Best credit cards after bankruptcy of April 2024

Responsibly using a credit card after bankruptcy can be a great way to improve your credit score, but you have to qualify for one first. CardRatings editors reveal the best credit cards for after bankruptcy, including those with rewards and no annual fees to help you rebuild your credit. … View More

Though the total number of individuals filing for bankruptcy is generally declining, there are still a staggering number of people who must deal with the repercussions of bankruptcy each year (according to the American Bankruptcy Institute, there were 544,463 filings in 2020). That means there are still a lot of people out there looking for the best credit cards to use after bankruptcy.

The thing is, sometimes, often even, the circumstances leading to a bankruptcy aren’t fully in the control of the person filing. A Texas A&M University research team found that more than four out of five bankruptcies resulted from “adverse events” outside the control of those filing, and according to studies published in The American Journal of Medicine, more than half our country’s bankruptcies involved significant medical debt of more than $5,000.

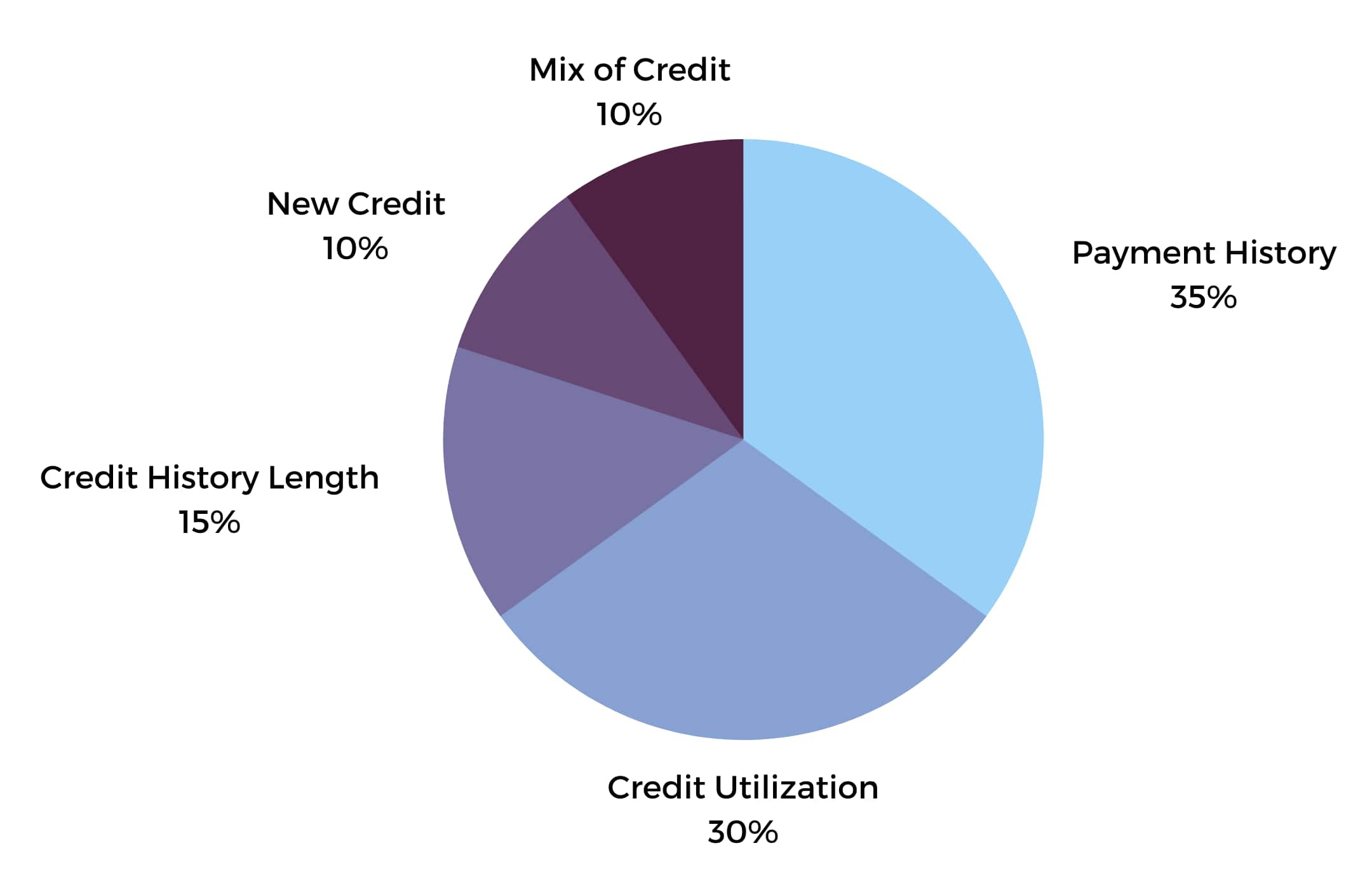

The good news is that many lenders understand that a bankruptcy rarely reflects your true relationship with money. That means if you managed credit cards effectively before you were forced to declare bankruptcy, you don’t have to give up their security or convenience for long. In fact, using a credit card after declaring bankruptcy is actually one of the best steps you can take to start improving your credit score, since your credit score is based upon several factors including your payment history, credit utilization (the ratio of your available credit to the amount you’re using) as well as how long your accounts have been open. Therefore, it can make sense to apply for a credit card soon after bankruptcy to begin re-establishing your creditworthiness. Just be sure you wait until after your discharge is complete before submitting any applications. View Less

20+ years

finding the best card for you

1,500+ cards

in our database

5,000+ cardholders

polled about their cards

243 reviews

from our experts

Why you should trust CardRatings.com

At CardRatings.com we discuss the most up-to-date news and trends within the credit card space. Since we first pioneered the concept of online credit card reviews in 1998, our team of financial experts has provided comprehensive and unbiased credit card reviews for more than 175 cards, plus hundreds of additional resource articles to help educate everyday cardholders so they can feel more confident about their card choices. All our content is written and reviewed by industry experts. Though our content may occasionally contain references to products from our partners, we maintain strict editorial integrity and advertiser relationships and compensation never influences ratings, reviews or featured products. The difference between editorial content and advertising must always be clearly stated. Learn more.

card_name discontinued_disclaimer

Read our full CardName review.

PROS:

- No weird fees. It isn't just a matter of there being no annual fee, but some secured credit cards have processing fees, application fees, membership fees (stay away from those). This doesn't have those. We aren't saying that there aren't some fees. There are (see: cons) but nothing crazy.

- No foreign transaction fee. So, if you travel abroad, this is a credit card worth packing.

- Try to make your payments on time, since that's the best way to eventually graduate from a secured credit card to an unsecured one, but you won't be charged a penalty APR if you miss a payment.

CONS:

- The $200 minimum security deposit could be a stretch for some people. However, there is no annual fee to worry about.

- Cash advances on any credit card are costly, and this one's no exception. You'll pay a hefty cash advance APR and a cash advance fee should you do this, so only do it if it's an absolute emergency and you have no other options.

| Current Scores | Past Scores | |

|---|---|---|

| Overall Score | 83.7 | 77.9 |

| Features Satisfaction | 8.6 | 7.7 |

| Customer Service | 8.1 | 8.1 |

| Website/App Usability | 8.4 | 7.8 |

| Likelihood of Continuing to Use | 9.1 | 8.2 |

| Recommend to a Friend/Colleague | 7.8 | 7.6 |

*Scores above reflect the results of surveys with actual cardholders. Full methodology below.

card_name discontinued_disclaimer

Read our full CardName review.

The Annual Fee: AnnualFees

Security Deposit: A $49, $99 or $200 refundable deposit. If your application is approved and you provide the minimum required security deposit prior to the expiration date, and have access to an authorized bank account for your security deposit, your account will be opened and you will receive the minimum initial credit line of $200. To increase your initial credit line, simply deposit more than your minimum required security deposit before your account opens. You can then raise your initial credit line by the amount of your additional deposit, up to $1,000. You can qualify for a higher credit line with no additional deposit needed in as little as six months. You may also earn credit line increases based on your payment history and creditworthiness.

Credit Management Tools: CreditWise from Capital One gives you unlimited access to your credit score, as well as free financial tools and information from the issuer's Financial Education site.

PROS:

- No foreign transaction fee.

- You can use this card with Apple Pay.

CONS:

- The card has a fairly high APR (RegAPR), but the whole point of getting this card is to build credit, which should mean you don't carry a balance.

- There is a late fee if you pay late, but this is a pretty standard thing with credit cards.

| Current Scores | Past Scores | |

|---|---|---|

| Overall Score | 77.1 | 84.3 |

| Features Satisfaction | 7.5 | 8.3 |

| Customer Service | 7.6 | 8.4 |

| Website/App Usability | 7.9 | 8.8 |

| Likelihood of Continuing to Use | 8.5 | 9.1 |

| Recommend to a Friend/Colleague | 7.7 | 8.1 |

*Scores above reflect the results of surveys with actual cardholders. Full methodology below.

card_name discontinued_disclaimer

Read our full CardName review.

The Annual Fee: AnnualFees

Security Deposit: Once you establish a Chime Checking Account, you'll need to set up direct deposit of at least $200 to qualify for your secured card.

Other Notes: You control your spending limit based on how much you move from your checking account into your secured card account. Furthermore, because you don't have a preset spending limit, this card won't impact your credit utilization.

PROS:

- It's always important to pay your balance in full, but especially so when you're working on building your credit score. This card makes it impossible to carry a balance.

- There is no minimum credit score required to apply for this card and no credit score required to qualify.

- There's no annual fee or minimum security deposit required2.

CONS:

- There are no rewards earned on purchases.

- It's great that you won't pay interest1, but it also means you CAN'T carry a balance should you need to. It's probably for the best that way, but still worth pointing out.

- While you don't have a minimum security deposit2, you do need to open a Chime Checking Account with a minimum direct desposit of $200.

| Current Scores | Past Scores | |

|---|---|---|

| Overall Score | 85.1 | 82.4 |

| Features Satisfaction | 8.5 | 8.2 |

| Customer Service | 8.2 | 8.1 |

| Website/App Usability | 8.6 | 8.4 |

| Likelihood of Continuing to Use | 9.0 | 8.4 |

| Recommend to a Friend/Colleague | 8.6 | 8.3 |

*Scores above reflect the results of surveys with actual cardholders. Full methodology below.

card_name discontinued_disclaimer

Read our full CardName review.

The Annual Fee: AnnualFees

Security Deposit: Not required as this is an unsecured card.

The Rewards: Based on your creditworthiness you could qualify for one of four cash-back rewards programs which could include 1% cash back on eligible gas, groceries, dining purchases, mobile phone services, internet services, and/or cable and satellite TV services or even just a flat 1% cash back on all your purchases, among other possibilities.

Credit Management Tools: Free credit score tracking and customizable account notifications.

PROS:

- Obviously, this is a card to rebuild credit, so it's a nice perk that there's the opportunity to earn rewards

- The free credit score tracking is appreciated.

- As with an unsecured credit card, you'll receive zero fraud liability, and so if your card is stolen (hey, it happens), you won't be liable for the charges.

CONS:

- There's a chance for no annual fee at all, but there's also a chance for a fairly high one.

- There really aren't many extra extras, like, say, cell phone insurance. That would be nice. But this doesn't card doesn't have that.

We have not polled this card yet, but would love to hear your thoughts on it if you are a cardholder. Comment below or email us at editor@cardratings.com to share more about your experience.

card_name discontinued_disclaimer

Read our full CardName review.

The Annual Fee: AnnualFees

Security Deposit: A refundable deposit as low as $200 and up to $3,000 will determine your credit limit. Since no credit check is required to apply for this card, the amount of your deposit is up to you (with approval). Furthermore, you can fund your deposit with small partial payments toward the total deposit over 60 days.

The Rewards: Extend your $200 credit line by getting considered for an unsecured credit line increase after six months, no additional deposit required!

Credit Management Tools: Easy online access to OpenSky's tips for rebuilding your credit as well as to stories from real OpenSky customers on what they're doing to get where they want to be financially. Sign up for email alerts that remind you when your bill is due or when you're nearing your credit limit. Take advantage of automatic payments so you pay your bill on time, every time.

PROS:

- Relatively low RegAPR APR. You can definitely find secured credit cards with significantly higher APRs. So in that sense, this card is a keeper.

- You can choose any available due date for your bill, which should make budgeting and responsibly paying your card easier.

- You can add authorized users to the card, if you want, and as long as they use the card responsibly, you may end up rebuilding your credit faster.

CONS:

- This isn't the best card to travel abroad with as it charges a foreign_fee fee on foreign transactions.

- Don't misplace your card! Besides being bad practice in terms of ID theft risk, there's also a $10 card replacement fee.

| Current Scores | Past Scores | |

|---|---|---|

| Overall Score | 67.7 | 77.2 |

| Features Satisfaction | 6.8 | 7.5 |

| Customer Service | 6.7 | 8.1 |

| Website/App Usability | 7.1 | 7.8 |

| Likelihood of Continuing to Use | 7.2 | 7.7 |

| Recommend to a Friend/Colleague | 6.5 | 7.7 |

*Scores above reflect the results of surveys with actual cardholders. Full methodology below.

There are a lot of subtle differences, but the end result with both, of course, is the same: you're going bankrupt. Generally, most bankruptcy attorneys will probably tell you to go with Chapter 7 (and you should hire one if you're facing bankruptcy, even if you feel like you can't possibly afford one, since you're, you know, broke).

If you file Chapter 13 (and you may have no choice, depending on your state), you'll be put you on a payment plan (this is the main difference between Chapter 7 and Chapter 13), so that you're able to make your payments back after three to five years.

That can be very helpful if you're wildly behind on your mortgage payments, and you don't want to lose your house, or car payments, and you desperately want to hang onto the car.

That said, if you file for Chapter 7, which you may well do if you're not behind on your mortgage, or not so far that you can't catch up, you may be able to get bankruptcy exemptions that will allow you to get through the bankruptcy without losing your home or car.

So don't automatically assume that you will lose your house or vehicle through Chapter 7. Again, talk to a lawyer and explain your situation. Everybody's bankruptcy story is going to be different.

Many bankruptcy attorneys will suggest filing Chapter 7 because you'll be able to get many debts discharged, for good, and you won't have to pay them back: debts such as credit card debts, medical bills and unsecured personal loans.

Learn more about the differences between Chapter 7 and Chapter 13 bankruptcy.

Yes, although your options may be limited.

Credit card issuers may be more than happy to issue you a new card since they know you'll be unable to file for bankruptcy again for seven years. However, they aren't likely to approve an unsecured card with a large line of credit. Instead, companies may limit you to a small credit line and charge a high interest rate on any balance you carry.

Depending on your particular financial situation and credit score, you may find only secured cards are available to you as well. Regardless of why you declared bankruptcy, the fact you couldn't pay back your debt is a red flag for businesses. Credit card issuers may want a deposit to ensure that they won't be out any money if you can't pay your bills again.

If you do have trouble getting approved for a credit card, see if someone you know well would be willing to add you as an authorized user on their card. This can be excellent way to build credit and boost your score, so long as the primary accountholder has good credit themselves and makes timely payments. Once your score increases, you may then qualify for a card on your own.

Learn more about applying for a credit card after bankruptcy.

You'll need to wait until your bankruptcy is discharged before you can expect to be approved for any type of credit card. If you filed a Chapter 7 bankruptcy, it may only be 3-5 months before discharge. However, a Chapter 13 bankruptcy may take years to complete.

While it's a good idea to apply for credit after a bankruptcy so you can rebuild your credit, be smart about it. Before you apply for any card, be sure to have a written budget and a plan for exactly what you will charge each month and how you will pay it off. Remember, you don't need to carry a balance to build credit. Making a purchase with a card and then paying it off immediately is just as helpful, if not more so, when it comes to improving your score.

It is also helpful to understand what led to your bankruptcy in the first place. Was it a medical event or lost job combined with no savings or did you simply spend beyond your means? Once you know the cause of your bankruptcy, you can put into place safeguards to ensure the same situation doesn't occur again.

Learn more about applying for a credit card after bankruptcy.

If you applied for a credit card and were denied, don't despair. You do have some options to access credit and rebuild your score.

- Talk to the card issuer: Some card issuers may change their decision if you talk to a representative directly to explain your situation. This option may work if your bankruptcy was related to a one-time event such as an illness, but otherwise, be prepared to hear another no.

- Become an authorized user: If you have a close friend or family member with good credit, ask if they would consider adding you as an authorized user on one of their cards. Even if you don't actually use the card, being an authorized user can help boost your score and pave the way to get your own card in the future.

- Open a secured card: Even those with the very lowest of credit scores can usually get a secured credit card. That's because secured cards require cardholders to send in a deposit equal to their credit limit. It eliminates most risk for the lender and provides you with a way to demonstrate you can responsibly charge purchases and pay them off each month.

See additional steps to consider if your credit card application is denied.

A secured card will be, by far, the easiest credit card to get after bankruptcy. These cards are designed specifically for those with bad credit who want to rebuild their score.

If you're hoping to get an unsecured card, we like the CardName mentioned above. It is one of the easier unsecured cards to get for those coming out of a bankruptcy.

As you get further out from your discharge date, other unsecured cards from Discover, MasterCard and Visa should become available to you. These won't be lucrative rewards cards but some may come with nice benefits such as no annual fee.

SECURED VS. UNSECURED CREDIT CARDS

Choosing between a secured or unsecured credit card after filing bankruptcy can be confusing. Your options after bankruptcy will likely include mostly secured credit cards, which provide excellent opportunities to rebuild your credit just like traditional (ie. unsecured) cards do. With a secured card, you'll be required to supply a security deposit up front, usually ranging from $49 up to $200 depending on the issuer. The deposit will secure your line of credit and will generally be equal to your credit limit. Assuming you keep your account in good standing and pay all your bills, that deposit will be returned to you in full when you either close the account or are upgraded to a non-secured card.

Though the terms of a secured credit card might not be as appealing as those offered with unsecured cards, don't discount them completely. Issuers of secured credit cards will report your payments to credit bureaus and help boost your credit score the same as other cards. However, as with other credit cards, compare several options to be sure you are getting the lowest fees and interest possible. And although they may appear similar, don't confuse secured credit cards with prepaid cards. Except in rare instances, prepaid cards don't report to the credit bureaus and won't help your score.

See our top picks for secured credit cards.

If an unsecured credit card is really what you're after, it's still an option, but proceed with caution.

If you filed a Chapter 13 bankruptcy, you may find it relatively difficult to qualify for an unsecured credit card. Depending on your trustee's plan, you may be making partial payments on existing credit card accounts, making it tough for new banks to accept your application. However, if you filed a Chapter 7 bankruptcy, you may notice a near flood of pre-qualified credit card applications in your mailbox a few months after your discharge posts to your credit reports.

Banks know that you're unable to file for bankruptcy again for another seven years, reducing the risk of default. While you might not hear from a bank that you included in your bankruptcy filing, you could hear from their biggest competitors. Just be sure to watch out for subprime lenders and scam offers during the first few years after your discharge. They'll send ads for credit cards for poor credit that actually only entitle you to heavily marked-up retail goods, and some subprime Visa and Mastercard issuers charge exorbitant application fees and monthly service charges in addition to high APRs. Their marketing pitches suggest that you won't find a better deal after bankruptcy, but in reality, you could save up what you'd otherwise pay in fees, park that cash in a secured credit card's linked deposit account, and get that money back after you've graduated to a stronger, unsecured card.

You may find it easier than you would expect. There's no doubt that after a bankruptcy, your credit score will be thrashed, and the bankruptcy will remain on your credit report for seven to 10 years (10 if you file Chapter 7; seven if you file Chapter 13). There's no minimizing the financial "fun" of a bankruptcy.

That said, rebuilding your credit after a bankruptcy can definitely be done. Your first move should probably be to apply for a secured credit card. These are credit cards that work like any credit card, except for an important distinction: you'll put down a refundable deposit and then use the secured credit card to make purchases. A large chunk of your credit score is determined by your payment history, so after a year or two of using the secured credit card responsibly, the credit card company you have the card with will likely give you that refundable deposit back - and invite you to apply for an unsecured credit card with them. Then you can continue to build the other areas of your credit, such as your credit history length and your credit utilization ratio.

That said, you may be able to successfully apply for a no-frills, or not many frills, credit card designed for people with fair or bad credit. You could try doing that before applying for a secured credit card, if you're not excited about paying money upfront, money that, again, is refundable.

In any case, you should find with a few select credit card issuers and lenders like car dealerships, that life still goes on, and you'll still be lent money (albeit, likely at insanely high interest rates). After a bankruptcy, with your worst debts hopefully discharged and behind you, lenders know that you probably have more money now to pay off anything you borrow.

Learn more about credit card options for building credit after bankruptcy.

After you’ve filed bankruptcy, you might have some difficulty qualifying for a credit card. But, there are credit cards available that, with responsible use, can help you start rebuilding your credit score. CardRatings experts select the CardName as the best credit card after Chapter 7 bankruptcy because it is one of the only unsecured credit cards available for people who are rebuilding credit. Most of the options available are secured and require a security deposit of at least $200.

This card also comes with a cash-back rewards program based on your creditworthiness. You could earn 1% cash back on eligible gas, grocery and telecommunication purchases, which include internet, cellphone, cable and satellite TV services. It is rare for credit cards offered after bankruptcy, to include any type of rewards program.

Although this card is the best for people who have filed bankruptcy and are rebuilding credit, one of the other secured credit cards available might be a better fit, especially if you’re willing to put down a security deposit. The best credit cards after bankruptcy are those that report your account activity to the three major credit cards so you can begin to rebuild your credit and have the fewest fees.

No pun intended, but you'll be limited. There aren't a lot of credit cards that you can get after a bankruptcy with a high limit - unless you get a secured credit card, where you'll be furnishing the high deposit, if that's what you choose to do.

For instance, the CardName will allow you to have up to $1,000 on your credit card - but you will have to pay that $1,000. Still, it's a refundable deposit, and if you want a credit card that has more meat on its bones than many secured credit cards offer, that's one way to go.

You also may be able to qualify for a higher credit line with no additional deposit - within six months. So this purgatory of bad credit and limited lending options may not last too long.

In any case, there are quite a few credit cards designed for people who have gone through a bankruptcy, and some of them are quite good. Others may have enough fees attached that you'll want to think twice before signing up.

You'll want to look for credit cards that offer low annual fees and offer monthly credit bureau reporting (that last part is very important). Some secured credit cards, like the CardName, even come with rewards.

Jennifer Doss is a credit card analyst and the executive editor of CardRatings.com. She has worked as both a print and online journalist and has over a decade of experience in the media industry. Her published work has covered a broad range of topics, from finance and technology to travel and dining. Through extensive travel experiences and her personal interest...Read more

Survey Methodology: CardRatings commissioned Op4G in September 2023 to conduct surveys among 1,869 cardholders nationwide. CardRatings website analytics from Jan. 1, 2023-Aug. 31, 2023 were used to determine a selection of the most popular cards and additional cards were included to add survey breadth. Responses to each of nine questions were given on a scale of 1-10 and respondents’ scores were then averaged under broad topics. To determine the overall score, responses from questions 1-8 were summed and the answer to “How likely are you to recommend this card to a friend, coworker or family member?” was double weighted. “Current Scores” reflect scores from the most recent survey (2023); “Past Scores” reflect scores from the 2022 survey.

Ranking Methodology: CardRatings experts review the fine print, details, perks, rewards and features of hundreds of cards and compare them side-by-side with similar cards. A card that makes an excellent balance transfer card may not make a great cash-back rewards card even though it offers those rewards. While the Best of the Year list is announced annually, that list – and all other “best of” lists on CardRatings – are regularly reviewed and updated as issuers change the terms and features of each card often.

1Out-of-network ATM withdrawal and OTC advance fees may apply. View the Bancorp agreement or Stride agreement for details; see back of card for issuer.2Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder Visa card, which means you can spend up to this amount on your card. This is money you can use to pay off your charges at the end of every month.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Disclaimer:

The information in this article is believed to be accurate as of the date it was written. Please keep in mind that credit card offers change frequently. Therefore, we cannot guarantee the accuracy of the information in this article. Reasonable efforts are made to maintain accurate information. See the online credit card application for full terms and conditions on offers and rewards. Please verify all terms and conditions of any credit card prior to applying.

This content is not provided by any company mentioned in this article. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any such company. CardRatings.com does not review every company or every offer available on the market.