American Express® Gold Card review

This card offers strong rewards at restaurants and on U.S. supermarket purchases as well as on airfare. Plus, you can earn a nice welcome bonus as a new cardholder, starting membership off on the right foot.

Jump to section

American Express® Gold Card

- Rewards

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X). Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- Bonus Rewards

- Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Annual Fee

- $250

Key Features

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- Terms Apply.

CardRatings Editor's Analysis: Pros & Cons

- A generous welcome offer for new cardholders.

- Very strong rewards rate for travel and dining expenses.

- Account credits for popular spend categories such as dining and hotel stays.

- The annual fee is a little on the hefty side, so cardholders should be heavier travelers to make the most of the rewards and offset the annual fee.

It’s no secret that choosing a new credit card can be challenging. Some credit cards have rotating categories which force a cardholder to think strategically about the use of their card quarterly while some cards have fixed categories that earn rewards points at the same rates year round.

The CardName is an example of a card that has the same rewards rates earned year round that can fit nearly anyone’s lifestyle. The Gold Card earns bonus rewards points on purchases that are common for many people including at restaurants, U.S. supermarkets, and flights booked directly with airlines. It does carry a AnnualFees annual fee, but a number of valuable benefits help to offset this, such as a new cardmember welcome offer, excellent travel perks, and monthly dining credits at select restaurants. American Express is a CardRatings advertiser. See Rates and Fees.

card_name benefits

The CardName earns 4X Membership Rewards® points per dollar spent when you dine at restaurants, plus takeout and delivery in the U.S.; 4X points at U.S. supermarkets (on up to $25,000 per year in purchases, then 1X); 3X points on flights booked directly with airlines or on amextravel.com; and 1X point per $1 on other eligible purchases.

- The card_name also includes up to $10 in statement credits monthly when you pay with your card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. This can be an annual savings of up to $120. (Enrollment required.)

- Add your Gold Card to your Uber account and each month you’ll automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 a year.

In addition to valuable ongoing rewards, there’s currently a great welcome bonus for new cardholders. New cardholders who spend $6,000 in eligible purchases with the card in the first six months of membership can earn 60,000 Membership Rewards® points. The Membership Reward® (MR) points earned by the American Express® Gold Card are extremely flexible as they can be redeemed directly for travel, transferred to airline and hotel partners, and redeemed for purchases on Amazon.com using the Shop with Points feature. With over 20 airline and hotel partners including Delta Airlines and All Nippon Airways, MR points can be useful for a wide variety of rewards travel redemption options.

And on that note, there are also a number of great card_name travel benefits, including:

Hotel credit – Get a $100 hotel credit to spend on qualifying dining, spa, and resort activities, plus a room upgrade upon arrival, if available, when you book a stay of at least two consecutive nights with American Express Travel at over 600 properties. Qualifying activities vary by property.

No foreign transaction fees – The Amex Gold Card has no foreign transaction fees, giving you peace of mind to use the card while you travel internationally. While there are several travel rewards cards that come with this similar feature, the value in using a no foreign transaction fee card can be realized quickly while traveling abroad. As a hypothetical, if you spend $6,000 while traveling on your bucket list vacation to experience an idyllic overwater villa in Bali, with the Amex Gold Card you will incur no fees for using your card internationally. However, if you used a card that does charge foreign transaction fees (usually around 3%), you would have to pay an additional $180 just in fees just to use that card. See Rates and Fees.

Rental Car Insurance – When you use your card_name to reserve and pay for the entire rental car and decline the collision damage waiver at the rental company counter, you can be covered for damage or theft of a rental vehicle in a covered territory.

card_name annual fee

The CardName‘s AnnualFees annual fee can be daunting for some but can certainly be justified with the benefits of the card. If you take advantage of the $120 Uber cash credit and the $120 in dining credit for select restaurants, you would have already offset $240 of the AnnualFees annual fee. However, if you won’t be able to use these benefits or prefer to have a no/low annual fee card it may be harder to justify the cost of the Amex Gold. See Rates and Fees.

card_name credit score

American Express doesn’t explicitly state a number, however, the CardName usually requires good to excellent credit to get approval. For reference, the credit bureau Experian says those with good credit usually have FICO scores of at least 670, with excellent scores starting at 800. Please note, though, that these numbers can vary between different bureaus. Other factors are certainly considered in the application process as well, including payment history of revolving credit, your total open cards, and the average age of accounts open.

Potential downsides of the card_name

Keep in mind, the CardName unlike typical credit cards, allows you to carry a balance for certain charges, but not all. The benefit of this is that you lower the likelihood of incurring interest. Just make sure you’re in a position to pay off balances in full every month though if you’re considering this card.

How do cardholders rate the card_name?

CardRatings conducts a survey annually to learn what actual cardholders think of their cards. Here are the results for the CardName:

| Current Scores | Past Scores | |

|---|---|---|

| Overall Score | 81.9 | 83.4 |

| Features Satisfaction | 8 | 8.4 |

| Customer Service | 8.4 | 8.4 |

| Website/App Usability | 8.2 | 8.3 |

| Likelihood of Continuing to Use | 8.6 | 8.4 |

| Recommend to a Friend/Colleague | 8.2 | 8.2 |

How the card_name compares to other cards

card_name vs. CardName

discontinued

With excellent everyday points earning, luxury travel benefits, and flexible redemption options, the CardName card can be a great alternative to the card_name.

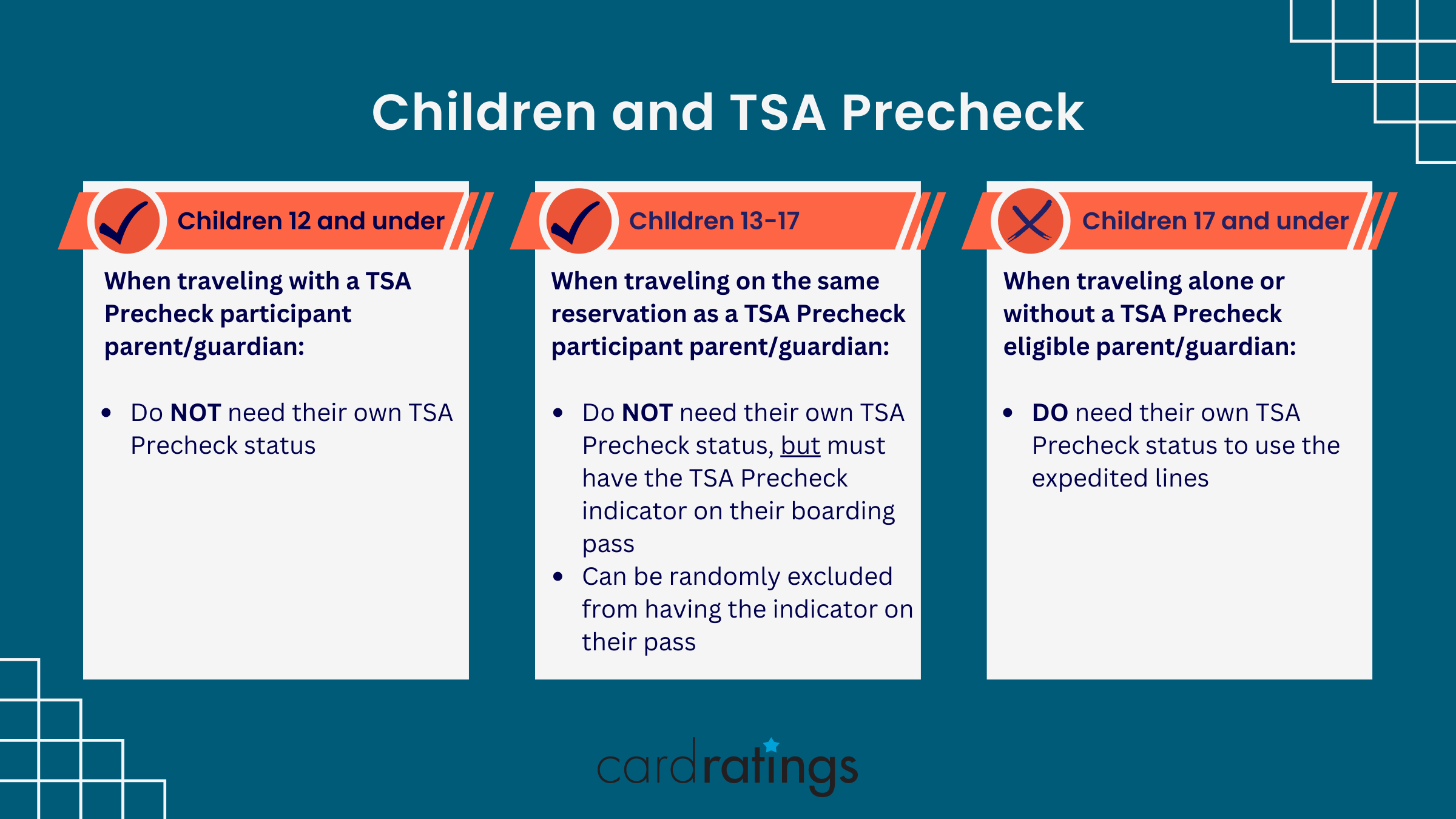

While the CardName has a higher annual fee, you get some serious travel benefits including a $300 annual travel reimbursement for travel purchases charged to your card each account anniversary year, fee credit for Global Entry or TSA PreCheck, one complimentary year of Lyft Pink ($199 value) that offers members discounts on each ride as well as additional comfort perks, and airport lounge access with Priority Pass Select.

Both cards offer elevated rewards on dining and travel purchases, but at slightly different rates. Which category is more important to you should help you narrow down which card is the better fit. They each also come with nice welcome bonuses, which can go a long way towards future reward redemptions, as well as offsetting the cost of the cards’ annual fees.

card_name vs. card_name

discontinued

With more premium travel perks and an match, CardName could be a good option for you if you’re looking for some of the best travel perks on the market and can justify paying a higher cost.

The card_name offers first-class travel benefits including access to airport lounges with the Global Lounge Collection, up to $200 in Uber credit annually, and a fee credit for Global Entry or TSA PreCheck, and $200 in annual airline fee credits with a pre-selected airline. Terms Apply. Enrollment required for select benefits.

As far as ongoing rewards go, the card_name was really designed with travelers in mind with elevated rewards earned on flights. Plus, the card comes with a valuable welcome bonus for new cardholders.

Is the card_name worth it?

The CardName is worth it for those who frequently travel, eat out at restaurants, and can utilize the card’s added perks. While the annual fee is a little on the hefty side, this can be easily offset by taking full advantage of the numerous benefits offered by the card.

Frequently Asked Questions

Who can qualify for the card_name_placeholder?

The card_name is designed for people with good to excellent credit. If your credit score falls within this range, you should qualify for eligibility. That said, other factors, such as payment history, your total number of accounts, and the average age of your accounts, could also be considered in the application process.

Does the card_name_placeholder have a credit limit?

According to American Express, with the card_name you do not have a credit limit. Instead, your card has no preset spending limit unless you have been previously notified otherwise. No preset spending limit means the spending limit is flexible. In fact, unlike a traditional credit card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history.

Our Methodology

Survey Methodology: CardRatings commissioned Op4G in September 2023 to conduct surveys among 1,869 cardholders nationwide. CardRatings website analytics from Jan. 1, 2023-Aug. 31, 2023 were used to determine a selection of the most popular cards and additional cards were included to add survey breadth. Responses to each of nine questions were given on a scale of 1-10 and respondents’ scores were then averaged under broad topics. To determine the overall score, responses from questions 1-8 were summed and the answer to “How likely are you to recommend this card to a friend, coworker or family member?” was double weighted. Current Scores reflect scores from the most recent survey (2023); “Past Scores” reflect scores from the 2022 survey.

Disclaimer:The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.

Any opinions, analyses, reviews or recommendations expressed here are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.

To see the rates and fees for the American Express cards mentioned in this post, please see the following links: CardName (See Rates and Fees); CardName (See Rates and Fees)