Why you should trust CardRatings.com

At CardRatings.com we discuss the most up-to-date news and trends within the credit card space. Since we first pioneered the concept of online credit card reviews in 1998, our team of financial experts has provided comprehensive and unbiased credit card reviews for more than 175 cards, plus hundreds of additional resource articles to help educate everyday cardholders so they can feel more confident about their card choices. All our content is written and reviewed by industry experts. Though our content may occasionally contain references to products from our partners, we maintain strict editorial integrity and advertiser relationships and compensation never influences ratings, reviews or featured products. The difference between editorial content and advertising must always be clearly stated. Learn more.

The Credit Card Accountability Responsibility and Disclosure Act (known as the Credit CARD Act of 2009) is a law intended to curtail deceptive and abusive practices by credit card issuers. The bill expanded on the Truth in Lending Act (TILA), and the United States Congress passed the CARD Act in 2009. It took effect in 2010.

Among other things, the act created a new federal agency, the Consumer Financial Protection Bureau (CFPB), to administer the law’s provisions.

Key takeaways

- The Credit CARD Act of 2009 aimed to protect consumers from deceptive practices common among credit card issuers

- The Consumer Financial Protection Bureau was created as part of the CARD Act of 2009

- CARD Act provisions require clarity in statements and fees disclosures

- The act limited card issuers ability to market cards to college students and raised the minimum age to have a credit card.

Before the Credit CARD Act of 2009, credit card terms and rules could be cryptic. It was much easier to get pinged for a mistake you didn’t even realize you could make or end up with a fee you weren’t aware you’d have to pay. The CARD Act was created to help consumers, like you, better understand things that might not have been so clear before. Nowadays, thanks to the CARD Act, choosing the best credit card for your lifestyle is much simpler as credit card terms, rates, and fees are much more transparent.

Credit CARD Act background

The Credit Card Accountability Responsibility and Disclosure Act was passed by lawmakers in response to the following practices:

- Interest rate hikes: Many credit card companies hiked the interest rate on their cards without adequate notification or reason. Most customers didn’t realize this was happening and often were powerless to do anything about it. Before the law was enacted, it wasn’t nearly as easy to compare low interest credit cards as it is today.

- Marketing targeted toward young consumers: Many credit card companies targeted college campuses with giveaways for teens and young adults who were not aware of what they were signing up for until it was too late.

- Fees: Numerous credit card accounts were hit with all manner of fees, often undisclosed. These ranged from late fees to over-limit fees. The latter were assessed when the credit card company allowed an account to go over its limit and then charged the customer a fee for doing so. These became known as “fee harvester” cards.

- Obfuscation: Most of the time, it was nearly impossible to decipher the myriad charges, fees and interest expenses that applied to a credit card account.

Credit CARD Act summary

The Credit CARD Act of 2009 consists of five titles:

- Title I: Consumer Protection – Offers protection for credit cardholders against increases in fees and interest rates as well as unclear and unduly short notifications about changes. Credit card companies are now required to take into consideration new applicants’ “ability to pay” before approving that applicant for new cards.

- Title II: Enhanced Consumer Disclosures – Revises and expands requirements for mandatory minimum payment disclosures provided by a creditor, such as payoff timing, penalties and renewals, as well as prevention of deceptive marketing of credit reports.

- Title III: Protection of Young Consumers – Prohibits extensions of credit to consumers under the age of 21 unless the consumer has submitted a written application that meets specified requirements. Requires underage applicants to have a cosigner, such as a parent, legal guardian, spouse, or any other individual over the age of 21 who has the means to repay debts incurred by the consumer in connection to the account.

- Title IV: Gift Cards – Amends the Electronic Fund Transfer Act to regarding the imposition of dormancy, inactivity or service fees on gift cards. Restricts when gift certificates or gift cards can expire.

- Title V: Miscellaneous Provisions – Instructs various offices and boards to issue regulations or report on matters such the use of credit by consumers, interchange fees, and their effects on consumers and merchants.

How the CARD Act of 2009 protects consumers

The CARD Act’s major provisions are intended to ensure people don’t fall prey to predatory practices. Among its requirements are the following:

Clear fee and repayment disclosures

You can thank the CARD Act for that box on your credit card statement that says how long it will take to pay off a balance if only minimum payments are made. Prior to the law’s passage, card issuers were under no obligation to let you know that minimum payments barely cover the interest and could keep you in debt for years, if not decades.

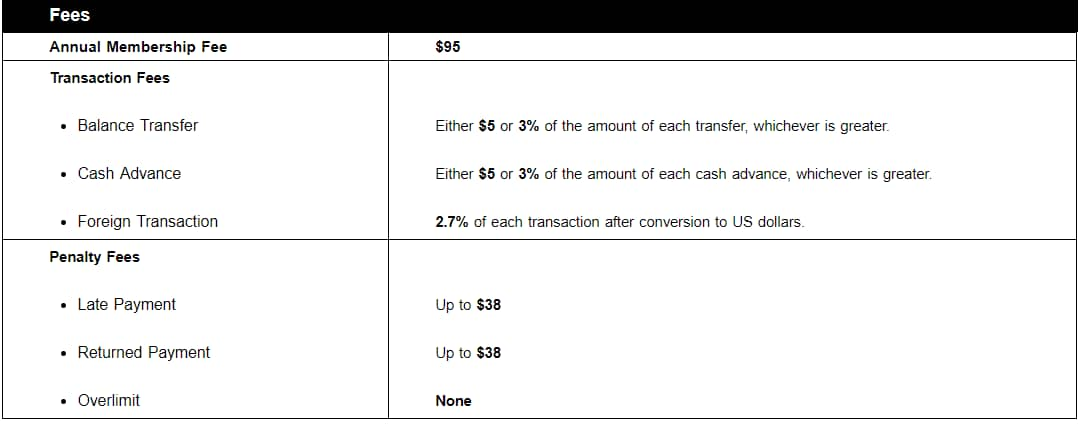

The CARD Act also made it easy for consumers to see exactly how much a card charges in interest and fees. You used to have to scan a block of fine print, but now, when you look at a card’s terms, you should see a big box with everything clearly laid out.

This is thanks to the use of Schumer boxes, a requirement of the original Truth in Lending Act. Named after Charles Schumer, the New York congressman (now senator) responsible for this legislation, Schumer boxes are the easy-to-read tables or “boxes” used by credit card issuers to clearly disclose important rate, fee, and term and condition information. They look something like this in many credit card terms documents:

Limits on penalty rates and fees

Credit card companies can no longer allow you to charge over your limit and then assess an exorbitant fee as a result. Instead, you now need to opt into this “privilege.”

The CARD Act also stipulates that a credit card issuer can’t increase your interest rate or charge a fee simply because they see on your credit report that you were late on a payment for another company. If they do want to impose a penalty rate, they need to wait until you are 60 days or more late on your monthly minimum payment to them. And should that happen, once you pay on-time for six months, the company must revert to your original interest rate.

Plus, the CARD Act puts caps on late fees and eliminated other costs, such as fees for making online payments or inactivity.

Elimination of double-cycle billing

In the past, some credit card issuers used accounting slight-of-hand to charge interest on purchases that had already been paid off. Known as double-cycle billing, this practice involved a company looking back two billing cycles when calculating interest charges. However, under the CARD Act, interest can now only be assessed on the most recent billing cycle.

Payments applied first to balances with higher interest rates

Some cards charge multiple interest rates. For instance, a cardholder may have a promotional APR that applies to a balance transfer and a higher rate for purchases. Under the CARD Act, payments must be applied to balances with the highest interest rate first.

The only exception is cards which have deferred interest arrangements. These are cards that promise, for example, 0% interest on a purchase if you pay off the balance in six months. If you fail to pay off the balance, the card will assess six months’ worth of interest at the end of the promotional period. If you financed a purchase with one of these arrangements, the issuer must apply your payments during the final two billing cycles of the promotional period to the balance subject to deferred interest.

Creation of the Consumer Financial Protection Bureau

The CARD Act created the Consumer Financial Protection Bureau to serve as a financial watchdog. In addition to providing consumer education resources, the government agency mediates complaints about financial institutions. In 2020, the bureau handled more than a half million complaints pertaining to debt collection, credit cards, banking practices and other financial institutions and products. In addition, the CFPB created a database of all credit card agreements, which it maintains here for anyone to refer to in the event they misplaced their agreement.

Protections for students and young adults

Long gone are the days of tables set up on college campuses with the offer of a free t-shirt in exchange for a credit card application. The CARD Act enacted new protections for students and young adults, and we’ll look at those in greater depth below.

In all, the Credit CARD Act of 2009 aimed to make the most egregiously deceptive practices unlawful and to set out clear provisions for disclosure.

Credit CARD Act statement requirements

In compliance with the CARD Act of 2009, issuers had to improve upon the readability of their credit card statements while also adding information that could prove vital for cardholders.

Before the changes necessitated by the act, you probably received your statement in the mail, lamented over its clunky, unapproachable design, spent a couple of seconds locating the minimum payment due and disregarded the rest. But now, with a more streamlined and uniform design, a few extra minutes going through your credit card statement can go a long way to making you better educated about your full credit card situation.

Aside from straightforward information such as a summary of your account activity and recent transactions, here are a few key additions thanks to the Credit CARD Act:

- Issuers have to warn cardholders of any penalties they can incur from late payments as well as the potential long-term cost of making only minimum payments on their balances.

- Cardholders must be notified of any changes to their interest rates at least 45 days before the rate changes.

- Interest and fees have to be listed separately from transactions.

How the Credit CARD Act of 2009 protects students

No one should start adulthood saddled with credit card debt, but it used to be easy for credit card issuers to market high-interest cards to unsuspecting students. Now, the CARD Act limits the ability of companies to take advantage of young adults’ financial inexperience by instituting the following:

- Marketing restrictions: Credit card companies can no longer offer giveaways on college campuses to entice students to apply for a credit card. The same goes for off-campus college-sponsored events. What’s more, companies can’t mail solicitations or credit card applications to those younger than age 21 unless they have opted in to receive those mailings.

- Age restrictions: If you are younger than age 21, you can’t get a credit card without an adult co-signer unless you can demonstrate an ability to independently repay any debt accrued.

Prepaid cards and gift cards

The CARD Act contains several provisions limiting abuses by issuers of prepaid cards and gift cards as well:

- Fees: All fees must be spelled out clearly for prospective buyers before they purchase a gift or prepaid card regardless of whether the purchase is completed in person, over the internet or over the phone. In addition, the card or certificate itself must clearly state that a fee may be charged, the amount of the fee and how often it may be assessed, and that a fee may be charged for inactivity. (This does not apply to gift certificates for which no money or other value has been exchanged nor to certificates that are issued as part of an award, loyalty or promotional program.) When fees are charged, no more than one fee per month may be charged.

- Expiration date: Under no circumstances may the cards expire sooner than five years after (1) the issuance of the gift certificate or card, or (2) the date funds were last loaded to a store gift card or general-use prepaid card.

If a card is subject to an expiration date, the terms of expiration must be clearly and conspicuously stated before issuance. The act also prohibits imposing fees to replace an expired certificate or card if the underlying funds remain valid. This ensures that consumers have full use of the underlying funds for the minimum five-year period.

For the most part, the CARD Act has resulted in better disclosure of fees and expiration terms than before, and choosing the best prepaid card these days is a much simpler task. As can be expected, however, there still are a number of issues which have come to light.

What the Credit CARD Act doesn’t cover

Although the CARD Act offers significant consumer protections, it does have some limitations:

- The act does not apply to small business or corporate accounts.

- Cards with variable interest rates (which is nearly every credit card these days) can be changed without advance notice.

- Issuers can close accounts or reduce credit limits at any time.

- There is no cap on interest rates in the CARD Act, although state laws may limit a card’s APR.

- Deferred interest can be charged if a purchase is not paid off before a promotional financing period ends.

Remaining issues the CARD Act of 2009 doesn’t address

The CFPB has previously noted a few more issues of abuse that remain and that are not addressed by the CARD Act of 2009.

- Add-on products: Credit card issuers market various “add-on” products to card users, including debt protection, identity theft protection, credit score monitoring and other products supplementary to the actual extension of credit. The bureau has found through its supervisory work that these products are frequently sold in a manner that harms consumers.

- Fee harvester cards: Some card issuers charge upfront fees that exceed 25% of a card’s initial credit limit. Those practices have been found to be excluded from the CARD Act because a portion of the fees are paid prior to account opening, e.g. so-called application fees.

- Deferred interest products: In the private label credit card market, it is common to offer promotional financing for purchases. These offers retroactively assess and charge interest if the balance is not paid in full by a specific date. The evidence gathered by the Bureau indicates that for borrowers with subprime credit scores, about 43% are ultimately charged retroactive interest in a lump sum.

- Prepaids: There are still no requirements for easy and free access to account information, fraud and lost-card protection or error resolution rights with pre-paid cards.

- Debit cards: Industry lobbying during the fight over the CARD Act resulted in carve-outs for bank-issued debit cards and prepaid debit cards, which continue to have minimal consumer protections.

Where the CARD Act falls short

In addition to the remaining issues above, the Credit CARD Act has been criticized by some for being too vague about the following matters:

- Regular interest rate hikes: Many consumers think that the law protects them against rate hikes. This is true, but only to a point. You’re only protected during the first year of a new account (with a few exceptions, such as variable rates that are tied to an index). But your rate on that card can increase significantly on your future purchases as long as you’re given 45 days’ notice.

- Penalty APRs: While the CARD Act limits when and how penalty rates can be enacted, it doesn’t put a cap on these APRs.

- Student credit cards: The legislation requires that students under the age of 21 can’t qualify for a card without a co-signer unless they show they have enough income to cover debts. However, “adequate income” is a subjective term that creditors may be able to work around. “Because higher-income students are more likely to have a willing co-signer, they can get credit cards, but lower-income students cannot,” says Todd J. Zywicki, George Mason University Foundation Professor of Law. “This also means that higher-income students can have an established credit report before they graduate, while lower-income consumers are behind the curve.”

- Discontinued credit cards: In the event your credit card is discontinued by its issuer, the language of the CARD Act doesn’t seem to be clear about how much warning you’ll receive. However, you should get notification in the mail.

- Allocation of payments: The CARD Act requires issuers to apply payments that exceed the minimum amount due to the higher interest balances first. But here’s a catch: Creditors can still put the minimum payment towards the balances with lower interest rates.

- Added fees: The card issuers have lost revenue due the legislation, so it was predictable that added fees would be part of the “unintended consequences” that accompanies this kind of law. You’ve already probably seen some of these: annual fees, over-the-limit fees, and foreign transaction fees.

What, if anything, has changed in this legislation since its passage?

The CARD Act hasn’t undergone any major revision since its passage in 2009. However, the Consumer Financial Protection Bureau did issue one significant clarification to its rules in 2013.

Originally, rules created around the act’s provisions called for companies to evaluate a consumer’s ability to independently make payments. As a result, non-working spouses and stay-at-home parents reported difficulty in being approved for credit cards.

The 2013 clarification maintains that credit card issuers need to ensure those younger than age 21 are able to independently make payments; however, for older applicants, decisions can take into account other assets and income, such as those of a spouse or partner.

How does the CARD Act of 2009 affect your use of credit cards?

Except for those younger than age 21, the CARD Act shouldn’t affect most people’s ability to get or use a credit card. Still, since card issuers do need to consider a person’s ability to repay a debt, there is a possibility that some people who could receive credit cards in the past may be denied or offered a lower credit limit today.

Overall, though, the act’s provisions have been largely beneficial for consumers. They have made it easier for people to avoid late fees, understand the true cost of debt and pay off high interest balances earlier.