Delta SkyMiles® Blue American Express Card

This is a good entry-level card for the occasional Delta traveler. Earn rewards on Delta purchases, plus on other common expenses as well.

Jump to section

Delta SkyMiles® Blue American Express Card

- Rewards

- Earn 2X Miles per dollar at restaurants worldwide, plus takeout and delivery in the U.S. Earn 2X Miles per dollar spent on Delta purchases, and 1X Mile on all other eligible purchases.

- Bonus Rewards

- Earn 10,000 bonus miles after you spend $1,000 in purchases on your new Card in your first 6 months.

- Regular APR

- 20.99% - 29.99% Variable

Key Features

- Earn 10,000 bonus miles after you spend $1,000 in purchases on your new Card in your first 6 months.

- No Annual Fee.

- Earn 2X Miles per dollar at restaurants worldwide, plus takeout and delivery in the U.S.

- Earn 2X Miles per dollar spent on Delta purchases, and 1X Mile on all other eligible purchases.

- Pay with Miles: take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com.

- Receive a 20% savings in the form of a statement credit after you use your Card on eligible Delta in-flight purchases of food and beverages.

- No Foreign Transaction Fees.

- Terms Apply.

CardRatings Editor's Analysis: Pros & Cons

- Earn 10,000 bonus miles after you spend $1,000 in purchases on your new card in your first six months of card membership.

- Earn 2X miles per dollar at restaurants worldwide (plus takeout and delivery in the U.S.), 2X miles per dollar spent on Delta purchases, and 1X mile on all other eligible purchases.

- Receive a 20% savings in the form of a statement credit after you use your card on eligible Delta in-flight purchases of food and beverages.

- No annual fee is great, but if you travel with Delta extensively you stand to earn more with a Delta branded card that charges an annual fee. If you're traveling with Delta enough, offsetting an annual fee shouldn't be tough. (See Rates and Fees.)

The CardName is just one of several in the Delta SkyMiles® family. With no annual fee, it’s the most affordable of the bunch, but it also comes with the least amount of perks. If you frequently travel with Delta, another SkyMiles® card (see our comparison section below) may be the better fit for you; however, if you’re only an ocassional Delta traveler who is looking for a way to earn rewards on a Delta flight here and there, read on. This may be the card for you. American Express is a CardRatings advertiser.

card_name benefits

Welcome bonus

One of the first benefits you might notice with the card_name is the welcome bonus. New cardholders who spend at least $1,000 in the first six months of card membership can earn 10,000 bonus miles. This isn’t a staggering amount of rewards, but it’s not bad considering the fact that the spend threshold to earn it is so low, and that the card doesn’t have an annual fee, which leads to our next benefit…

No annul fee

Though many travel credit cards come with annual fees, the CardName doesn’t. While the lack of an annual fee is reflected in fewer perks than some other cards, it makes it an easy card to keep in your wallet, even if it’s not your primary credit card.

Ongoing rewards

The CardName allows you to earn miles on all of your purchases. With this card you’ll earn:

- 2X miles per dollar at restaurants worldwide, including takeout and delivery in the U.S.

- 2X miles on Delta purchases made directly with Delta

- 1X mile on other eligible purchases

Travel perks

Like most travel credit cards, the CardName offers a few additional travel benefits to help save you money and stress while you’re traveling. First, the card offers no foreign transaction fees so it’s a good one to travel abroad with. While this perk is one that comes with many travel cards, it’s not always a given for a card with no annual fee. Another travel perk that Delta offers cardholders is a 20% savings on in-flight purchases. When you use your card for in-flight food and beverage you’ll get a statement credit for 20% of your purchase. Finally, the the card offers offers a Pay with Miles feature, which allows you to take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on Delta.com. (See Rates and Fees.)

Potential downsides of the card_name

While the CardName has several benefits, it also has a few downsides that we should discuss. First, the card’s welcome bonus offer doesn’t stack up well to many other travel cards on the market. While it’s better than nothing, many other travel cards offer welcome bonuses that are considerably higher.

Another thing Delta SkyMiles® Blue is missing are some of the travel perks you’ll find with many other branded credit cards, such as free checked bags, priority boarding, and lounge access. It’s important to note, however, that many of the cards that offer these perks have annual fees. Since Delta doesn’t charge an annual fee for the SkyMiles® Blue card, it’s more understandable that some of these perks are missing. You could upgrade to a Delta SkyMiles® card with an annual fee to enjoy more robust travel perks if that’s important to you.

How does the card_name compare to other cards?

CardName vs. CardName

discontinued

CardName is another of Delta’s travel credit cards available through American Express. This card has a AnnualFees, so it’s a comfortable step up from the Blue card for those looking for a few more perks. (See Rates and Fees)

To start, CardName offers a considerably larger welcome bonus than SkyMiles® Blue. New cardholders can earn 40,000 bonus miles after you spend $2,000 in purchases on your new card in your first six months. As for ongoing rewards, the two cards match up closely. You’ll get the same 2X miles on dining purchases worldwide (plus takeout and delivery in the U.S.) and Delta purchases that you do with SkyMiles® Blue, but SkyMiles® Gold also offers 2X miles on purchases made at U.S. supermarkets.

SkyMiles® Gold offers a couple of additional travel perks you won’t find with SkyMiles® Blue. With the Gold card, you’ll get your first checked bag free on all Delta flights, as well as a $100 delta flight credit after you spend $10,000 on purchases on your card in a calendar year.

CardName vs. CardName

discontinued

CardName is a premium version of Delta’s SkyMiles® cards, which is reflected in the card’s AnnualFees annual fee. (See Rates and Fees)

If you’re a regular Delta traveler, though, you may find the benefits outweigh the cost. First, you can earn 50,000 bonus miles after you spend $3,000 in purchases on your new card in your first six months. Plus, receive $2,500 MQDs each medallion qualification year and get closer to status with MQD Headstart. The bonus miles are great, but so are the bonus MQDs which get you one step closer to earning Medallion Status. With Medallion Status, you’ll get perks like unlimited complimentary upgrades, more miles earned on your spending, and waived fees such as baggage fees.

The card also offers higher spending rewards than the other two SkyMiles® cards discussed here. You’ll get 3X miles on Delta purchases and hotel purchases made directly with hotels, 2X miles on dining worldwide (and U.S. takeout and delivery) and at U.S. supermarkets, and 1X mile on other eligible purchases.

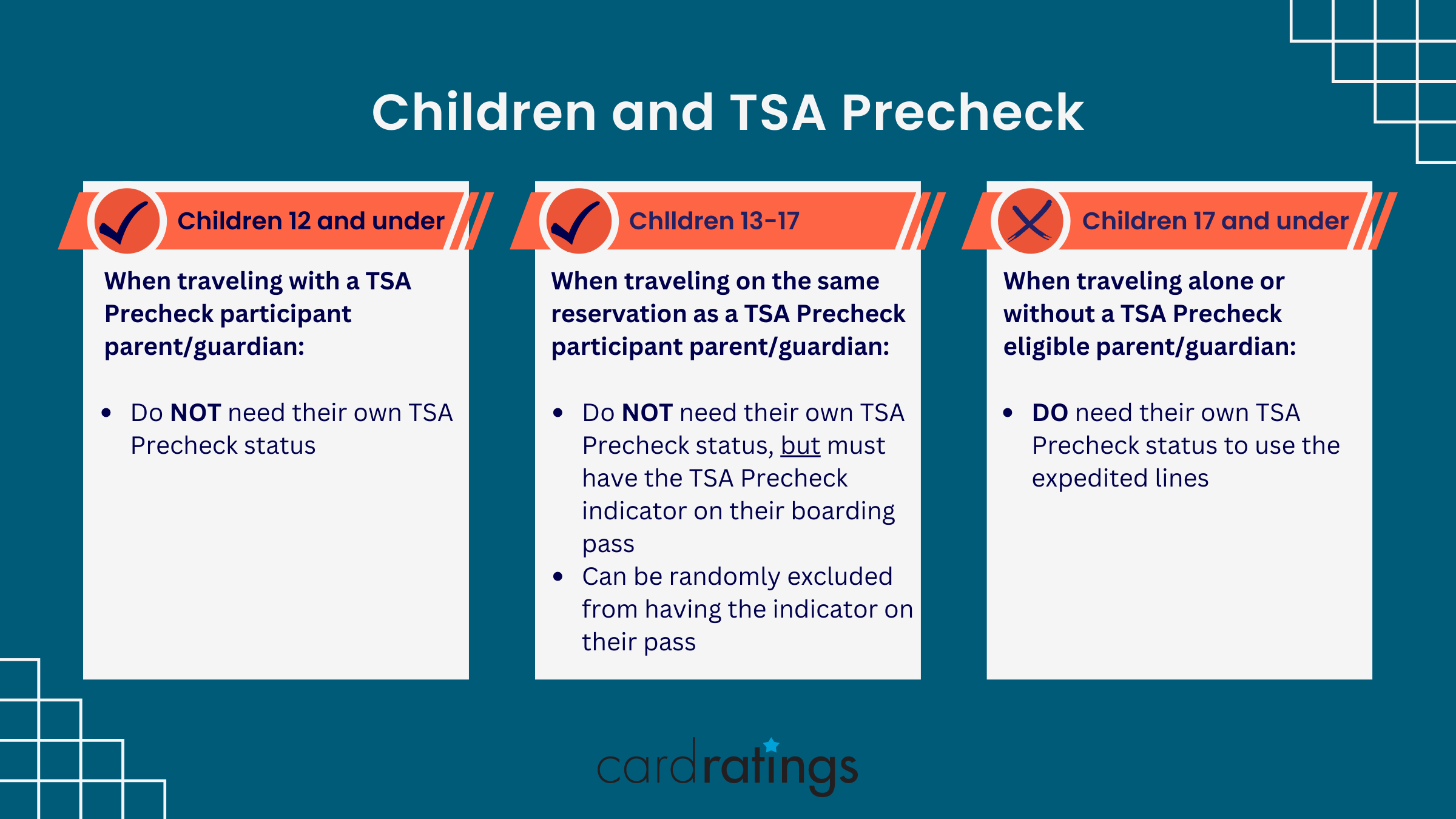

Finally, the CardName offers a variety of other travel perks that include an annual companion certificate, a free checked bag on Delta flights, a fee credit for Global Entry or TSA Precheck (enrollment required), a discounted rate for Delta Sky Club visits, and more.

Is the card_name a good card?

With so many travel credit cards on the market, it’s easy to wonder which is right for you. CardName comes with some of the benefits people look for in a travel card, but it’s also missing others.

The CardName might be the right card for you if Delta is your preferred airline, but you don’t travel often. You’ll earn points toward your flights, along with a few other travel perks, without having to pay an annual fee.

Travelers who prefer Delta and fly often are probably better off upgrading to one of the more premium SkyMiles® cards, such as the SkyMiles® Gold or SkyMiles® Platinum. Even with the higher annual fee, those cards offer more bang for your buck for frequent travelers.

Frequently Asked Questions

What credit score is needed for the card_name_placeholder?

Do you get a free checked bag with the card_name_placeholder?

Does the card_name_placeholder have a foreign transaction fee?

Our Methodology

Survey Methodology: CardRatings commissioned Op4G in September 2023 to conduct surveys among 1,869 cardholders nationwide. CardRatings website analytics from Jan. 1, 2023-Aug. 31, 2023 were used to determine a selection of the most popular cards and additional cards were included to add survey breadth. Responses to each of nine questions were given on a scale of 1-10 and respondents’ scores were then averaged under broad topics. To determine the overall score, responses from questions 1-8 were summed and the answer to “How likely are you to recommend this card to a friend, coworker or family member?” was double weighted. “Current Scores” reflect scores from the most recent survey (2023); “Past Scores” reflect scores from the 2022 survey.

To see the rates and fees for the American Express cards mentioned in this post, please visit the following links: CardName (See Rates and Fees); CardName (See Rates and Fees); CardName (See Rates and Fees)