A low credit score always makes it tough to get credit, but sometimes it’s harder than at other times.

Recent conditions suggest we are entering a period when it’s going to be especially difficult for people with so-so credit to get access to loans and credit cards. High debt loads and rising numbers of missed payments are making lenders warier about extending credit.

This can affect you even if you haven’t missed a payment lately. If you don’t have a strong credit score, you may find lenders reluctant to approve a new application. Your credit card companies might even lower your credit limit or raise your interest rate a little extra under these conditions.

To protect your access to credit, it’s important to understand what’s going on and what you can do about it.

How credit card companies look at credit scores

Lending is a risk. There are always some people who fail to repay what they owe. That costs credit card companies and other lenders money.

Naturally, lenders look to minimize this risk. One of the tools they use is credit scores. Based on your history with using credit, your credit score gives lenders an idea of how much risk you represent.

Lenders manage that risk in three ways:

- Rejection or approval decisions. Lenders consider the likelihood that a credit applicant will make their payments in deciding whether to reject or approve each application. They aren’t concerned so much with the occasional missed payment as with the possibility that a borrower will default. That means completely failing to pay what is owed.

- Credit limits. Credit score is also a factor that determines your credit limit. That controls how big a balance you are allowed to carry on a credit card at any one time. If you have a mediocre credit score, the credit card company may manage their risk by keeping your credit limit low.

- Interest rates. People with low credit scores generally pay higher interest rates than people with strong scores. The extra amounts charged to low credit score customers helps make up for the fact that more of them are likely to default on their payments.

Credit score isn’t the only factor credit card companies look at in making these decisions, but it is an important one.

➤ LEARN MORE:Guide to understanding different credit scoring models

A changing economy affects access to credit

Credit scores affect lending decisions differently depending on what’s going on with the economy.

When the economy is strong and consumer finances seem to be on solid ground, lenders are willing to take a little more risk. That means they may approve more applications from low credit score customers, and not charge them as much extra interest.

However, when consumers are showing signs of financial strain, credit card companies will work to reduce their risk. They’ll approve fewer borderline applications, impose lower credit limits and raise rates for customers with mediocre credit.

➤ LEARN MORE:How does the Federal Reserve impact credit card interest?

Debt balances and late payments are rising

Lately, conditions have been giving lenders reason to start taking less risk.

First of all, debt levels are high. In the second quarter of this year, the total amount of credit card debt outstanding rose above $1 trillion for the first time ever, according to the Federal Reserve Bank of New York. Overall consumer debt also hit a new high, of $17.06 trillion.

There are signs that consumers are increasingly struggling with this amount of debt. Consumer default rates have been rising, especially for credit card debt.

The risk of higher debt burdens and rising payment problems is seen especially among consumers with lower credit scores.

According to TransUnion’s July 2023 Credit Industry Snapshot, credit card customers with subprime credit scores are much more likely to be 90 or more days late with their payments than customers with prime scores. That’s no surprise. Late payments are a big reason why people have low credit scores in the first place, and why they generally have a harder time getting new credit.

What’s noteworthy, though, is the late payment problem is getting even worse for subprime customers. Over the past year, the percentage of subprime credit card customers with payments late by 90 days or more has grown by 20.38%. For credit card customers with prime credit scores, the percentage with late payments has grown by 11.76%.

Not only are late payments a faster-growing problem for subprime customers, but the amount they owe is growing especially fast. The average credit card balance for prime customers grew by 11.8% over the past year. For subprime customers, the average balance grew by 30.9%.

So, not only is the risk of late payments growing especially fast for subprime customers, but the amount of money at stake is also rising fast.

Under those circumstances, it’s only natural that lenders are becoming more hesitant to extend credit to consumers with lower credit scores.

➤ LEARN MORE:How to eliminate credit card debt

How credit card companies are responding

In response to rising debt loads and increasing numbers of late payments, lenders are responding about as you might expect.

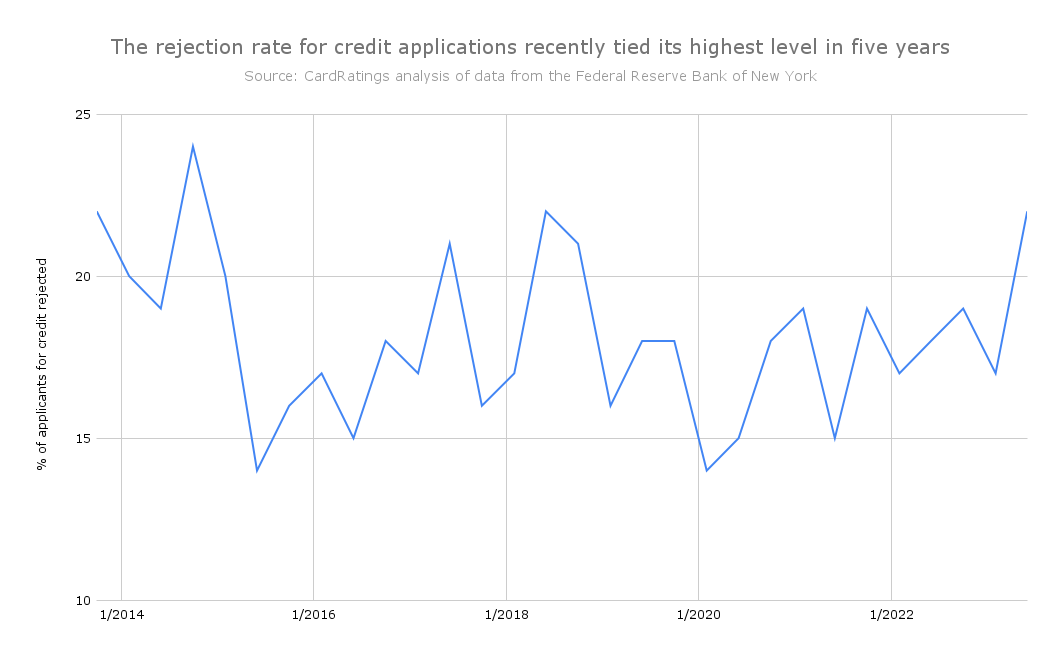

According to data from the Federal Reserve Bank of New York’s Survey of Credit Access, the rejection rate on applications for new credit recently reached its highest level since 2018.

In particular, lenders are showing reluctance to approve applicants with lower credit scores.

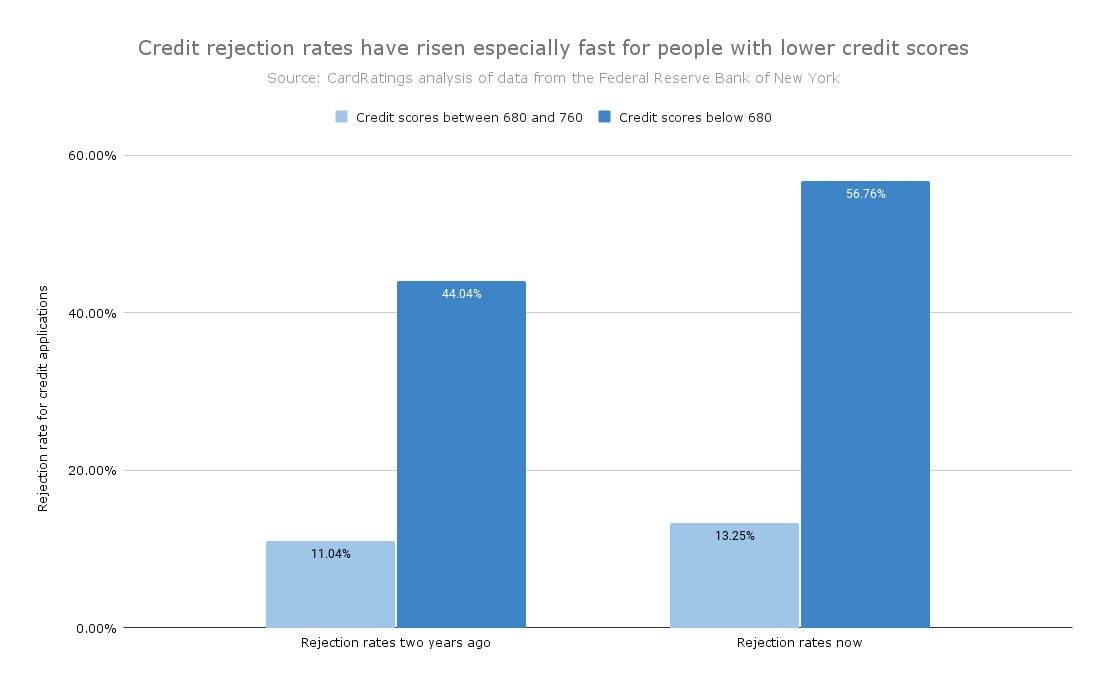

Over the past two years, the rejection rate for applicants with credit scores between 680 and 760 has risen from 11% to 13% – an increase of just 2 percentage points.

In contrast, the rejection rate for applicants with credit scores of 680 or below has jumped from 44% to 57% – an increase of 13 percentage points.

As these numbers show, it was already much tougher for people with lower credit scores to get credit. Recently though, it has gotten even harder. Along with having more difficulty getting credit, in this environment people with lower credit scores may have to pay much more for the privilege.

How to protect your access to credit

With credit becoming harder to get, here are some tips for protecting your access to credit:

- When you shop for credit cards, be sure to compare rates for people with your credit score. Unless you have excellent credit, the rates credit card companies advertise most prominently probably won’t apply to you.

- Work on improving your credit score. A good payment history is the most important factor here. It also helps to bring your balances down. Learn more about how to improve your credit score when you have no credit.

- Ask for a credit limit increase on an existing card. If you have a good payment history on a credit card, you might find it easier to get that limit raised than to get a new card. According to the Federal Reserve Bank of New York, nearly 70% of requests for a credit limit increase are approved.

- Consider applying for a secured credit card. Secured credit cards require applicants to put down a refundable deposit in order to establish a line of credit, and generally don’t require a credit check to apply. By using a secured credit card responsibly you have an opportunity to show lenders that you’re a trustworthy borrower.

Credit is becoming both more expensive and harder to get. You should prepare by taking steps to protect your access to affordable credit.