Why you should trust CardRatings.com

At CardRatings.com we discuss the most up-to-date news and trends within the credit card space. Since we first pioneered the concept of online credit card reviews in 1998, our team of financial experts has provided comprehensive and unbiased credit card reviews for more than 175 cards, plus hundreds of additional resource articles to help educate everyday cardholders so they can feel more confident about their card choices. All our content is written and reviewed by industry experts. Though our content may occasionally contain references to products from our partners, we maintain strict editorial integrity and advertiser relationships and compensation never influences ratings, reviews or featured products. The difference between editorial content and advertising must always be clearly stated. Learn more.

Are you searching for ways to build your credit before buying a house? Depending on when you plan on applying for a mortgage, a credit card could help you achieve your goal. After all, even if you have minimal or no credit history, you could qualify for a type of credit card designed to help you establish or rebuild credit.

However, before you rush to add another credit card to your wallet, it’s important to understand when doing so could be a bad idea. We’ll cover that in this article, but first, it’s important to understand why building good credit is important.

Why is it important to build good credit when buying a house?

Building good credit is important when buying a house because it can help you qualify for a mortgage. When you apply for one, a mortgage lender will review your credit score – a three-digit number based on information on your credit reports – to assess how risky of a borrower you may be. The higher your credit score, the more likely you are to receive loan approval at low interest rates.

Although lenders use a variety of credit scoring models, one of the most widely used is FICO® Score. It has a scoring model that ranges from 300 to 850, and is broken down into the following categories:

- 800 and above – Excellent

- 740 to 799 – Very good

- 670 to 739 – Good

- 580 to 669 – Fair

- 579 and below – Poor

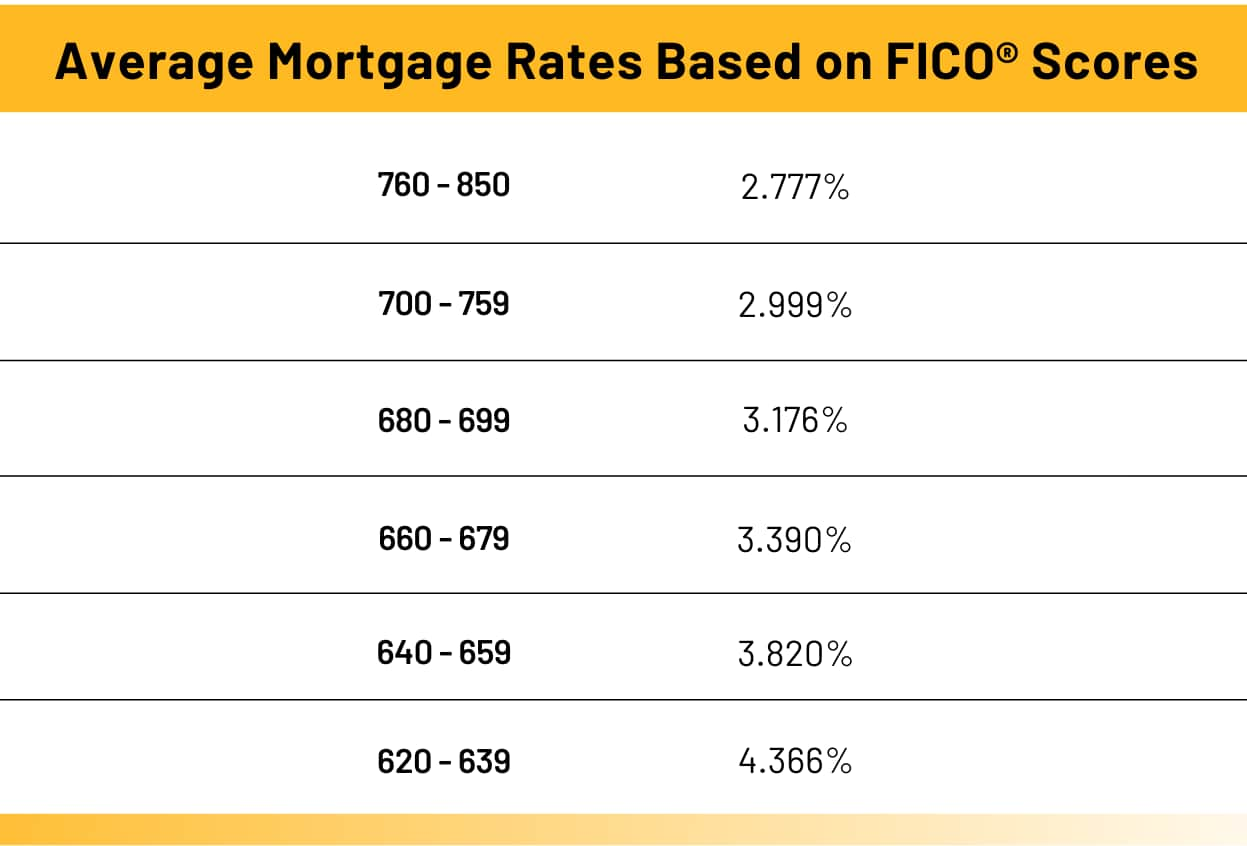

This table that shows an estimate of how much your mortgage rate could be based on your FICO® score:

Source: myFico Based on national average mortgage rates for a 30-year fixed, $300,000 mortgage as of October 28th, 2021.

Based on the table above, your interest rate could be 1.589% lower if your credit score falls in the highest credit scoring range listed (760 and 850) versus the lowest (620 to 639).

While a 1.589% interest rate difference may not seem like a lot, it can add up to a lot of savings over the life of a mortgage. For example, say you took out a 30-year fixed, $300,000 mortgage with a down payment of $60,000 at 2.777% versus the same mortgage at 4.366% interest, you’d have a lower monthly note. Your estimated monthly payment for the 30-year mortgage at 2.777% would be $983 while the estimated monthly payment for the mortgage at 4.366% would be $1,197. That equals an annual savings of $2,568.

*The scenario above was created using Zillow’s mortgage calculator and doesn’t include private mortgage insurance (PMI) and taxes, only principal and interest.

Can a credit card help you build good credit?

Absolutely. If you use it responsibly, that is. When you repay your credit card bill on time, it adds positive payment history to your credit report. As a result, your credit score should increase.

That said, applying for a credit card right before you buy a house isn’t a good idea. When you apply for a credit card, a hard inquiry shows up on your credit report, which results in a temporary drop in your credit score.

However, if your plan is to wait six months to a year, getting a credit card to build credit could be a smart move. And what’s the best credit card to build credit? Well, that depends on your unique financial circumstances.

For instance, if you have minimal or no credit history, a secured credit card might be your best bet. Unlike a traditional credit card, it requires a security deposit. The deposit is used to help establish your credit limit and can be seized by the credit card issuer if you fail to repay what you borrowed.

If your credit is good enough to qualify for a traditional card, the right card for you will depend on your needs. For instance, if you travel a lot, you might want to consider a travel rewards card with a huge sign-up bonus. If you want to refinance debt, a 0% interest balance transfer card could be a perfect fit. And if you love to shop, a credit card that offers a lot of cash back could work.

Can you buy a house with credit card debt?

You sure can. There’s no rule that you have to get rid of all of your credit card debt before purchasing a home. That said, you may scare off a mortgage lender if you have too much credit card debt.

Why? It’s because your credit utilization ratio – the percentage of your available credit you use – is a key factor lenders consider. Maxing out your credit cards or getting too close to your total credit limit could signal to a lender that you’re overextended financially.

For this reason, you should pay down your credit cards as much as possible prior to applying for a mortgage. And once you apply for a mortgage, don’t put any large expenses on your credit card before closing on the loan. Otherwise, a lender could raise your interest rate or deny your loan.

Can you buy a house with no credit?

While buying a house with no credit is possible, a lender may require more documentation and cash reserves. For example, the Department of Housing (HUD) requires applicants who apply for an FHA loan with little to no credit history to have at least two months of cash reserves.

In addition, you have to provide documentation that you’ve paid bills on time that aren’t usually reported to the major credit bureaus, such as utility bills, rent payments, phone bill and your internet bill.

Can you buy a house with cash?

If you have enough money, you can choose to buy a house with cash instead of financing it. Doing so could save you a ton of money on borrowing expenses, such as interest and closing costs.

What’s the best credit card for homeowners?

Similar to the best credit card for building credit, the best credit cards for new homeowners depends on individual needs. For example, if you plan on spending a lot of money on home improvements, a card that offers a lot of cash back in the home improvement category could be a good match.

Also, if you prefer paying no interest, a card with a long 0% interest period, like the CardName could work. It has an intro 21-month interest-free period on balance transfers from the date of the first transfer and for 12 months from the date of account opening on new purchases (then RegAPR). As long as you repay any balances before the promotional period expires, you can avoid interest charges. BalanceTransferFees Citi is a CardRatings advertiser.