Delta SkyMiles® Gold American Express Card review

This credit card comes with an impressive welcome bonus offer and solid ongoing rewards for normal use. The addition of airline benefits make this card a good choice for anyone who is loyal to the Delta brand for travel.

Jump to section

Delta SkyMiles® Gold American Express Card

- Rewards

- Earn 2X Miles on Delta purchases, at U.S. Supermarkets and at restaurants worldwide, including takeout and delivery in the U.S. Earn 1X Miles on all other eligible purchases.

- Welcome Bonus

- Earn 40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months of Card Membership.

- Annual Fee

- $0 introductory annual fee for the first year, then $150.

Key Features

- Earn 40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months of Card Membership.

- Enjoy a $0 introductory Annual Fee for the first year, then $150.

- Delta SkyMiles® Gold American Express Card Members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

- $200 Delta Flight Credit: After you spend $10,000 in purchases in a year, you can receive a $200 Delta Flight Credit to use toward future travel.

- Earn 2X Miles on Delta purchases, at U.S. Supermarkets and at restaurants worldwide, including takeout and delivery in the U.S. Earn 1X Miles on all other eligible purchases.

- You can check your first bag free on Delta flights, saving up to $60 on a round-trip Delta flight per person. For a family of four that's a potential savings of up to $240 per round-trip flight.

- Receive Main Cabin 1 Priority Boarding on Delta flights; board early, stow your carry-on bag and settle in sooner.

- $100 Delta Stays Credit: Delta SkyMiles® Gold American Express Card Members can earn up to $100 back annually on eligible prepaid Delta Stays bookings on delta.com.

- Take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com.

- Receive a 20% savings in the form of a statement credit on eligible Delta in-flight purchases after using your Card.

- No Foreign Transaction Fees.

- With Send & Split®, you can send money and split your Card purchases with any other Venmo or PayPal user, directly from the Amex App. Enroll today.

- Terms Apply.

CardRatings Editor's Analysis: Pros & Cons

- Earn 40,000 bonus miles after you spend $2,000 in purchases on your new card in your first six months.

- Use the card while abroad and enjoy the lack of foreign transaction fees.

- Cardholders save money on checked bags – you'll receive one free checked bag per Delta flight.

- The annual fee after the first year may not be worth it if you aren't a regular Delta traveler. See Rates and Fees

card_name welcome offer

Are you a frequent Delta flyer looking to rack up some extra SkyMiles® and earn rewards flights more quickly? New CardName members can earn 40,000 bonus miles once spending $2,000 in purchases in the first six months of opening an account. American Express is a CardRatings advertiser.

A welcome bonus offer is almost always a nice perk, but when said bonus can quickly be turned into a free flight, that’s something that really gets our attention.

Depending on travel location and dates, Delta offers domestic, round-trip plane tickets for as low as 20,000 SkyMiles®, meaning, if you plan it right, you can snag yourself a couple of reward tickets just with the welcome offer alone.

card_name benefits

With no foreign transaction fees, your first bag checked for free on Delta flights, and an intro offer on the annual fee for the first year, the CardName puts more money into your pocket, making it a smart choice for frequent travelers. All this for a reasonable AnnualFees (See Rates and Fees).

Other ways the CardName helps cardholders save is by providing its members with one free checked bag on Delta flights and a flight credit once spending $10,000 in a calendar year – two small perks that could add up big for those who travel often. Also, cardholders can earn up to $100 back annually on eligible prepaid Delta Stays bookings made on delta.com.

Lastly, as travel hiccups are bound to happen, we’ve come to love the protection perks that come along with being a CardName member. With its available insurance plans, when using your card to pay for your travel expenses, the CardName can help to cover the cost of eligible lost, damaged or stolen baggage, as well as help cover any expenses you may incur if your car rental is damaged or stolen.

So many savings and we haven’t even covered the ongoing rewards yet!

On an ongoing basis, cardholders can earn:

- 2X miles for every dollar spent with Delta

- 2X miles per dollar at restaurants worldwide, including takeout and delivery in the U.S.

- 2X miles at U.S. supermarkets

- 1X mile on other eligible purchases

Plus, if you spend $10,000 on your card in a calendar year, you’ll receive a $200 Delta flight credit to use toward future travel. The CardName can certainly help you get where you’re going if you’re Delta-loyal.

Potential downsides of the card_name

Though a good base-level credit card, some of the CardName perks seem a bit sub-par when compared to other American Express Delta Airlines credit cards. The CardName and the CardName, for example, both include bonus opportunities to rack up status miles with the airline, a valuable feature for frequent travelers. If you are truly Delta-loyal, you may find that the perks and features of one of these higher tier cards make them well worth their annual fees.

How do cardholders rate the card_name?

CardRatings conducts a survey annually to learn what actual cardholders think of their cards. Here are the results for the CardName:

| Current Scores | Past Scores | |

|---|---|---|

| Overall Score | 77.2 | 77.7 |

| Features Satisfaction | 7.5 | 7.7 |

| Customer Service | 7.9 | 8 |

| Website/App Usability | 7.6 | 8 |

| Likelihood of Continuing to Use | 8.1 | 7.6 |

| Recommend to a Friend/Colleague | 7.8 | 7.6 |

How the card_name compares to other cards

card_name vs. CardName

discontinued

The CardName comes with a more sizeable annual fee of AnnualFees, but this cost could certainly be worth it for the right kind of Delta traveler. See Rates and Fees

The CardName is packed full of travel benefits. Cardholders can enjoy a Companion Certificate on main cabin domestic, Caribbean, or Central American roundtrip flights to select destinations each year after renewal of the card. The Companion Ticket requires payment of the government-imposed taxes and fees of no more than $80 for roundtrip domestic flights and no more than $250 for roundtrip international flights (both for itineraries with up to four flight segments). Baggage charges and other restrictions apply.

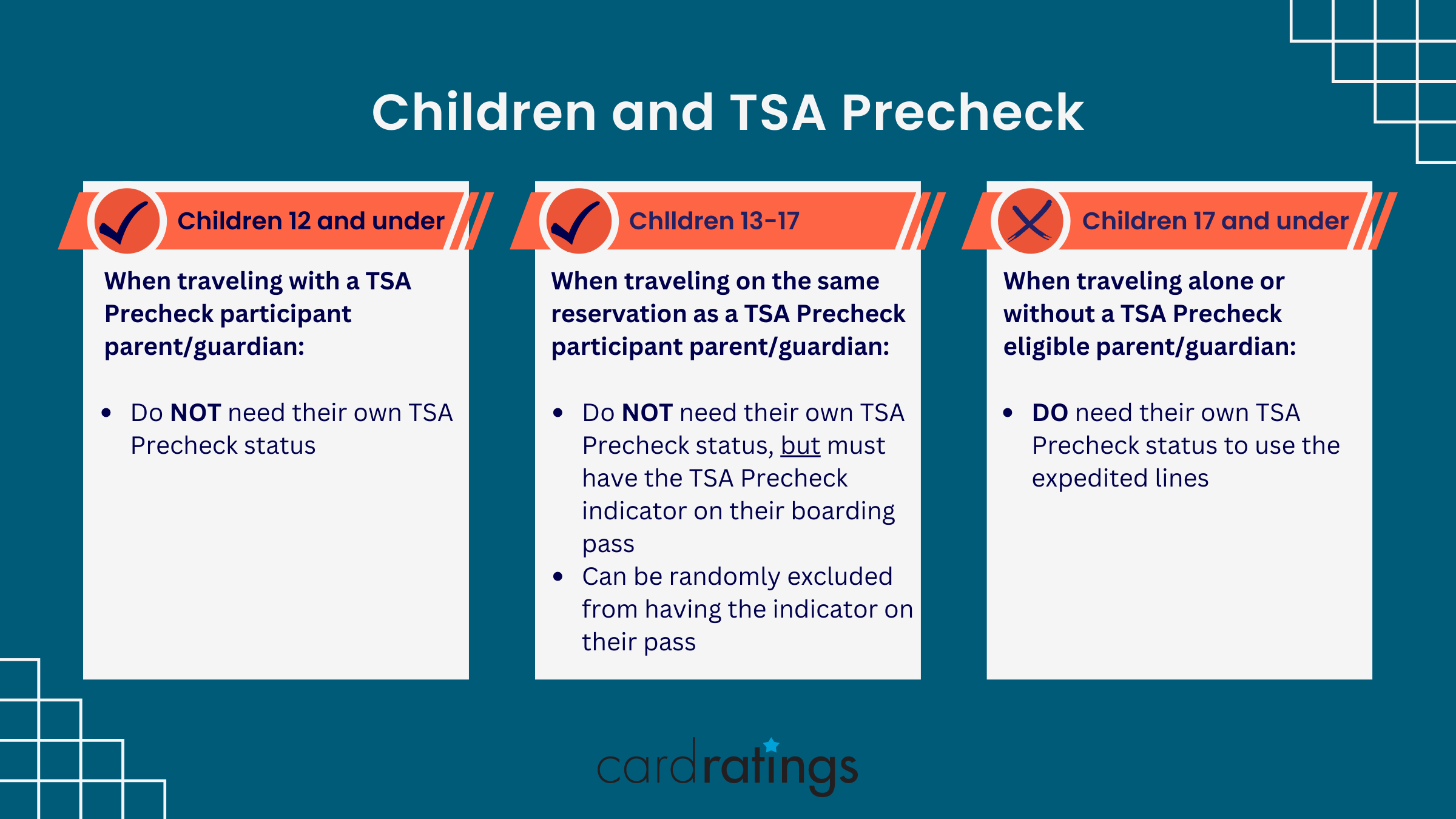

Additionally, cardholders can receive $100 back for Global Entry or $85 back for TSA PreCheck after applying through any official enrollment provider. On an ongoing basis cardholders earn 3X miles on Delta purchases and purchases made directly with hotels; 2X miles at restaurants and at U.S. supermarkets; and 1X mile on all other eligible purchases. Furthermore, earn 50,000 bonus miles after you spend $3,000 in purchases on your new card in your first six months. (Enrollment required for some benefits)

Considering all the perks that come with the Platinum card, the annual fee hardly seems like much as it can so easily be offset. If you’re a frequent Delta traveler, going with the more premium Platinum card could have its advantages. However, if you’re only an occasional Delta travel, you may be better suited with the Gold card.

card_name vs. card_name

discontinued

Though the 60,000 points you receive for spending $4,000 in the first three months with CardName are a nice perk, the spending threshold could be a barrier. Still, even with the spending requirement, 60,000 points is a great bonus and it’s worth $750 when redeemed through Chase Travel.

CardName cardholders earn 5X points on travel purchased through Chase Travel; 3X points on dining, select streaming services and online groceries; 2X points on all other travel purchases; 1X point on all other purchases; a $50 annual Chase Travel Hotel Credit; plus more. Better yet, points are worth 25% more when redeemed through Chase Travel, so there’s potential to stretch your rewards really far.

Furthermore, CardName points can be redeemed through a number of different airlines, providing its users with more scheduling flexibility than CardName cardholders enjoy. The difference here really comes down to the difference between a more general travel rewards card and a branded option. If you want to keep things flexible the CardName might be a great fit for you, but if your loyalty is with Delta, a SkyMiles® card may be better.

Is the card_name worth it?

Thanks to its great welcome offer, no foreign transaction fees and other travel perks such as free checked baggage, the CardName is a solid option for frequent travelers loyal to the Delta brand.

Frequently Asked Questions

Does card_name_placeholder have foreign transaction fees?

Do you get free checked luggage with the card_name_placeholder?

Where can I earn extra miles with the card_name_placeholder?

Does the card_name_placeholder cover TSA PreCheck?

Does the card_name_placeholder have lounge access?

Our Methodology

Survey Methodology: CardRatings commissioned Op4G in September 2023 to conduct surveys among 1,869 cardholders nationwide. CardRatings website analytics from Jan. 1, 2023-Aug. 31, 2023 were used to determine a selection of the most popular cards and additional cards were included to add survey breadth. Responses to each of nine questions were given on a scale of 1-10 and respondents’ scores were then averaged under broad topics. To determine the overall score, responses from questions 1-8 were summed and the answer to “How likely are you to recommend this card to a friend, coworker or family member?” was double weighted. “Current Scores” reflect scores from the most recent survey (2023); “Past Scores” reflect scores from the 2022 survey.

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.

To see the rates and fees for American Express cards mentioned in this article, please see the following links: CardName (See Rates and Fees); CardName (See Rates and Fees); CardName (See Rates and Fees)