible for even those with bad credit to earn cash back with select cards.

If you do have bad or limited credit, you may have to get a secured credit card, but even that doesn’t mean you can’t still earn cash back. The Discover it® Secured Credit Card is one example of a secured card that offers cash back and even a welcome bonus.

How to maximize cash-back rewards

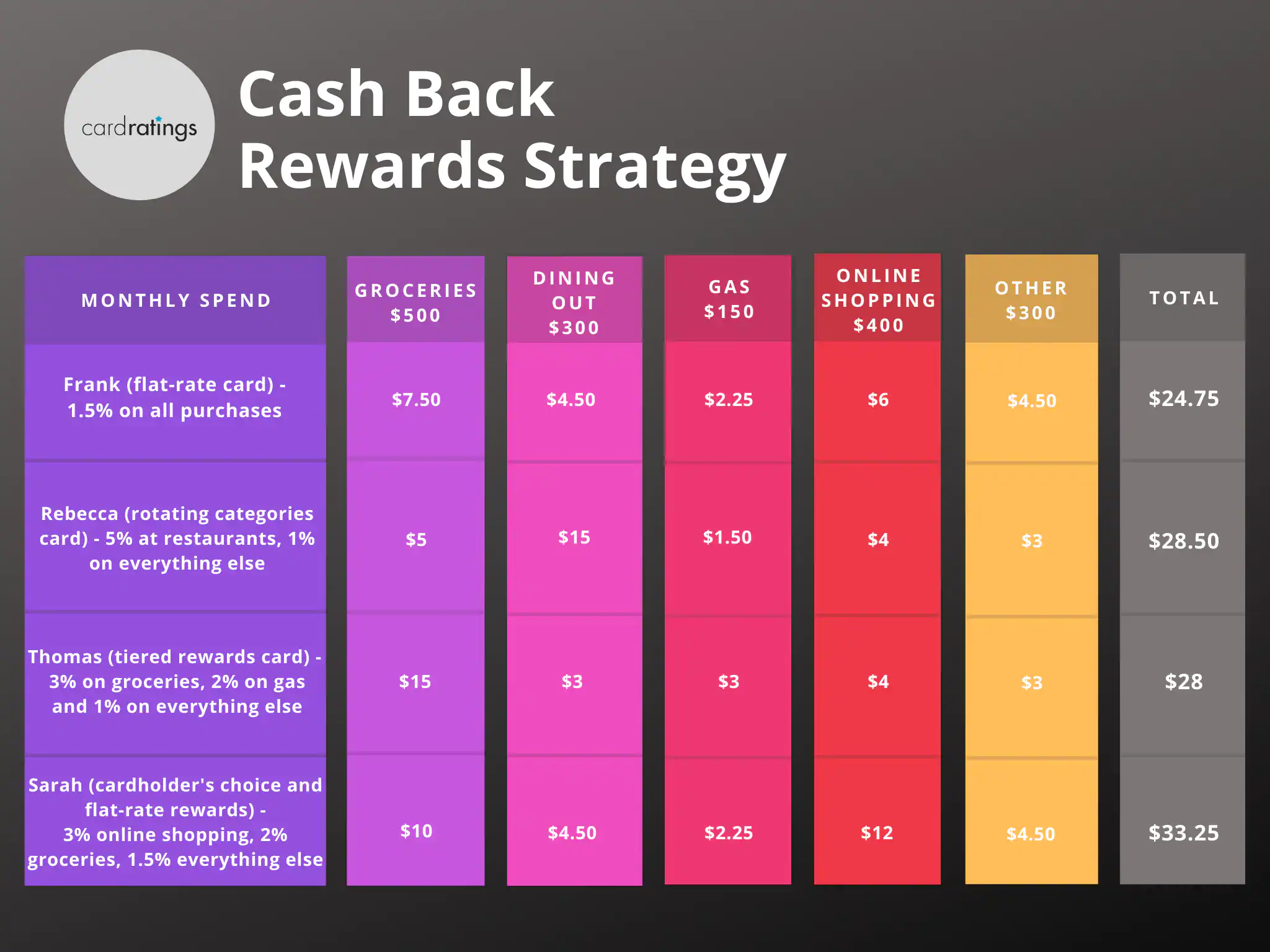

While you might think the best way to maximize rewards is to apply for the card with the highest percentage cash back rate, that isn’t always the case. Depending on your spending habits, it’s possible a flat-rate cash back card could provide greater rewards than a tiered card that limits higher rewards to only certain categories. The type of card that is right for you will depend on your spending habits and your tolerance for organizing your card spending. Just to give you an idea of how each of these types of cards COULD stack up for you, take a look at the hypothetical scenario below for Frank, Rebecca, Thomas and Sarah.

As you can see in the example above, Sarah with her combo usage of cardholder’s choice and flat-rate cards came out on top for this particular time period; however, let’s say Rebecca wanted to maximize her 5% restaurant rewards for the period and spent $500 at restaurants and just $100 at grocery stores. In that case, Rebecca would have come out ahead, earning a total of $38.50 in rewards for the month ($5 on groceries, $25 on restaurant spending, $1.50 at gas stations, $4 on online shopping and $3 for her other purchases).

What this should show you is the importance of honestly assessing your spending habits before making a decision about which cash back credit cards to add to your wallet. At the end of the day, a cash rewards credit card card is only as good as your willingness and ability to responsibly use it.

When not to use cash back credit cards

Cash back cards earn valuable rewards, but they aren’t always your best payment choice. In particular, you want to avoid using them in the following circumstances:

- Financing a large purchase: Cash back credit cards often have higher APRs than those found on other cards. If you are making a large purchase and need to carry a balance, the interest you pay could easily outweigh any cash back you earn. Instead, you might want to consider a 0% intro APR card.

- Transferring a balance: Unless your card comes with a 0% intro APR offer on balance transfers, think twice before using your cash back credit card for a balance transfer. Not only could you be paying a lot in interest, but you might get hit with a balance transfer fee as well. Plus, you won’t earn cash back on the transferred amount.

- Foreign transactions: If your card charges a foreign transaction fee, it’s best to leave it at home when traveling abroad. There’s no reason to pay a 3% foreign transaction fee in order to earn 1% cash back. Fortunately for international travelers, there are a number of cards – including some cash back cards – that don’t charge foreign transaction fees.

- Cash advances: Credit cards generally charge fees for cash advances – often in the 3% to 5% range – plus there are sometimes additional fees if you use an ATM. What’s more, the APR on cash advances is often higher than on regular purchases and that interest usually starts accruing immediately rather than after a grace period. Once the fees and interest start piling up, you’ll surely regret the decision to use your card for a cash advance.

Best practices for using cash back credit cards

When using a cash back credit card, there are some steps you should follow to make sure you’re getting the most benefits from your card. These tips include:

Avoid adding new debt. Pay your balance in full each month or interest will offset the cash rewards you’re earning with your card. Even with a card that has a low or zero interest intro offer, get in the habit of paying your bill in full and on time each month. That will keep your finances healthy and your credit score high.

Don’t overspend. Don’t buy just for cash-back rewards. That’s an easy way to spend too much on things you don’t need. Instead, look for a cash back program that rewards you for purchases you already make, such as groceries or gas. That way you don’t break the bank on things, such as dining out, that you wouldn’t normally buy.

Monitor your rewards. Cash-back offerings are sometimes capped, particularly for tiered or rotating category cards, and sometimes rewards do expire. It’s important to pay close attention to the fine print of your credit card. Once you max out the bonus cash back available on your account, consider whether it makes sense to switch to a different card for future spending.

Redeem wisely. While it is most common to redeem cash back for a statement credit, check or bank deposit, some cards may have other redemption options. These may include merchandise or the ability to shop on select sites such as Amazon. However, if shopping with cash back leads you to make impulse purchases you might normally never buy, it could be better to stick with statement credits.

Track spending. If you decide to carry a tiered or rotating category cash back card, make sure that you are using that card for the purchases that will earn bonus rewards. Often, you’ll need to sign up quarterly in order to take advantage of rotating categories. Set reminders on your calendar so that you don’t miss out on those bonus rewards.

Share your cash back card wisely. We certainly don’t advocate just handing your card to anyone, but you should consider whether adding a trusted authorized user could help you maximize your reward opportunities. That person’s charges on the card will also accumulate toward your cash-back rewards. Just be sure you and the authorized user have clear expectations about when and how purchases will be paid off.

Now that you know the basics of how cash back credit cards work, you can browse our top picks for the best cash back credit cards to find a card that suits your spending habits and lifestyle and start putting cash rewards in your wallet.

Blue Cash Preferred® Card from American Express – See Rates and Fees