Why you should trust CardRatings.com

At CardRatings.com we discuss the most up-to-date news and trends within the credit card space. Since we first pioneered the concept of online credit card reviews in 1998, our team of financial experts has provided comprehensive and unbiased credit card reviews for more than 175 cards, plus hundreds of additional resource articles to help educate everyday cardholders so they can feel more confident about their card choices. All our content is written and reviewed by industry experts. Though our content may occasionally contain references to products from our partners, we maintain strict editorial integrity and advertiser relationships and compensation never influences ratings, reviews or featured products. The difference between editorial content and advertising must always be clearly stated. Learn more.

Editor’s Note: This article originally published Sept. 24, 2020. Some information may no longer be up to date.

Research shows COVID-19 preys most heavily on those with preexisting conditions. Similarly, the economic burden may fall most heavily on households with the weakest credit standing going into this year.

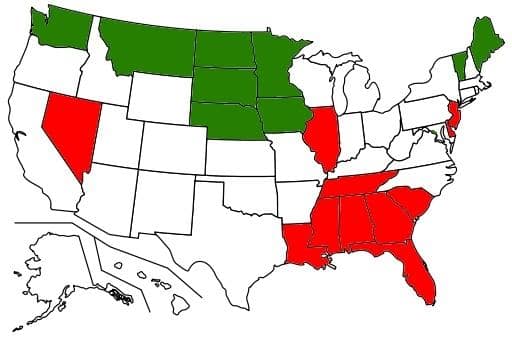

The 2020 CardRatings.com annual study of the Best and Worst States for Credit Conditions identifies the states where consumers seem best positioned to weather the economic storm, and those where consumers may be most vulnerable.

Certainly, there are some big differences in conditions from state to state:

- Relative to their populations, Alabama has almost 10 times as many bankruptcies as Alaska.

- The average credit score in Minnesota is more than 60 points higher than the average in Mississippi.

- Residents of Alaska carry credit card debt equal to nearly 15% of their annual income; in Washington, DC the average is less than 9%.

- A house in New Jersey is 17 times as likely as one in South Dakota to go through foreclosure.

- The unemployment rate in Massachusetts has soared to four times the jobless rate in Kentucky.

These differences take on added significance in an election year, so CardRatings also looked at how credit conditions might impact electoral math.

Ranking the best and worst states for credit conditions

To measure the combined impact on credit conditions, CardRatings.com examined the following factors:

- Bankruptcies per capita, based on data from the American Bankruptcy Institute

- Average credit scores from Experian

- Credit card balances as a percentage of average income, based on credit card data from Experian and wage data from the Bureau of Labor Statistics

- Foreclosure data from Attom Data Solutions

- State unemployment rates from the Bureau of Labor Statistics

All 50 states plus the District of Columbia were ranked based on the above factors. Those rankings were then averaged to create an overall ranking of the best and worst states for credit conditions.

Best states for credit 2020

Here are this year’s 10 best states for credit conditions:

1. North Dakota. This is the fourth consecutive top ranking in this study for North Dakota. It ranked in the top 10 in four out of five categories, and narrowly missed the top 10 in the fifth.

2. Vermont. Having the second lowest bankruptcy rate and second highest average credit score in the nation helped Vermont repeat last year’s overall second-place finish.

3. South Dakota. The strongest point for South Dakota is having the lowest foreclosure rate of any state, and it also finished among the 10 best in three other categories.

4. Minnesota. Residents of Minnesota have the highest average credit score of any state, due in part to having the third lowest average credit balance as a percentage of income.

5. Montana. A seven-position jump this year put Montana squarely in the top 10, with rankings among the 10 best in three out of five categories.

6. Washington. This state ranked in the top 10 in three categories, including having the fifth-lowest average credit card balance as a percent of income.

7. Nebraska. The strongest attributes Nebraska had going for it in this year’s study were top 10 rankings for low unemployment and high average credit score.

8. Iowa. The only category in which Iowa scored among the 10 best was for low average credit card balance as a percent of income. Also being better than median in the other four categories helped Iowa place in the top 10 overall.

9. Maine. Top-10 rankings for low bankruptcy rate and low unemployment helped push Maine into the top 10 after it narrowly missed last year.

10. District of Columbia. Washington, DC has a lower average credit card balance as a percentage of income than any state, and also did better than median in three other categories.

Worst states for credit 2020

Here are the worst states for credit, starting with the worst state overall. Eleven states are listed here, because there was a tie for the 10th-worst position.

1. Nevada. The biggest gamble in Vegas might be ex10ding credit. Nevada is the worst state for credit conditions for the third year in a row because it ranked among the 10 worst states in all five categories.

2. Louisiana. Last year, Louisiana tied for second-worst, but this year it holds that distinction all on its own. This is because it ranks below median in all five categories, including having the nation’s second-lowest average credit score.

3. Florida. After narrowly missing the bottom 10 last year, Florida couldn’t escape it this year. That’s because it was below median in all five categories, including being among the 10 worst for foreclosure rate and credit card debt as a percent of income.

4. Georgia. The good news is that this is a slight improvement after Georgia tied for being the second-worst state for credit conditions last year. The bad news is that Georgia is still among the 10 worst states in three out of five categories.

5. Alabama. This state has the highest bankruptcy rate in the nation, and the fifth-lowest average credit score.

6. (tie) Delaware. No state fell further in the rankings since last year than Delaware, which was 31st overall in 2019. The biggest cause for concern is the second-highest foreclosure rate in the nation.

6. (tie) Mississippi. Besides having the lowest average credit score, Mississippi is also among the 10 worst states for bankruptcy rate and credit card debt as a percent of income.

8. Tennessee. Having the second highest bankruptcy rate was the worst of Tennessee’s problems, but it was also below median in every other category.

9. Illinois. Finishing among the 10 worst states in three out of five categories doomed Illinois to the bottom 10 overall.

10. (tie) New Jersey. New Jersey has the highest foreclosure rate in the nation, and with the second highest unemployment rate this problem may only get worse.

10. (tie) South Carolina. The biggest concern here is the second highest level of average credit card debt as a percent of income, but South Carolina is also among the 10 worst states for foreclosures and average credit score.

Biggest Movers – Most Improved and Worst Declines

Kentucky showed the biggest improvement since the 2019 study, climbing 15 places to finish 25th this year. Most of its category rankings are little changed since last year, but the difference maker was that Kentucky jumped from 42nd to 1st for low unemployment.

This is based on the June, 2020 unemployment rate from the Bureau of Labor Statistics. As of this writing that is just a preliminary figure. Kentucky showed an unusually steep drop in Labor Force participation rate and a big jump in employment in June, both of which drove its unemployment rate down.

Pandemic conditions have distorted some of the government’s data collection efforts, so it will be interesting to see whether Kentucky’s low unemployment rate will hold up when the preliminary figures are finalized.

On the other side of the ledger, Delaware showed the biggest decline in overall ranking this year. What happened there? Somewhat the opposite of what happened in Kentucky. Delaware saw its unemployment rate rise much more than that of other states, such that it’s ranking for employment conditions dropped from 16th nationally to 42nd.

The economic impact of the coronavirus pandemic has been felt most immediately in the job market. Thus it is no surprise that unemployment rates should be a big driver of changes in rankings since last year. Over time, weakness in the job market is likely to have a wider impact on other aspects of credit conditions.

Credit Conditions and the 2020 Election

Household finances of10 influence elections, and this may be especially true during a recession. So what impact might credit conditions have this time around?

Interestingly, states that voted for then-Democratic presidential candidate Hillary Clinton have improved their average ranking in this study since the last election, while those that voted for Donald Trump have slipped slightly.

The question is, are states that improved now more likely to reward the incumbent when filling out their ballots, or are those that have declined more likely to punish the incumbent?

Another way to look at the issue is this: the best states for credit this year have an average of 5.2 electoral votes each in the upcoming election. The worst states have an average of 11.9 electoral votes.

That suggests people in states that are struggling might have a louder voice in the upcoming election than those that are doing well.