Why you should trust CardRatings.com

At CardRatings.com we discuss the most up-to-date news and trends within the credit card space. Since we first pioneered the concept of online credit card reviews in 1998, our team of financial experts has provided comprehensive and unbiased credit card reviews for more than 175 cards, plus hundreds of additional resource articles to help educate everyday cardholders so they can feel more confident about their card choices. All our content is written and reviewed by industry experts. Though our content may occasionally contain references to products from our partners, we maintain strict editorial integrity and advertiser relationships and compensation never influences ratings, reviews or featured products. The difference between editorial content and advertising must always be clearly stated. Learn more.

The four Chase Ink business cards provide incredible rewards value on everyday spend for small business owners. Whether your business expenses are primarily travel related, at office supply stores, or fluctuate in different categories from month to month, there is likely a Chase Ink card that is well-suited for you.

With a myriad of other benefits and perks like travel protection and warranty extensions, there are a number of reasons to have at least one small business credit card in your wallet – or maybe even all four. Continue on to learn why this could be a smart option for your business.

Rewards earning rates

One of the key differences between the Chase Ink business credit cards is their rewards earning rates. The CardName earns three points per $1 on the first $150,000 spent on travel and select business categories including shipping purchases, phone services, and advertising purchases with social media sites each account anniversary year. Additionally, the CardName earns one point per $1 on all other purchases – with no limit to the amount you can earn.

The CardName, on the other hand, earns 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. The card also earns 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year as well as 1% cash back on all other card purchases.

The card_name earns users 2% cash back on all purchases, and if you make a purchase that’s $5,000 or more, you’ll earn 2.5% cash back.

Finally, the CardName earns unlimited 1.5% cash back on every purchase. All four cards offer tremendous daily spending value; the card that is best for you depends on the expenses and spending that your small business will incur.

Annual fees and welcome bonuses

The annual fees these cards carry are also worth mentioning, as are their welcome bonuses, as they are some of the best offers currently available for small business cards. Neither the CardName or the CardName require an annual fee, and they both have solid welcome offers – the Ink Business Unlimited offers $750 bonus cash back after you spend $6,000 on purchases in the first three months from account opening, and the Ink Business Cash offers $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening. These are excellent offers for card with no annual fees!

The CardName does charge a AnnualFees annual fee, but the 100,000 bonus points new cardholders can earn once spending $8,000 within the first three months easily offsets this. When redeemed for travel through Chase Ultimate Rewards this bonus is worth $1,250, which offsets that annual fee for more than 10 years!

The card_name has the highest annual fee (annual_fees) of the bunch, but its welcome bonus also goes a long way in offsetting this cost. New cardholders can earn $1,000 cash back once spending $10,000 on purchases within the first three months of opening an account.

What are Chase Ultimate Rewards and how do you redeem them?

Chase Ultimate Rewards points are the rewards that you earn when using certain Chase credit cards, and they are redeemable for a wide variety of things including gift cards, cash back and travel.

With their varied redemption options, including transfers to travel partners, Ultimate Rewards are widely considered to be among the most valuable credit card loyalty currencies. With the number of cards that earn Chase Ultimate Rewards points, there are a variety of ways to earn your points and, perhaps more importantly, a variety of ways to redeem those rewards. In fact, Chase allows you to combine all of your Ultimate Rewards into one account, so if you hold several credit cards that earn Chase Ultimate Rewards points, all of those rewards have the potential to be worth more if combined under a card with higher redemption value, such as the CardName; points redeemed under this card are worth 25% more when redeemed through the Ultimate Rewards portal.

LEARN MORE

Explore all the ins and outs of the Chase Ultimate Rewards program with our Guide to Chase Ultimate Rewards.

Benefits of using multiple Chase credit cards

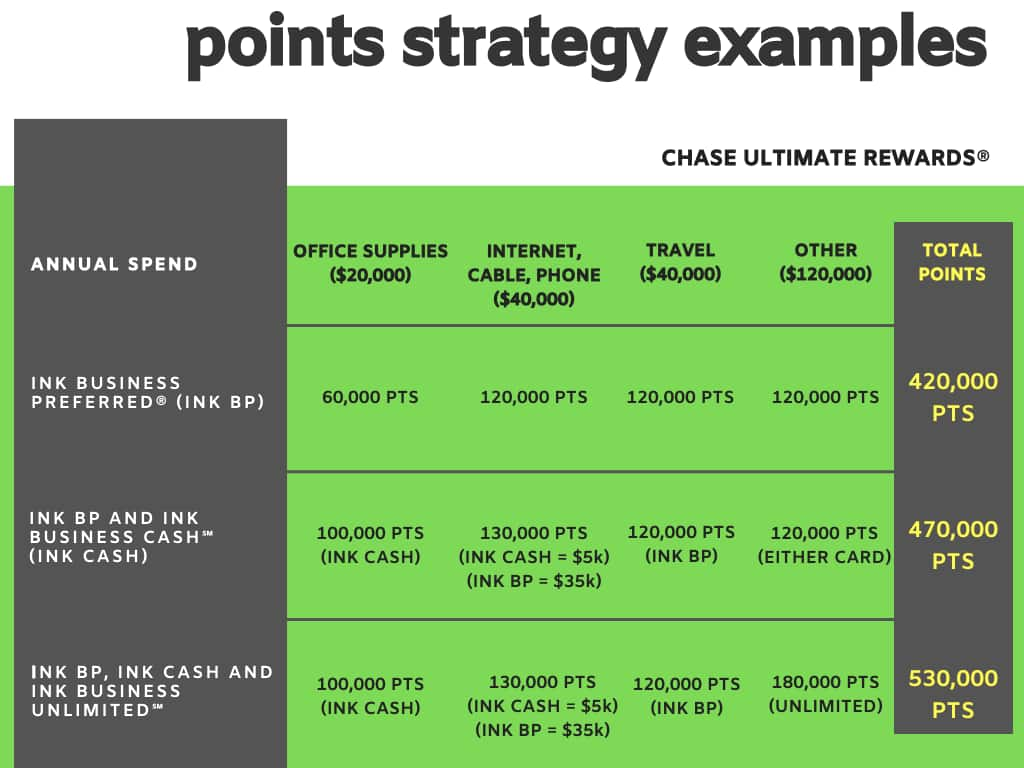

A great option to consider is combining two or more of the Chase Ink business cards. By doing this, you can benefit from the higher rewards rates with each card depending on what you’re buying, and can then combine all of your Ultimate Rewards points to maximize redemption value.

For example, if you have both the CardName and the CardName you can maximize Ultimate Rewards earning by using your Preferred® card on travel, Internet, and shipping purchases, and then your Ink Business Cash® card at office supply stores or going out to dinner. By doing this, you’d not only maximize the number of points you’d accumulate, but you could then redeem all of those points for 25% more value on travel if combined in your Ink Business Preferred® account.

Since the CardName also has no annual fee, you could add it into your wallet to earn 1.5% on purchases in non-bonus categories instead of just the flat 1%, making all three of these credit cards work overtime for your business. Or, if you have large purchases on the horizon, you might consider the card_name as it earns 2% cash back on all purchases, and 2.5% cash back on purchases of $5,000 or more.

This value isn’t limited to the small business cards but can be utilized with any of the Chase Ultimate Rewards earning cards. If, for instance, you have the CardName, with the above scenario you could combine all of your earned Ultimate Rewards points from your business credit cards into your Sapphire Reserve® account and redeem them for 50% more value on travel.

)

The chart above is an example of the minimum rewards you could earn with a few hypothetical spend combinations. As you can see, using all three cards in combination could earn you over 100,000 points more than using a single card on its own. And, by combining rewards into your CardName account, points are worth 25% more, so in this example, 530,000 points are worth as much $6,625 in travel!

Chase’s 5/24 rule

Now, before you go and sign up for all four cards at once, you should know that Chase has introduced some rules to ensure that individuals signing up for cards are using them in legitimate ways and not just trying to take advantage of signup bonuses only. One of those rules is their 5/24 rule, which means that an individual who has signed up for credit cards in excess of five in the past 24 months will likely have their application denied by Chase if applying for a new credit card. Therefore, if you have a number of recent card applications, you likely won’t be able to get approved for a new Chase card right away.

The good news, however, is that applying for one of these Ink cards won’t add to your 5/24 count. Let’s say, for instance, that you’ve applied for four cards in the past two years, and now you want an CardName to earn rewards on the gas you buy for your rideshare driver side hustle. Go ahead and apply! You’ll still only be at four applications in the past 24 months as far as Chase is concerned.

One final note on this: Chase doesn’t specifically describe this rule; rather, all we know about it is anecdotal. In other words, think of this as a guideline rather than a hard and fast rule. There’s enough evidence out there to suggest it’s true and accurate, but Chase hasn’t publicly discussed it so they could make changes at any time.

Do I qualify for a Chase Ink business credit card?

There are a number of people who can apply for a small business credit card including self-employed individuals and freelancers, entrepreneurs, small business owners, and owners of startups. One thing to note, in order to qualify for a business credit card, you must be an “authorized officer” of a company. In other words, you need to have the legal right to enter into a borrowing arrangement with financial institutions on behalf of a business. If you are the owner of a sole proprietorship business or the sole owner of a small business, you are already an “authorized officer.” Each application is considered on its own, so if you have a unique small business (maybe an Uber driver or Airbnb host, for instance) don’t automatically assume that you don’t qualify. Also, even though these are small business credit cards, your personal credit history will be factored in to determine your eligibility and/or credit limit unless your business has already established a credit history and has an EIN (employer identification number).

To learn more, check out the table below to compare the various rewards, benefits, features, and fees associated with each card.

Annual Fee

AnnualFees

AnnualFees

AnnualFees

annual_fees

New Cardholder Bonus Offer

Earn 100,000 bonus points after you spend $8,000 on purchases in the first three months from account opening. That’s $1,250 toward travel when you redeem through Chase Ultimate Rewards.

Earn $750 bonus cash back after you spend $6,000 on purchases in the first three months from account opening

Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

Earn $1,000 cash back if you spend $10,000 on purchases within your first three months of opening an account.

Rewards

Earn three points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn one point per $1 on all other purchases – with no limit to the amount you can earn.

Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other card purchases with no limit to the amount you can earn.

Earn unlimited 1.5% cash back on every purchase made for your business.

Earn 2% cash back on all purchases; if you make a purchase that’s $5,000 or more, you’ll earn 2.5% cash back.

Redeeming Rewards

Points can be exchanged for cash transfers, gift cards or, for 25% more value, redeemed for travel through Chase Ultimate Rewards. For example, 100,000 points are worth $1,250 towards travel when redeemed through Chase Ultimate Rewards compared to $1,000 when redeemed for cash.

Once you earn 2,000 points you can redeem those points for a statement credit or an electronic deposit to your checking or savings account. Points can also be redeemed for gift cards and travel.

You can redeem your rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards. Cash back rewards do no expire as long as your account is open.

You can redeem your rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards. Cash back rewards do not expire as long as your account is open. *Points earned with the Premier card cannot be moved to other Chase cards or transferred to Chase travel partners.

Purchase and Balance Transfer APR

RegAPR

Enjoy 0% introductory APR for 12 months on purchases, then RegAPR.

Enjoy 0% introductory APR for 12 months on purchases, then RegAPR.

reg_apr

Pay off eligible purchases over time with interest up to your Flex for Business limit. All other purchases must be paid in full each month.

Foreign Transaction Fees

foreign_fee

foreign_fee

foreign_fee

foreign_transaction_fee

Travel Protection

- Trip cancellation and interruption insurance – If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $5,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels.

- Roadside dispatch – If you have a roadside emergency, call 1-800-847-2869 anytime to dispatch the help you need: anything from a tow or jumpstart to a tire change, lockout service, winching or gas delivery. Roadside service fees will be provided when you call and will be billed to your card.

- Auto rental collision damage waiver – Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary when renting for business purposes and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most cars in the U.S. and abroad.

- Roadside dispatch – If you have a roadside emergency, call 1-800-847-2869 anytime to dispatch the help you need: anything from a tow or jumpstart to a tire change, lockout service, winching or gas delivery. Roadside service fees will be provided when you call and will be billed to your card.

- Auto rental collision damage waiver – Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary when renting for business purposes and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most cars in the U.S. and abroad.

- Roadside dispatch – If you have a roadside emergency, call 1-800-847-2869 anytime to dispatch the help you need: anything from a tow or jumpstart to a tire change, lockout service, winching or gas delivery. Roadside service fees will be provided when you call and will be billed to your card.

- Auto rental collision damage waiver – Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary when renting for business purposes and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most cars in the U.S. and abroad.

- Trip Cancellation/Interruption Insurance and Trip Delay Reimbursement

- Baggage Delay Insurance

- Auto Rental Collision Damage Waiver

- Travel and Emergency Assistance Services

Purchase Protection

- Purchase protection covering your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- Extended warranty protection which extends the time period of the U.S. manufacturer’s warranty by an additional year, on eligible warranties of three years or less.

- Get up to $600 per claim in cell phone protection against covered theft or damage for you and your employees listed on your monthly cell phone bill when you pay it with your card. Maximum of three claims in a 12 month period with a $100 deductible per claim.

- Purchase protection covering your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- Extended warranty protection which extends the time period of the U.S. manufacturer’s warranty by an additional year, on eligible warranties of three years or less.

- Purchase protection covering your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- Extended warranty protection which extends the time period of the U.S. manufacturer’s warranty by an additional year, on eligible warranties of three years or less.

- Purchase with confidence. Your card comes with built-in protections like Fraud protection, Zero Liability Protection, Purchase Protection, and Extended Warranty Protection.

- Get up to $1,000 per claim in Cell Phone Protection against covered theft or damage for you and your employees listed on your monthly cell phone bill when you pay it with your Premier card. (Maximum of three claims in a 12-month period with a $100 deductible per claim.)

Still not sure which Ink business card is right for you? Check out our CardName, CardName, CardName, and card_name reviews for even more information.